AEPS, or Aadhar Enabled Payment System, is like a special way for people in India to do basic banking stuff using their Aadhar card. Aadhar is like a super ID card in India, and with AEPS, you can use it to get to your bank account.

Imagine you want to take out some cash from your bank account, but you don’t want to go to an ATM. With AEPS, you can go to a special person called an AEPS agent. This agent helps you get money using your Aadhar card.

What are the benefits of an AEPS?

Aadhaar payment has many cool benefits that make life easier for people in India. First off, you can use your Aadhaar card to do simple money stuff without carrying cash. It’s like having a magic card that connects to your bank account. No need to remember long account numbers – just use your Aadhaar!

Imagine you’re in a place without an ATM. With Aadhaar payment, you can still take out cash by going to an Aadhaar payment shop. The best part is, that it’s super safe. They ask for your Aadhaar details, and send you an OTP code on your phone, and only with that code can they get your money out. It’s like having your own secret money superhero code!

Aadhaar payment is also great for checking how much money is left in your bank account. No need to stand in long lines at the bank – just use your Aadhaar card, and know your bank balance.

Oh, and another cool thing – you can even do “e-KYC,” which is like proving who you are but without all the paper mess. It’s super handy for opening a new bank account or getting a new SIM card.

So, in short, Aadhaar payment makes money stuff simple, safe, and speedy. No need to worry about carrying cash or waiting in lines – just use your Aadhaar card, and you’re good to go!

How AEPS Works:

1. Tell the AEPS Agent:

You go to the AEPS agent and say you want to take out some cash. The agent asks for your Aadhar card details.

2. Agent Enters Aadhar Details:

The agent types in your Aadhar details into their computer or device.

3. Access Bank Account:

By using your Aadhar details, the agent gets access to your bank account linked with Aadhar.

4. Enter Withdrawal Amount:

The agent then types in how much money you want to take out.

5. Get an OTP on Your Phone:

For extra security, you get a special code on your phone. This is like a secret password for this transaction.

6. Agent Enters OTP:

You tell the agent the code, and they type it into the AEPS portal.

7. Transaction Done:

Once the agent enters the code, the money comes out of your bank account, and you get a message saying the transaction is complete.

8. Agent Gets Commission:

The AEPS agent gets a little reward or commission for helping you with the transaction.

So, in short, AEPS lets you do basic banking stuff like getting cash or checking your balance using your Aadhar card, and the AEPS agent is there to assist you with the process.

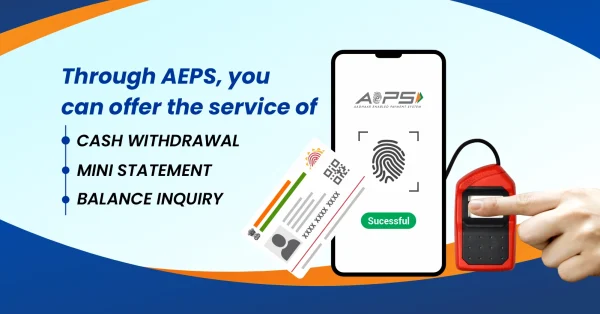

What services are offered by the Aadhar-based Payment system?

The following are the services that an AEPS agent can offer:

- Cash withdrawal

AEPS is mainly developed by the government of India, to facilitate the service of cash withdrawal in unbanked parts of the country.

- Bank balance

Any person can view/ check their monthly, quarterly, and yearly bank balance through AEPS

Customer can check their balance after the transaction for further clarity.

- Cash Deposit (New feature)

Now you can deposit cash in your Bank through your Aadhar card.

How do you start your AEPS business?

- Any person can start their own business of AEPS by completing the process of Aadhaar-enabled payment system registration in just 5 minutes.

- All that a person needs to do is to register and make their FREE id in an AEPS portal

Complete the signup and registration process

- Complete the process of E-KYC

- Activate your service of AEPS from the service portal

- After activating the service of AEPS, AePs agents can offer the service of cash withdrawal & deposit, mini statement, balance inquiry, Aadhar seeding, etc. to their customers and earn up to 13+2 rupees on every transaction.

Conclusion

In conclusion, AEPS, or Aadhar Enabled Payment System, provides a simple and convenient way for people in India to perform basic banking transactions using their Aadhar card. Through AEPS, individuals can withdraw cash, check their bank balance, and receive mini statements with the assistance of AEPS agents.

The process involves providing Aadhar details, entering withdrawal amounts, and ensuring extra security through OTP verification on the customer’s phone. This system not only facilitates financial transactions but also rewards AEPS agents with commissions for their assistance.

The services offered by the Aadhar-based payment system extend beyond cash withdrawal, including features like checking bank balances, receiving mini statements, and enabling customers to view their transaction details for clarity.

The benefits of Aadhaar payment are numerous, offering a hassle-free alternative to carrying cash, ensuring safety with OTP verification, and simplifying tasks like checking bank balances. Additionally, the system supports e-KYC, streamlining identity verification for various purposes such as opening bank accounts or obtaining a new SIM card.

For those interested in starting their own AEPS business, the process is relatively straightforward. By completing the Aadhaar-enabled payment system registration in just five minutes, individuals can become AEPS agents.

The steps involve registering on an AEPS portal, completing the signup and registration process, undergoing E-KYC, and activating the AEPS service from the portal. Once activated, AEPS agents can offer services like cash withdrawal, mini statements, balance inquiries, Aadhar seeding, and more to customers, earning commissions for each transaction. This not only empowers individuals to provide essential financial services but also presents an opportunity for them to earn a livelihood.