API

Upgrade Your Business with Our APIs

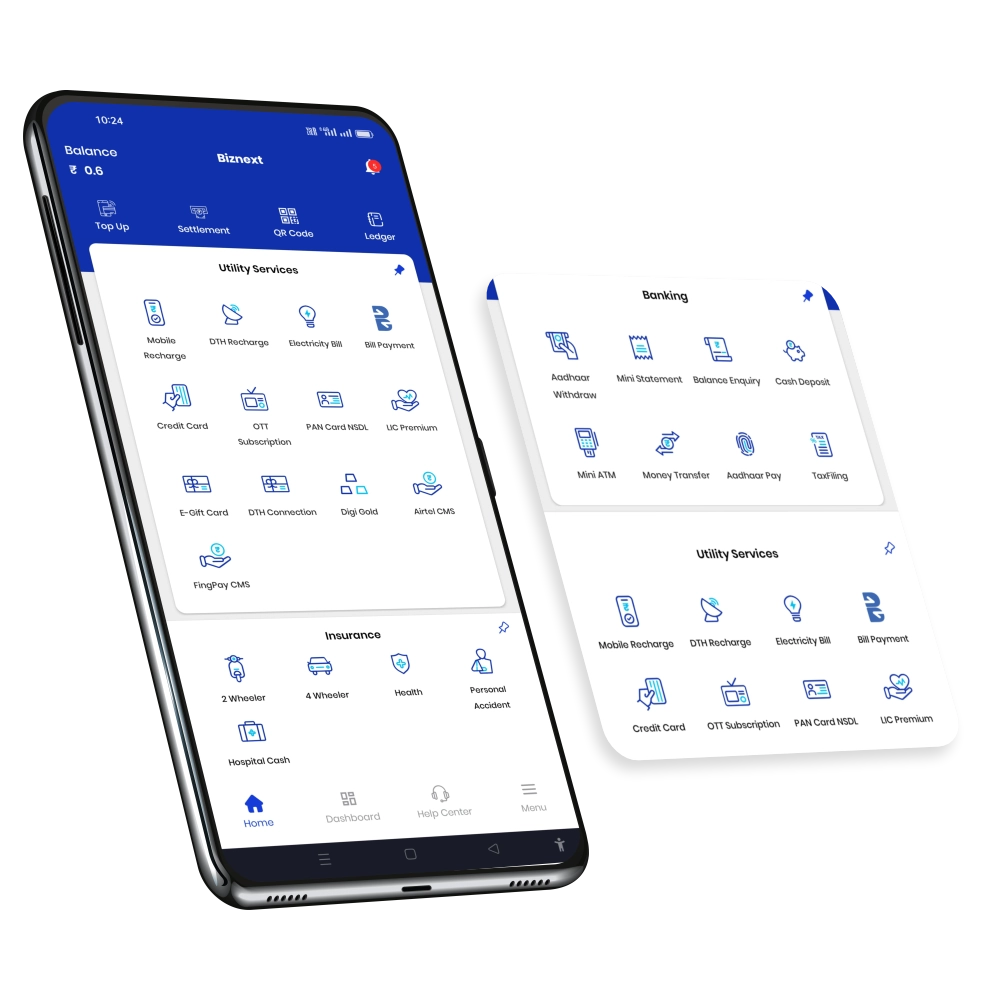

Biznext simplifies business financial transactions by offering easy-to-use APIs like Money Transfer, Recharge, PAN Card, AEPS, and more. These APIs integrate seamlessly with B2B and B2C platforms, ensuring secure, smooth, and efficient operations. With Biznext, businesses can deliver fast, real-time payment solutions that are reliable and hassle-free.

Become a API Partner & Earn Up to ₹1 Lakh Per Month

Discover a Faster and Smarter Way to Run Your Recharge and AEPS Business

Powerful REST APIs

Easily integrate banking & utility services into your apps with our flexible APIs.

Flexible Platform

Robust REST APIs enable smooth integration for multiple use cases.

Go Live Quickly

Rapid deployment and integration for faster market entry.

Clear Documentation

Start quickly with detailed documentation, code samples, and SDKs

Dedicated Support

Get prompt resolution with our dedicated support team.

Detailed Dashboard

Manage all API transactions efficiently from a single dashboard.

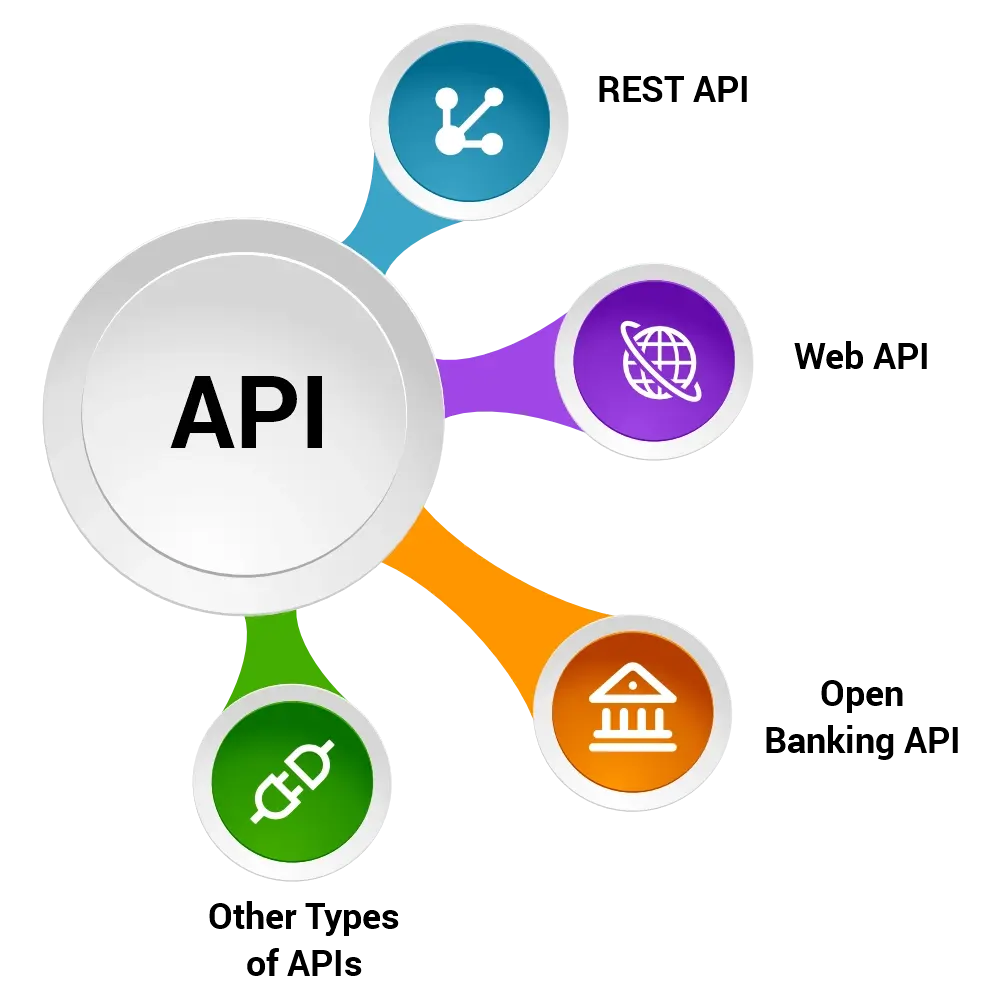

What is API?

An API (Application Programming Interface) is a set of protocols and tools that allow software applications to communicate and exchange data. In fintech, APIs enable systems to securely share information, such as payment details, transaction histories, and account data, between platforms or applications. This seamless data exchange allows businesses and customers to perform financial transactions quickly, securely, and efficiently.

Types of APIs

REST API (Representational State Transfer API):

- Connects web services effortlessly.

- Simple, fast, and user-friendly.

- Works using standard HTTP methods like GET, POST, PUT, and DELETE.

Web API:

- Enables communication over the Internet.

- It is commonly used to integrate external services like payment gateways and social media logins.

Open Banking API:

- Securely allows third-party services to access user banking data with consent.

- Powers financial tools like budgeting apps and payment solutions.

Other Common Types of APIs:

- SOAP API : Secure and reliable, often used in large enterprises.

- GraphQL API : Allows optimised data requests for specific needs.

- OAuth API : Ensures secure authorisation for third-party applications.

Biznext API Services Overview

Biznext provides API-based solutions that help entrepreneurs and businesses grow quickly and efficiently. We specialise in sectors like fintech, utility services, and travel, offering tools to simplify operations and boost growth.

Overview of API Service Opportunities for Entrepreneurs

Biznext’s API services make it easy for businesses to add payment, recharge, and other services to their platforms. This improves the customer experience and helps grow revenue.

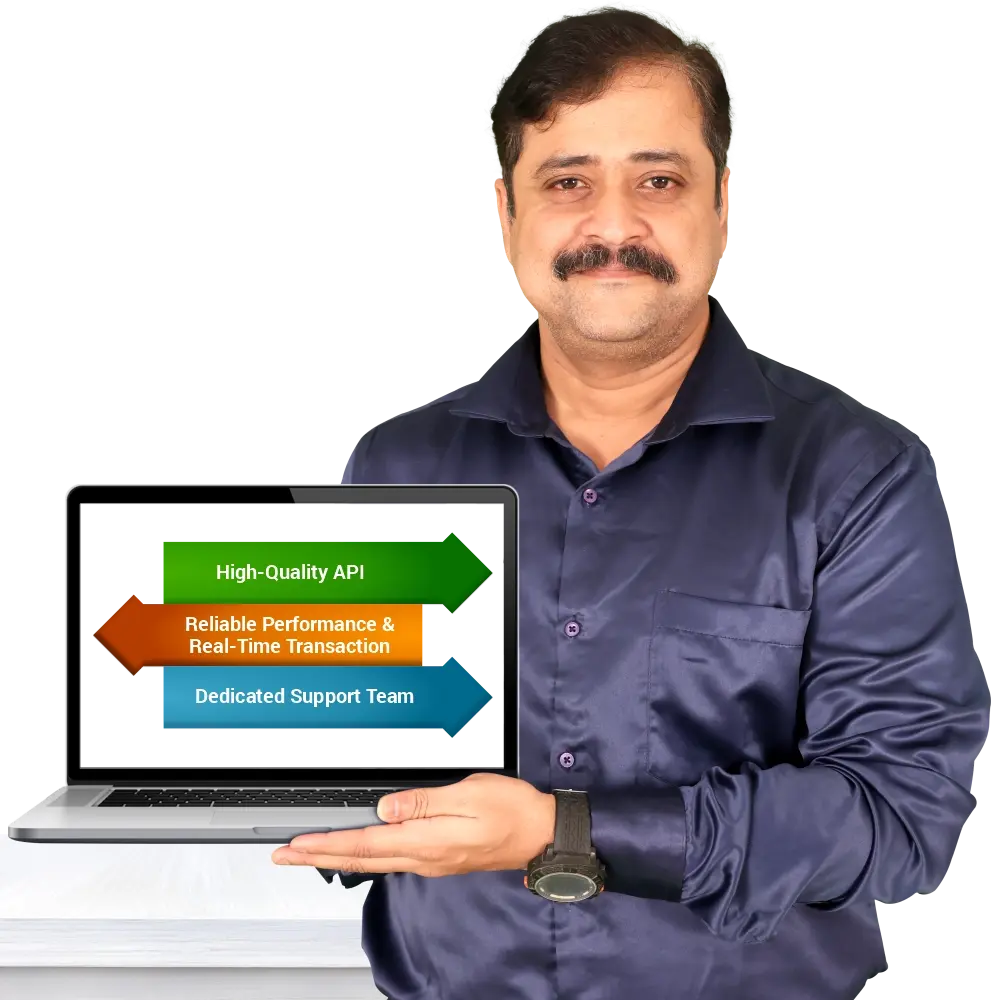

Why Choose Biznext?

- High-quality API solutions.

- Reliable performance and real-time transaction capabilities.

- Dedicated support team for smooth operations.

Best API Providers in India: Why Biznext Stands Out

Free API Options

Attractive solutions for startups and small businesses.

Affordable API Costs

Flexible pricing models for businesses of all sizes.

Commission Rates

Transparent, competitive and profitable margins.

Multi Services API

Enable recharge services for multiple operators on a single platform.

Popular API Services Offered by Biznext

Recharge API Services

- Mobile Recharge API: Offer seamless mobile recharges with the best margins and commission structures.

- Utility Bill Payment API: Support utility bill payments through the Bharat Bill Payment System (BBPS).

AEPS API (Aadhaar Enabled Payment System)

- Commission Structures: Transparent cost and earnings analysis.

- Integration: Easy to set up for banking and financial services.

Money Transfer API

- Domestic Money Transfer (DMT) API:Secure & quick money transfer services.

- Best Providers in India: Partner with top providers for competitive rates.

PAN Card and Insurance APIs

- PAN Card API Services: Streamline PAN card applications for customers.

- White Label Insurance API Solutions: Offer insurance services under your brand.

IRCTC and Travel APIs

- IRCTC API Services: Enable travel bookings through a trusted platform.

- Travel Business Integration: Expand offerings with seamless travel service integration.

API Integration and Documentation

API Key and Authentication

API keys provide secure access to services. Biznext offers easy-to-follow authentication guidelines to ensure safe and efficient use. Our detailed documentation includes code samples, SDKs, and integration guides to help you get started quickly.

Bank API Integration

Integrate banking APIs to simplify financial services and create a better customer experience.

Benefits of APIs in Modern Businesses

Improved Efficiency

Automate tasks & simplify complex processes.

Greater Flexibility

Easily scale and integrate new technologies.

Cost-Effective

Save both time and resources.

Multi-Faster Innovation

Adapt quickly to market changes and customer needs.

Enhanced Customer Experience

Deliver real-time services for better satisfaction.

Becoming a Biznext API Partner

Steps to Partner with Biznext

- Sign up for the API partner program.

- Select the services you want to offer.

- Integrate Biznext APIs into your platform.

- Go live and start earning.

Benefits for Entrepreneurs and Business Owners

- Access to a variety of API services.

- High margins with real-time commission tracking.

- Dedicated support to ensure smooth operations.

What Our Clients Said About Biznext

FAQs About Biznext API Services

What is an API?

An API (Application Programming Interface) is a set of protocols that allows software systems to communicate. In fintech, APIs enable secure data exchange for transactions like payments, recharges, and account management.

What types of APIs does Biznext offer?

Biznext offers APIs such as Money Transfer, Recharge, PAN Card, AEPS, Utility Bill Payments, and more to simplify business operations.

How does Biznext help entrepreneurs with APIs?

Biznext provides API solutions to help entrepreneurs integrate services like payments and recharges into their platforms, improving customer experiences and revenue generation.

What makes Biznext’s APIs reliable?

- Robust REST architecture.

- Secure transactions.

- Real-time updates.

- Comprehensive dashboard management.

What are REST APIs, and why are they popular?

REST APIs use standard HTTP methods (GET, POST, PUT, DELETE) to communicate efficiently between applications, making them user-friendly and scalable.

What services can I integrate with Biznext APIs?

You can integrate mobile recharges, utility bill payments, domestic money transfers, Aadhaar-enabled payment systems (AEPS), PAN card applications, and travel bookings.

How do Biznext APIs ensure secure transactions?

Biznext APIs use authentication mechanisms like API keys and provide detailed integration documentation to ensure secure and efficient operations.

Why should businesses use APIs?

APIs improve operational efficiency, enhance customer experience, reduce costs, enable scalability, and allow faster innovation to adapt to market needs.

What benefits do entrepreneurs get from Biznext’s API services?

Entrepreneurs benefit from high margins, transparent commissions, various services, and dedicated support for seamless operations.

What is the Biznext API Partner Program?

The Biznext API Partner Program allows businesses to integrate API services, go live quickly, and start earning with transparent commission tracking and support.

How can I become a Biznext API partner?

- Sign up for the partner program.

- Choose services to integrate.

- Use Biznext APIs in your platform.

- Launch your services and start earning.

What documentation does Biznext provide for API integration?

Biznext offers detailed documentation, including code samples, SDKs, and integration guides for smooth and quick setup.

What industries can benefit from Biznext APIs?

Biznext APIs are ideal for fintech, utility services, travel businesses, and other sectors that need secure, real-time payment solutions.

Are Biznext APIs suitable for startups?

Biznext provides affordable API solutions with free options and flexible pricing, making them ideal for startups and small businesses.

What support does Biznext offer for API users?

Biznext provides dedicated support, rapid issue resolution, and a comprehensive dashboard for managing transactions efficiently.