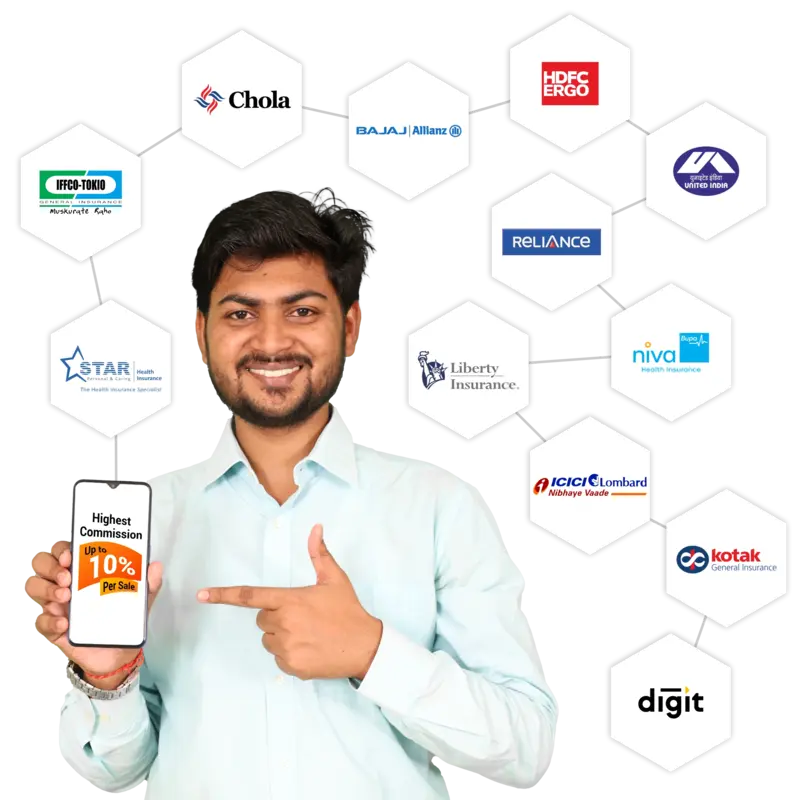

Insurance Agent or Adviser

Sell insurance policies to your customers and earn attractive commissions

With Biznext, you can easily start your business by offering health, motor, and Hospicash insurance, helping you grow your earnings.

Free Retailer Agent Registration – Earn Up to ₹50K Per Month from Your Shop

Why Become an Insurance Agent?

Fully Automated

Issue policy instantly to your customers through a fully automated and user-friendly portal.

Paperless

You can provide the insurance policies to your customers without uploading or sending any paper.

Zero Investment

You do not have to pay an activation fee to start an insurance business, & you can start selling insurance from more than 15 companies.

Easy Process

Issuing insurance is easy, as no medical checkups are required for insurance.

Sale Wide Range of Insurance Products

Health Insurance

Partner with Biznext to become a health insurance agent and earn attractive commissions. Health Insurance helps people manage their medical expenses by covering hospital stays, surgeries, medicines, and doctor visits. Instead of paying everything, the insurance pays most of the bills.

Through Biznext, you can offer a variety of Health Insurance plans. These plans can cover different treatments and hospital services, allowing customers to choose what suits them best. This partnership helps your customers feel secure about their health expenses while adding valuable services to your business.

Hospicash Insurance

Partner with Biznext to offer Hospicash Insurance to your customers. This type of insurance pays a fixed amount of money every day someone is in the hospital. It helps them pay for things like room rent, doctor fees, and other small costs that can add up. The best part is that the fixed cash is paid, no matter the hospital bill.

With Biznext, you can provide five different Hospicash plans, each offering various amounts of daily money, so your customers can choose what suits them best. This partnership helps you offer more services to your customers and gives them extra support during challenging times in a simple, affordable way.

Bike Insurance

Provide 2-wheeler insurance policies to your customers with Biznext. Bike Insurance is essential because it helps your customers cover the costs of repairs if they have an accident or their bike gets stolen. This way, they don’t have to worry about paying a lot to fix their bike; the insurance will help cover those expenses.

By partnering with Biznext, you can offer different bike insurance plans tailored to your customers’ needs. Plus, you can earn a commission on every sale you make! This means not only do your customers get valuable protection, but you also boost your income while providing an essential service.

Car Insurance

Provide 4-wheeler insurance policies to your customers with Biznext. Car Insurance protects customers from unexpected costs like repairs, damages, or theft. With the right coverage, your customers won’t have to worry about paying large amounts in case of accidents or other issues with their cars.

By partnering with Biznext, you can offer a variety of car insurance plans, ensuring your customers get the protection they need. This helps them feel safe and secure while allowing you to provide a valuable service that enhances your business.

What Are the Advantages of Working as an Insurance Agent?

Being an insurance agent can be a great career choice with many benefits.

Zero Investment

You don’t need to spend any money to get started, making it easy for anyone to begin this career.

Adjustable Hours

You can choose when you work, allowing you to balance your job with your personal life.

Growth Opportunity

The insurance industry offers many opportunities to advance in your career and learn new skills.

Helping Others

You get to assist people in protecting their families and belongings, giving them peace of mind.

Consistent Income

Once you build a good client base, you can earn a stable & continuous income from commissions on the policies you sell.

Work from Anywhere

Many agents can work from home or anywhere they choose, allowing them to set up their workspace.

Networking Opportunities

You’ll meet various people who can help you find new clients and get referrals.

Who Can Become an Insurance Agent?

Becoming an insurance agent is an excellent opportunity for many different people, no matter their background.

Potential Candidates for Insurance Agents:

- Business Owners: If you own a business, becoming an insurance agent can help you earn extra money and offer essential services to your customers.

- Financial Advisors: If you already work in finance, adding insurance to your services can help give your clients more complete advice about their money.

- Homemakers: Stay-at-home parents can also become insurance agents! This job is flexible, making it easier to work around family schedules.

- Other Professionals: People from various jobs—like teachers, salespeople, or even retirees—can become insurance agents. It’s a great way to start a new career or earn extra cash.

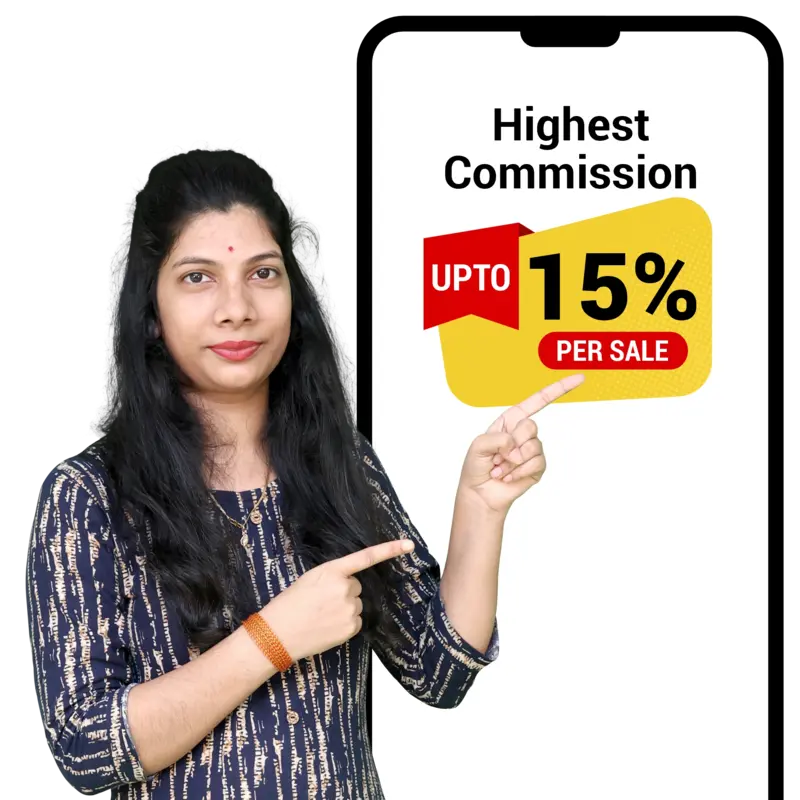

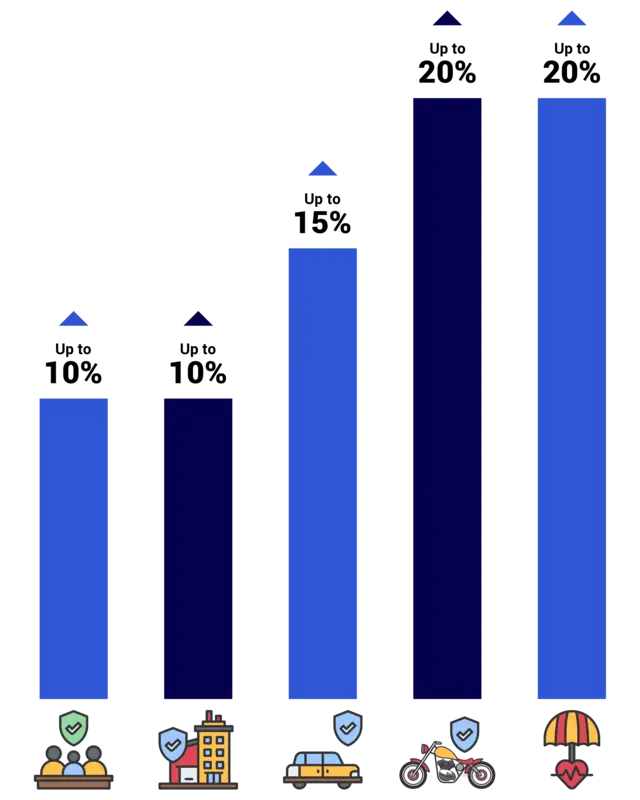

How Much Commission Can I Earn as a General Insurance Agent?

Types of Insurance and Commission Rates

Health Insurance

- Initial Commission: 5% to 10% of the premium.

- Renewal Commission: 2% to 5% of the premium.

Hospicash Insurance

- Initial Commission: 10% to 15% of the premium.

- Renewal Commission: 2 5% to 7% of the premium.

Car Insurance (4-Wheeler)

- Initial Commission: 10% to 15% of the premium.

- Renewal Commission: 5% to 10% of the premium.

Bike Insurance (2-Wheeler)

- Initial Commission: 15% to 20% of the premium.

- Renewal Commission: 5% to 10% of the premium.

General Insurance (Property, Liability, etc.)

- Initial Commission: 5% to 20% of the premium, depending on the specific type of coverage.

- Renewal Commission: 2% to 5% of the premium.

What Documents Are Required for an Insurance Agent?

To become an insurance agent, you'll typically need the following documents:

- Aadhaar Card: For identity verification.

- PAN Card: For tax purposes.

- Educational Certificates: Class 10th and/or 12th mark sheet.

- Bank Details: To set up your commission payments.

Having these documents ready will help you get started on your journey as an insurance agent!

What Our Clients Said About Biznext

FAQs on Insurance Agent or Adviser

What is an Insurance Adviser?

An Insurance Adviser is a professional who helps individuals and businesses choose the right insurance policies based on their needs. They provide guidance on different types of insurance, such as health, life, auto, and property insurance.

Can I work as an insurance agent part-time?

Yes, many people work as part-time insurance agents. This flexibility allows you to earn extra income while managing other commitments or jobs.

What ongoing support can I expect from an Insurance Consultant?

An Insurance Consultant typically offers ongoing support, including regular reviews of your insurance policies, updates on changes in regulations, and guidance on any adjustments needed as your business grows or changes. This ensures that your coverage remains relevant and effective.

How do I choose the right insurance product for my needs?

Assess your needs, risks, and financial situation to choose the right insurance product. Consider factors like coverage amounts, premium costs, and policy features. Consulting with an insurance advisor can also help you make informed decisions.

How is the commission structure set for insurance agents?

The insurance company determines the commission structure, which can vary based on several factors, including the type of insurance, the agent's experience, and the company’s policies.

What types of insurance can a general insurance agent sell?

A general insurance agent can sell various types of insurance products, including auto insurance, home insurance, health insurance, business insurance, and liability insurance.

Is it necessary to use a life insurance adviser?

While it’s unnecessary to use a life insurance adviser, their expertise can be invaluable in helping you make informed decisions about life insurance. They can provide insights and recommendations that may be difficult to obtain independently.

What qualifications do I need to become a health insurance agent?

A 10th passing certificate and the mandate to clear the exam are required to become a health insurance agent. Completing a pre-licensing course and obtaining a state-issued insurance license are essential steps to starting your career.

What types of motor insurance can agents provide?

- Third-Party Liability Insurance: Covers damages to another party in the event of an accident.

- Comprehensive Insurance: Offers protection against damages to your vehicle, theft, and third-party liabilities.

- Own Damage Insurance: This covers damages to your vehicle caused by accidents, fire, or natural disasters.

- Personal Accident Coverage: Provides financial support in case of injury or death of the driver or passengers in an accident.

How long does the online registration take?

The duration of the online registration process can vary by state, but it generally takes a few days to two weeks to process your application and issue your license.