Retailers and small shop owners in rural and semi-urban areas can now boost their monthly income by offering digital banking services right from their store. With the help of the Aadhaar Enabled Payment System (AEPS), they can provide essential services like cash withdrawal, deposit, balance inquiry, and mini statements to customers who may not have… Continue reading Best AEPS App for Retailers

Author: Alisha Bharmal

I am Bharmal Alisha, a seasoned Social Media Marketer and Content Writer with a rich background spanning over 3 years. My expertise lies in the dynamic intersection of digital marketing and content creation. Having dedicated substantial time to the study of the fintech industry, I bring a comprehensive understanding of its nuances. My skills are honed towards effectively translating the complexities of the fintech sector into compelling and engaging content. Through strategic social media marketing, I aim to enhance visibility and drive meaningful engagement within the fintech realm.

How to Start an ATM Business in India

In many small towns and villages in India, people still need cash for daily use. But not every area has a bank or ATM nearby. That’s why starting an ATM business is a smart idea. You can set up an ATM and help people withdraw money easily—while also earning income for yourself. You don’t need… Continue reading How to Start an ATM Business in India

Mobile Recharge Software

In today’s time, almost everyone needs mobile recharge—whether it’s for calls, internet, or DTH. People go to nearby shops or look for quick online options to get their recharge done. This is where mobile recharge software helps. It’s a simple tool that allows shopkeepers or small business owners to do mobile and DTH recharges for… Continue reading Mobile Recharge Software

Digital Gramin Seva

डिजिटल ग्रामीण सेवा एक ऐसा डिजिटल प्लेटफ़ॉर्म है जो गाँव के लोगों तक बैंकिंग और सरकारी सेवाएँ पहुँचाने का काम करता है। इसका मकसद है ग्रामीण क्षेत्रों में रहने वाले लोगों को ऑनलाइन सेवाओं के ज़रिए आसानी से पैसा भेजने, लेने, बिल भरने, रिचार्ज करने और सरकारी योजनाओं का लाभ लेने की सुविधा देना। जहाँ… Continue reading Digital Gramin Seva

Fastest Courier Service in India

When it comes to sending important parcels or urgent documents, speed matters the most. In a country as vast as India, choosing the right courier service that delivers quickly and reliably can save both time and stress. Whether it’s a business shipment or a personal delivery, having access to the fastest courier service ensures that… Continue reading Fastest Courier Service in India

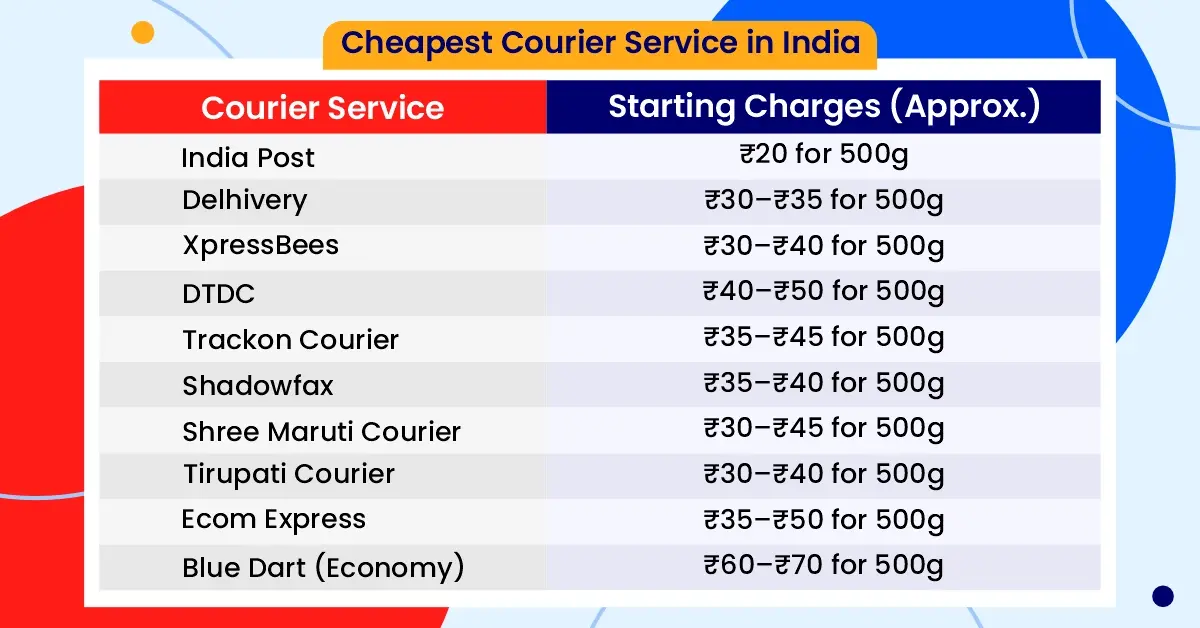

Cheapest Courier Service in India

Looking for the cheapest courier service in India? Whether you’re sending parcels for business or personal reasons, finding an affordable courier is key to saving costs. In this blog, we’ll explore the most cost-effective courier services available in India, comparing their prices, services, and features to help you make the right choice without breaking the… Continue reading Cheapest Courier Service in India

Best Courier Service in India

Courier service is something we all need whether it’s for sending a gift to family, delivering documents, or sending products to customers. But with so many options in India, it can be confusing to pick the right one. Some are fast, some are cheap, and some offer better service in remote areas. A good courier… Continue reading Best Courier Service in India

Best UPI App in India

In today’s time, UPI (Unified Payments Interface) has made sending and receiving money super easy. Whether it’s paying for groceries, splitting a restaurant bill, or shopping online, UPI apps have become a part of daily life. With so many options available, choosing the best UPI app can feel confusing. In this blog, we will explore… Continue reading Best UPI App in India

Vi Balance Check Number

Want to check your Vi (Vodafone Idea) mobile balance? Whether you’re using a prepaid SIM or just want to check your talktime, data balance, or validity — it’s super easy. Vi gives you simple ways to check your balance in seconds. No need to go anywhere or call customer care. In this blog, we’ll explain… Continue reading Vi Balance Check Number

BSNL Balance Check

BSNL offers easy methods to check your balance, whether you’re using a prepaid or postpaid connection. Whether it’s through USSD codes, SMS, or the BSNL app, these options help you stay on top of your balance, data usage, and validity without any hassle. In this blog, we’ll guide you through various methods to check your… Continue reading BSNL Balance Check

Airtel Balance Check Number

Looking to check your Airtel balance quickly and easily? Whether you’re using prepaid or postpaid, Airtel offers multiple ways to help you keep track of your account balance, data usage, and validity. From USSD codes and SMS to the Airtel Thanks app, this blog will guide you through all the simple methods to check your… Continue reading Airtel Balance Check Number

Jio Balance Check Number

To keep track of your Jio account balance, there are simple ways to check it anytime. Whether you’re looking for your main account balance, data usage, or plan validity, Jio offers easy methods through USSD codes and SMS services. In this guide, we’ll walk you through the Jio balance check number and other quick ways… Continue reading Jio Balance Check Number

Bank of India Balance Check Number

If you have a Bank of India account and want to check your account balance quickly, there’s no need to visit the bank or ATM. Bank of India gives you an easy way to check your balance just by giving a missed call or sending an SMS. Whether you use a smartphone or a basic… Continue reading Bank of India Balance Check Number

Indian Bank Balance Check Number

Checking your bank balance is now easier than ever, especially if you have an account with Indian Bank. Whether you’re using a basic mobile phone or a smartphone, Indian Bank offers multiple ways to check your account balance without visiting the branch. In this blog, we’ll explain the easiest method—using the Indian Bank balance check… Continue reading Indian Bank Balance Check Number

Canara Bank Balance Check Number

If you have a Canara Bank account and want to quickly check your account balance, there’s no need to visit the bank or ATM. Canara Bank offers an easy way to know your balance just by giving a missed call from your registered mobile number. In this blog, we’ll explain how you can check your… Continue reading Canara Bank Balance Check Number

SBI Balance Check Number – SBI Quick Balance Enquiry

If you have an SBI bank account and want to check your balance quickly without going to the bank or ATM, this blog is for you. State Bank of India offers an easy way to check your account balance through your mobile phone. Whether you use a smartphone or a basic keypad phone, you can… Continue reading SBI Balance Check Number – SBI Quick Balance Enquiry

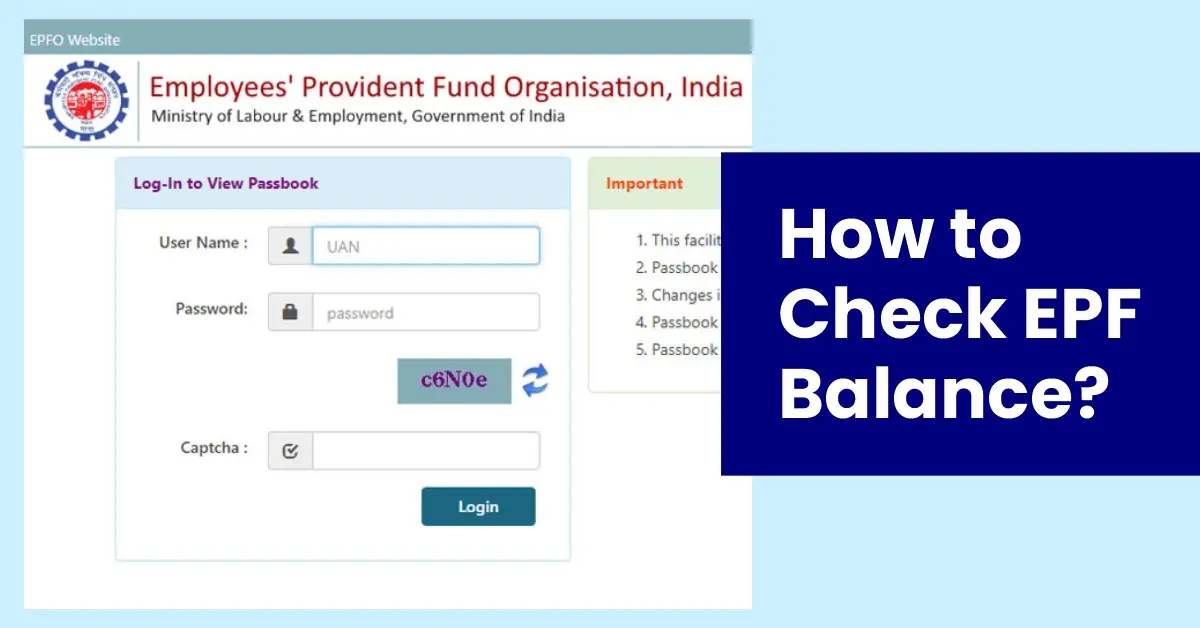

EPF: Balance Check, Passbook, Withdrawal

Employees’ Provident Fund (EPF) is a savings scheme introduced by the Government of India to help employees build a financial cushion for their retirement. It is managed by the Employees’ Provident Fund Organisation (EPFO) and applies to most salaried employees in the private sector. Every month, both the employee and employer contribute a fixed percentage… Continue reading EPF: Balance Check, Passbook, Withdrawal

PF Balance Check: Quick & Easy Ways to Check Your EPF Balance Online

Checking your PF balance is now easier than ever. If you want to keep track of your savings, check if your employer is making regular contributions, or plan for withdrawals, knowing your EPF balance is important. Earlier, people had to visit the EPFO office or depend on their employer for updates. But now, you can… Continue reading PF Balance Check: Quick & Easy Ways to Check Your EPF Balance Online