AEPS Registration

Free AEPS Registration – Start Aadhaar-Based Banking from Your Shop Today!

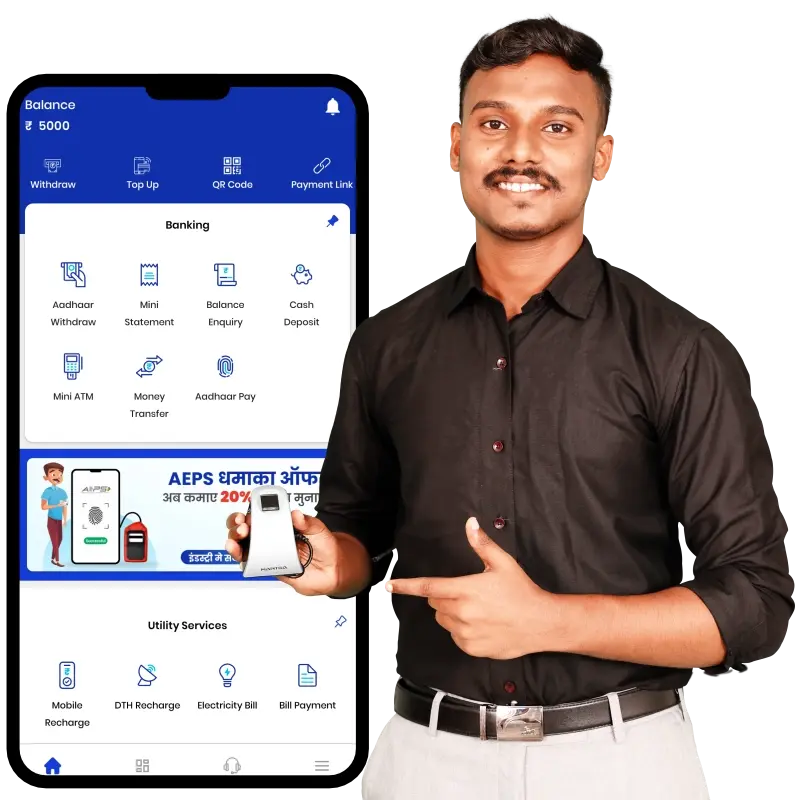

Register for AEPS services absolutely free and turn your shop into a mini banking point. With Biznext’s integration across all major banks, you can offer instant cash withdrawal, balance inquiry, and other AEPS services to your customers with ease. Start earning while providing essential banking solutions in your locality.

Free Retailer Agent Registration – Earn Up to ₹50K Per Month from Your Shop

AEPS Facility Services

AEPS Facility Services authorize small store owners to offer essential banking services using just an Aadhaar number and fingerprint authentication. Our AEPS Facility Services help retailers, shop owners, and banking correspondents (BCs) become mini-banking points in their local areas, promoting financial inclusion and enhancing customer convenience. The AEPS registration service setup offered by Biznext is fast, reliable, and fully compliant with NPCI standards.

Balance Inquiry

An AEPS Agent can check a customer’s bank balance in seconds using the Biznext portal or app, India’s leading AEPS service provider.

Cash Withdrawal

Shop owners can turn their store into an Aadhaar ATM, enabling cash withdrawals using customers' Aadhaar number and fingerprint—no bank visit needed.

Mini Statement

AEPS Agents can easily check and print mini statements and earn a commission on every transaction made through the AEPS service.

Cash Deposit

Customers can deposit cash into their Aadhaar-linked bank account using Aadhaar and biometrics via the Biznext AEPS Portal.

What is AEPS?

AEPS full form is Aadhaar Enabled Payment System. AEPS Service is a unique Aadhaar-based payment solution that enables bank customers to conduct financial transactions without needing debit cards, credit cards, or cheques. Users can perform transactions simply by using their Aadhaar number, which is registered to their bank account, and biometric authentication.

AEPS agents and distributors can provide basic banking services to their customers, such as cash withdrawal, deposit, balance inquiry, and obtaining a mini statement. This initiative by NPCI (National Payments Corporation of India) supports India's unbanked and underbanked populations.

At Biznext, we do more than just onboard AEPS Agents and Distributors; we actively support them in maximising their income through 25+ value-added services. Joining our AEPS Portal is quick and completely free—simply fill out the short registration form below or sign up directly and complete the video KYC to activate AEPS.

How Does AEPS Service Work?

Once the AEPS Agent registration process is complete, a Biznext AEPS Agent login ID is generated. The Aadhaar Enabled Payment System (AEPS) process is very simple.

- Setup: The AEPS Agent installs a biometric device with their computer or smartphone.

- Customer Information: The agent inputs the customer's Aadhaar number and bank name.

- Transaction Type Selection: The agent selects the desired transaction type, such as cash withdrawal.

- Biometric Authentication: The customer authenticates the transaction by providing a thumbprint, matching the one associated with their Aadhaar.

- Transaction Processing: The customer's account is debited, and the merchant's Biznext wallet account is credited in real-time. This includes an additional commission amount for the agent.

- Confirmation and Receipt: The AEPS Agent receives a transaction receipt, and the customer receives an SMS confirmation from the bank, verifying the successful completion of the transaction.

Features of Our AEPS Portal

- Instant Transaction Settlement: Enjoy real-time transaction settlements along with attractive AEPS commissions.

- Secure and Reliable System: Our platform ensures the utmost security and reliability for all transactions.

- Convenient Access: No need to carry debit or credit cards. Simply use your Aadhaar number and fingerprint authentication for seamless access.

- Effortless Money Management: Easily withdraw or deposit money and avoid long queues at banks or ATMs.

- Quick Processing: Complete an AEPS transaction in under a minute, ensuring a quick and efficient experience.

Benefits of Becoming an AEPS Agent

Starting an AEPS (Aadhaar-enabled Payment System) service is a low-investment, high-return opportunity. Here are some of the key benefits.

- Minimal Investment: To set up your AEPS business, you only need a smartphone or computer (depending on your preference and availability) and a biometric device.

- Attractive Commissions: Earn substantial commissions on every AEPS transaction. We offer commissions of up to ₹13 + ₹2 per transaction.

- Efficient Process: Complete AEPS transactions in less than a minute, ensuring a quick and seamless experience for your customers.

- Optimal Cash Utilization: Fully utilize the cash available by offering AEPS services.

- Expanded Customer Base: Provide additional AEPS services to attract more customers, enhancing your business's reach and reputation.

Why Choose Biznext for AEPS Apps Services?

Real-Time Settlement

Biznext ensures that AEPS agents and distributors receive instant, real-time settlements for every transaction, providing immediate access to funds and FREE.

Zero Downtime

With multiple banks integrated into our backend, Biznext guarantees uninterrupted service, ensuring your business operations are always up and running.

Experienced Support Team

Our team of trained and experienced professionals is dedicated to helping your AEPS business thrive by offering expert guidance and assistance whenever needed.

Efficient Transactions

Save valuable time by conducting AEPS transactions through the Biznext Web Portal or Mobile Application, designed for quick and convenient processing.

Streamlined Process

Our platform offers a seamless transaction process, minimizing time and effort while enhancing business efficiency.

Hassle-Free Business Setup

Setting up your AEPS business with Biznext is straightforward. We offer comprehensive support throughout the entire process, ensuring a seamless start.

Activation Process for the Free AEPS Registration Portal

Whether you're a new or existing business partner, registering for the AEPS free portal is straightforward and requires minimal documentation. You’ll need to provide your Aadhaar Card, PAN Card, Bank Account with IFSC code, and Mobile Number linked to Aadhaar. These documents are required during free AEPS agent registration. Once you complete the AEPS registration form, you can get started and begin earning a significant income with every AEPS transaction.

Requirements to Start an AEPS Service Business

To start your AEPS service business and become a local banking point, you’ll need a few basic things in place. Here are the key requirements for AEPS registration and setup:

- Established Shop: Any shop where you are currently selling goods & services.

- Smartphone or Computer: A basic Android phone or system to run the AEPS app or portal smoothly.

- Biometric Device: A fingerprint scanner (RD Device) registered and compatible with your AEPS portal.

- Internet Connectivity: A stable internet connection to perform real-time Aadhaar banking transactions.

What Our Clients Said About Biznext

FAQs on AEPS Service Registration

What is the Aadhaar Enabled Payment System?

AEPS is a payment solution that allows banking transactions using an Aadhaar number and biometric authentication without the need for debit or credit cards.

How does the AEPS service work with Biznext?

Agents use a biometric device to verify customer transactions with their Aadhaar number. Transactions are processed quickly, with funds credited to the agent's wallet and confirmations sent to the customer via SMS.

Is AEPS Registration Free?

Yes, AEPS registration through the Biznext AEPS Portal is entirely free.

Why should I choose Biznext for AEPS services?

Biznext offers real-time settlements, easy setup, reliable support, efficient transactions, and uninterrupted service.

What are the benefits of becoming an AEPS agent with Biznext?

Benefits include low investment, high commissions per transaction, increased customer base, and quick transaction processing.

How do I register for the AEPS free portal with Biznext?

Provide your PAN Card and Aadhaar Card, fill out the registration form, and receive your AEPS Agent login ID to start offering services.

What equipment do I need to start an AEPS business?

You need a smartphone or computer with internet access and a biometric device for authentication.

Can I Start My Own AEPS Service Business?

Starting your own AEPS (Aadhaar Enabled Payment System) business is simple with Biznext. By registering with Biznext, you can launch your AEPS Service business within one day.

Which AEPS Service Provider is the Best?

Biznext stands out as the premier AEPS service provider. It offers the highest AEPS commissions, free registration, and instant wallet credits. Since its inception in 2011, Biznext has built a robust network of over 500,000 AEPS agents who conduct daily transactions through the Biznext AEPS Portal.

What services can I offer as a Biznext AEPS agent?

Services include cash withdrawal, balance inquiry, mini statement retrieval, and cash deposit using Aadhaar authentication.