Buy A Micro ATM Machine Make Money on Every Withdrawal

Earn Up to ₹12 Per Cash Withdrawal with a Micro ATM Machine

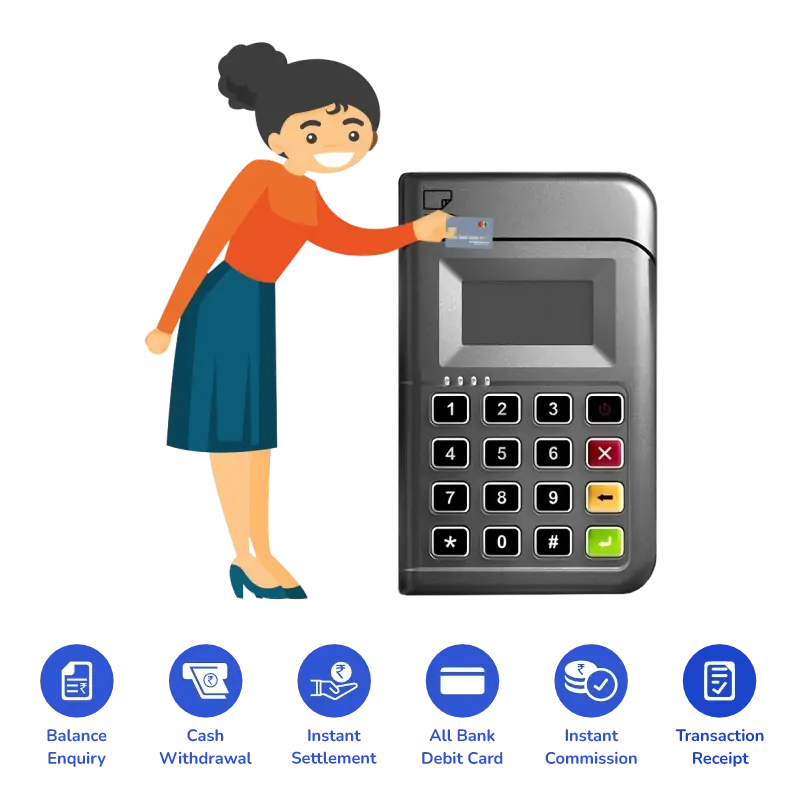

Biznext has a great new opportunity for you to become a bank for your local area. By setting up a Micro ATM in your store, you can easily offer your customers services like balance inquiries, cash withdrawals, and sales transactions. Every transaction you handle for your customers earns you an attractive commission. This not only boosts your revenue but also gives you a profitable business opportunity. Mini or Micro ATM Machine. Earn a commission on every transaction.

Free Retailer Agent Registration – Earn Up to ₹50K Per Month from Your Shop

What is the Use of Micro ATM Machines?

Micro ATM Machine helps you convert your shop into a Bank and provide multiple banking services to your customers. This makes it easy for them to fulfil their banking needs by visiting your store, which is present in their local area. Services that can be provided using the Biznext Micro ATM Machine.

Balance Inquiry

The agent can check the customer's bank account balance in less than a minute using the Biznext portal or mobile application & the customer’s debit card.

Cash Withdrawal

Agents from Biznext can convert their store into an ATM using a Micro ATM device. Instead of searching for an ATM, the customers can withdraw money using their debit card.

Sale Transaction

The same device for cash withdrawal can also be used as a POS terminal to accept customer payments through their debit or credit cards.

What is a Micro ATM?

A Micro ATM, also called a Mini ATM, is a small, handheld device that lets people withdraw cash and check their account balances in areas where regular bank ATMs are hard to find. These Mini ATMs act like a "Bank-ina-Box," bringing banking services to remote areas.

MPOS Micro ATMs are smaller and portable versions of regular ATMs. They are affordable and have high earning potential, making them a great way to boost income with little effort.

Only 5% of India's rural population has access to ATMs. To address this gap, the Government of India is promoting Micro ATMs. These devices are easy to set up and cost-effective, making banking services accessible to more people in rural areas.

With Biznext Micro ATMs, you can provide essential banking services and earn attractive commissions, helping your community while increasing your income.

Key Features of Micro ATM Machine

- Accepts All Debit Cards: It supports Chip & Pin, Magnetic Swipe, and NFC* (Near Field Communication) cards.

- Easy Payments: Use debit cards for payments at your store with the Biznext Micro ATM. It's quick, easy & provides flexibility to easily transact.

- Safe Transactions: Secure and reliable transactions with Biznext Micro ATM. Biznext maintains all security protocols to enhance your experience.

- Payment Receipts: After each transaction, you will receive a receipt that you can print or share via email or WhatsApp at your convenience.

- Real-Time Commission: Earn instant commissions on each transaction, credited to your Biznext wallet.

- Affordable Price: The low cost of the Micro ATM ensures a high return on investment.

Why Choose Biznext Micro ATM?

Cost-Effective Solutions

Our Micro ATM machines offer the most competitive pricing structure, ensuring affordability for all retailers.

Secure Transactions

Enjoy peace of mind knowing that every transaction conducted through our Micro ATM machines is safe and secure.

Real-Time Commissions

Earn a commission instantly with each transaction processed on our Micro ATM machines.

Comprehensive Customer Support

We provide robust grievance support to address all customer inquiries regarding our Micro ATM machines.

Lucrative Commission Opportunities

Benefit from the highest commission structure available for our retailers.

Benefits of Micro ATM Machine

Micro ATM Machine Use For Retailers

The Micro ATM Business requires no extra setup, but it does ensure you an additional source of income.

- Biznext Micro ATM accepts all Debit cards, whether Chip & Pin, Magnetic Swipe, or NFC* (Near Field Communication).

- Get Maximum Utilization of the cash at hand—high income at low investment.

- After the transaction is completed a payment receipt is produced, which can further be printed or shared directly via email or Whatsapp.

Offering a broader range of services to your customers not only enhances their experience but also increases your customer base. The Micro ATM is a cost-effective solution, with its affordable price making it a smart tool for efficient cash management in your store.

Benefits of Using a Micro ATM Device for Customers

- Convenience of Accessibility: Micro ATMs eliminate the necessity of travelling long distances to find an ATM, ensuring you can meet your cash needs without hassle.

- Time-Saving Efficiency: Avoid the inconvenience of standing in long queues at banks or traditional ATMs. Micro ATMs offer quicker service, saving you valuable time.

- Safe and Secure Transactions: Use the reliable Biznext Micro ATM Machine to conduct secure transactions with a trusted retailer. Your financial safety is prioritized.

- Reliable Availability: Traditional ATMs can often be out of service due to cash shortages or maintenance. With Micro ATMs, you won't face these issues, ensuring continuous service.

- 24/7 Operation: Micro ATMs are operational around the clock, providing access to cash anytime without concerns about being stuck or unexpected balance deductions.

How to Withdraw Cash Using a Micro ATM Machine?

With the introduction of micro ATMs, cash withdrawal has become more accessible and convenient for consumers, especially in areas lacking traditional banking ATMs. By following these steps, you can easily and securely withdraw cash using a Micro ATM, making banking services more accessible to everyone. Here’s a step-by-step guide on how to withdraw cash using a micro ATM:

- Customer Visit Store: The customer enters the store with their debit card.

- Card Swipe: The customer gives you their debit card, which you swipe using the Biznext Micro ATM Device.

- Device Connection: The micro ATM is connected to an Android phone, enabling the retailer to access the Biznext Mobile Application. The retailer selects the Micro ATM option within the application to proceed with the transaction.

- Enter Withdrawal Amount: The retailer enters the amount of cash to be withdrawn by the customer, who then confirms the amount.

- Enter PIN: The customer enters the PIN of their debit card, and the transaction is completed.

- Transaction Completion: Return the cash and card to the customer. Your commission will be added to your Biznext wallet in real time.

How to Get a Micro ATM Machine?

To get a Micro ATM machine, you need to become a Biznext Retailer/Distributor by filling out the registration form and submitting the following documents for verification:

- Aadhaar Card

- PAN Card

Please complete the registration form today to learn more about Micro ATM pricing and registration and to partner with Biznext for a seamless start to your own Micro ATM business. Once the verification process is completed, we will contact you to arrange the delivery of your Micro ATM machine.

What Our Clients Said About Biznext

Do You Have Any Questions About Micro ATM?

Who can Install a Micro ATM Machine?

Any retail shop owner who wants to grow their business and increase their revenue by turning their shop into a Mini Bank and several people in their local area can Install a Micro ATM Machine. Always remember, an Aadhaar Card and PAN card are the ‘must to have’ documents to become eligible for installing a machine.

What is an MPOS Machine?

An mPOS machine, or mobile Point of Sale machine, is a small, portable device that allows businesses to accept customer payments using debit or credit cards, just like the card swipe machines you see in shops. But the best part about an mPOS machine is that it's connected to a smartphone or tablet through an app.

What is the Cost of a Micro ATM Machine?

Biznext offers a wide range of Micro ATM Machines, starting from Rs.999/—to Rs.14999/—all-inclusive, depending on the kind of machine the user is buying.

Which Service Can Be Offered By Micro ATM Machine?

Banking services like cash withdrawal, balance inquiry, and mini statement can be offered using a Micro ATM and earn attractive commissions.

How Will the Micro ATM Agent Get Commissions?

Biznext offers instant and real-time commission to its Micro ATM agents. This commission is reflected in the wallet of your Biznext portal immediately after you make a transaction on a Micro ATM Machine.

How much time does it take to install a Micro ATM at a Retail Shop?

The Micro ATM reaches the retailer 2-5 days after the order is placed. During this time, the activation process of the Mini ATM device takes place simultaneously. Once the Micro ATM has reached the retailer, our team will train them regarding the process, and they can start using it immediately!

What is the Cash Withdrawal Limit through Micro ATM?

In a single transaction, a customer can withdraw ₹10,000, which is the maximum limit for a Micro ATM in India.