EMI & Cash Collection

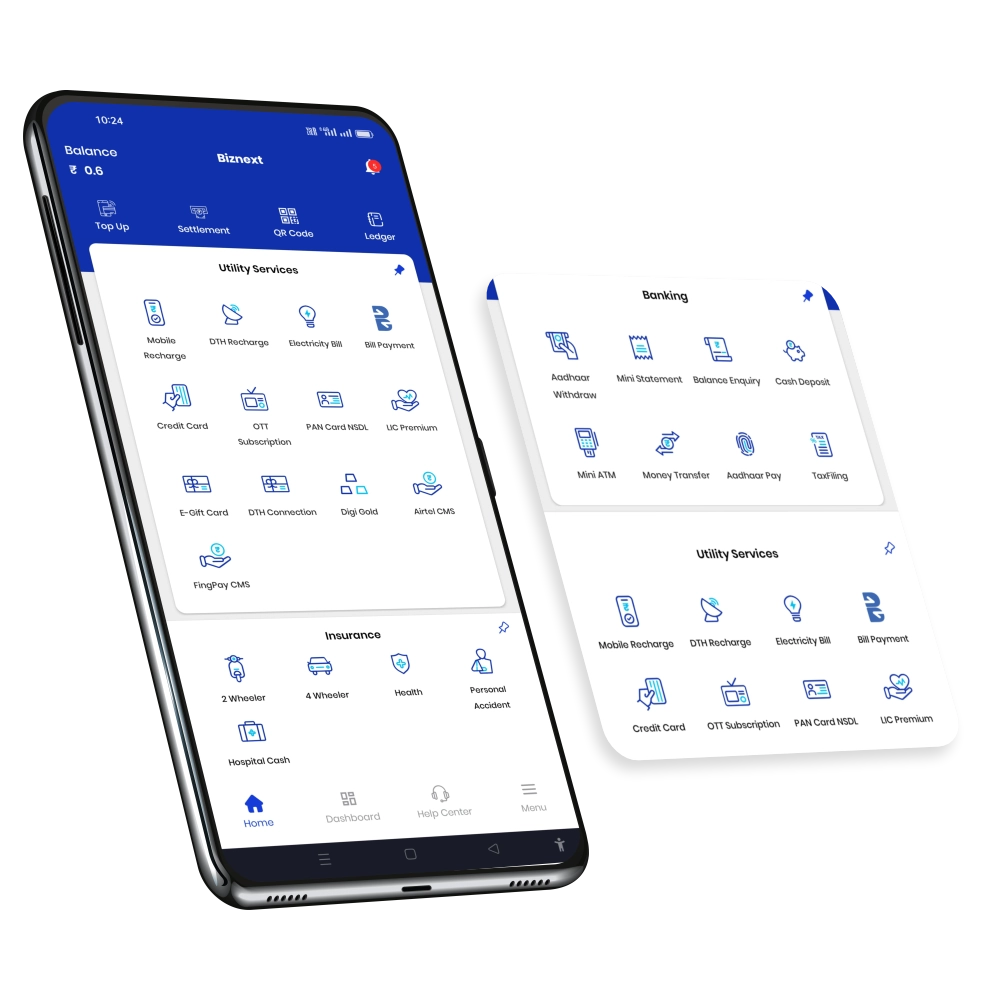

Provide Cash Collection Service with 220+ Billers on the Biznext Portal & Earn Commissions

Start your own cash or EMI collection centre in your area and earn commissions ranging from Rs. 0.10 to 0.80 per transaction by collecting payments or EMI installments for various financial institutions. This service allows you to help people manage their payments easily while earning a steady income through commissions, benefiting your community and your business.

Free Retailer Agent Registration – Earn Up to ₹50K Per Month from Your Shop

Excellent Features of Cash Collection

220+ Billers

Biznext portal and application has 220+ billers for the Cash Collection service.

Seamless Settlement

Payments are processed without hassle, ensuring a smooth customer experience.

Quick Fund Settlement

CMS is connected to the partner’s server, so the bill is settled quickly when a customer deposits cash for EMI.

Safe & Secure

Digital payments are processed through encrypted and secure systems, making them safe and secure.

24/7 Operational

Customers can deposit EMI against their loan whenever they want, without waiting in long queues.

What is Cash Collection

With the cash collection service, you can easily earn extra money by helping customers and collection agents deposit their loan EMIs at your store. This service is partnered with over 40 financial partners, including well-known banks and lending companies. Customers can visit your store to pay their monthly EMIs, and collection agents can drop off payments for multiple clients.

Every time someone deposits an EMI through you, you earn a commission. This means more transactions lead to more income for you. Plus, it brings more people to your store, allowing you to sell other products or services. It’s an effortless way to grow your business and help your community simultaneously.

What is the EMI Collection

The EMI collection service allows you to earn extra money by accepting EMI payments directly at your store. With partnerships across 40+ financial institutions, including popular banks and lenders, this service makes it easy for customers and collection agents to pay EMIs without hassle. Customers can drop by your store to settle their monthly EMI payments, while collection agents can deposit multiple payments on behalf of their clients.

Each transaction means a commission for you, so the more payments you handle, the more you earn. This service also brings more people to your store, increasing the chances of selling other products or services. It’s a simple way to grow your income while providing a convenient service to your community.

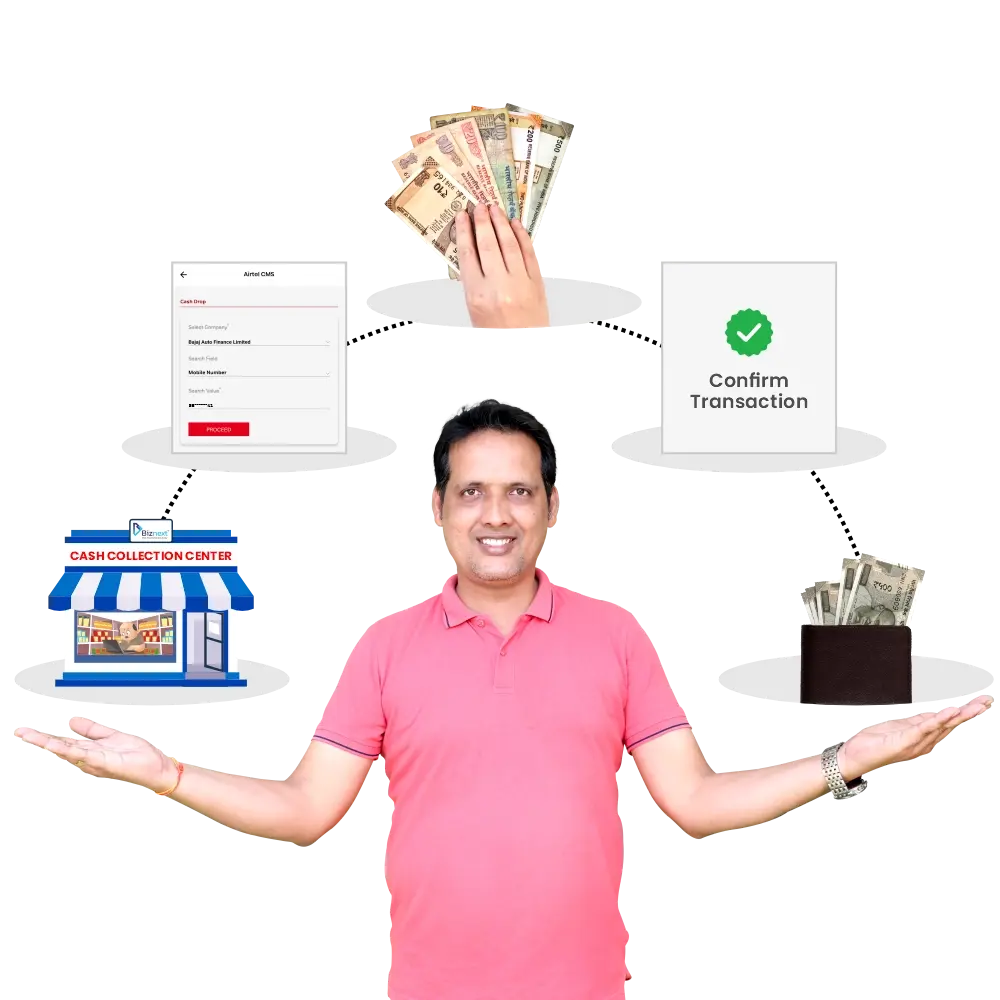

How to Collect EMI Payments from Customers

Collecting EMI payments from customers at your store is straightforward and can be done in a few easy steps:

- Set Up the Service: Ensure your store is registered with the EMI collection service provider. This usually involves setting up a platform or app to process the payments. You can do this by signing up with Biznext in 5 minutes.

- Customer Visits Your Store: When customers need to pay their monthly EMI, they can visit your store and provide loan account details.

- Enter Loan Details: Using the app or platform, enter the customer’s loan account information, including the loan provider and EMI amount.

- Receive Payment: Depending on the service, collect the payment from the customer, which can be in cash or other accepted modes.

- Confirm Transaction: Complete the transaction on the platform and provide the customer with a receipt as proof of payment.

- Earn Commission: You receive a commission for every EMI collected at your store, adding to your income.

How to Become Cash Collection Agents

Any person can become a Cash Collection Management System (CMS) agent by following the below-given steps:

Sign Up as an Agent

First, you must sign up with Biznext. This involves completing the E-KYC process, a quick and secure way to verify your identity online.

Verification and Service Activation

After verifying all the details, Team Biznext will review and approve your cash collection service activation request once your registration is complete.

Start Providing Collection Services

You can assist customers by collecting EMIs and cash payments after activation. Earn attractive commissions on every successful transaction, boosting your income effortlessly.

Our EMI & Cash Collection Partners

Here are some popular EMI and cash collection partners, including banks, NBFCs, and other lenders:

What Our Clients Said About Biznext

FAQs on EMI & Cash Collection

What is the Cash Collection service?

The Cash Collection service allows businesses to collect payments for EMI installments and other bills from more than 220 billers. It is facilitated through the Biznext web portal and mobile application. By offering this service, you can help your community manage their payments while earning commissions.

How does the Biznext portal work for Cash Collection?

The Biznext portal allows you to collect payments and EMI installments on behalf of various financial institutions and billers. Register as a Cash Collection Center and use the portal to track and manage real-time transactions. The portal provides access to over 220 billers and ensures seamless settlement and quick fund transfers.

How do I start my Cash or EMI Collection centre?

Register on the Biznext web portal or download our app to start your Cash or EMI Collection centre. Once set up, you can begin collecting payments and EMI installments for various billers and earning commissions on every transaction.

How much can I earn by offering Cash or EMI Collection services?

You can earn commissions ranging from Rs. 0.10 to Rs. 0.80 per transaction, depending on the amount of the payment or EMI instalment processed. The more payments you process, the more you can earn.

Do I need any special equipment to start with Cash Collection?

To get started, you’ll need essential equipment, such as a computer or mobile device with internet access, to use the Biznext portal or application. To collect cash, you’ll need a safe and secure way to handle cash transactions.

What are the working hours of the Cash Collection service?

The service is available 24/7, allowing customers to deposit their EMI installments anytime. This flexibility benefits customers and you, as you can manage payments whenever convenient.

How do I track my earnings and transactions?

You can easily track all your transactions and earnings through the Biznext portal or the Biznext app. The platform provides detailed reports on payments collected, commissions earned, and pending settlements.

How does the cash-collecting service work?

With Cash Collecting, you can receive cash payments on behalf of service providers or financial institutions. Customers can pay their bills or installments directly through your centre, and you will facilitate the collection and payment process through secure methods.

What should I do if I face any inline Cash Collection System issues?

If you experience any problems, you can contact our customer support team through the online portal. Our team can assist you with resolving any technical or transaction-related concerns.

What types of payments can be collected through Money Collection Services?

Money Collection Services can collect various payments, including utility bills, loan EMIs, credit card payments, insurance premiums, and more. These services support both individual payments and bulk collections for businesses.

Can I collect EMIs for multiple financial institutions?

The EMI Collection service allows you to collect EMIs for various financial institutions. The platform supports multiple partners, allowing customers to pay for different types of loans and financial services in one place.

How can I collect EMIs from customers?

You can collect EMIs through various methods, including in-person payments at retail centres, online payment gateways, mobile apps, or by setting up direct debit/standing instructions from customers' bank accounts.

How can I remind customers about their EMI due dates?

Send timely reminders via SMS, email, or app notifications a few days before, on the due date, and if the payment is overdue.

Can I use the Digital Cash Collection Service for my payments?

Yes, businesses can use Digital Cash Collection Services to pay their bills, loans, or other obligations and collect customer payments.

How do I set up a Web-Based Cash Collection for my business?

Partner with a technology service provider to set up a web-based cash collection. You can start accepting payments through the web platform after registration and integration with your website or app.

What services do EMI Agencies provide?

EMI Agencies offer services such as EMI collection, tracking overdue payments, generating payment receipts, sending reminders, and delivering multiple payment methods (online, cash, or bank transfers).

How do I ensure the security of payments handled by an EMI Agency?

EMI Agencies use secure payment gateways, encryption, and compliance with data protection regulations to ensure that all payments are securely processed and customer information is protected.

What happens if I miss an EMI payment through the Bank EMI Collection?

The bank may charge a late fee or penal interest if you miss an EMI payment. Continuous missed payments can negatively affect your credit score and may result in further collection efforts from the bank.