In India, agent registration has become one of the most practical ways to start a business with low investment and steady income. From booking railway and flight tickets to selling insurance, loans, banking, fintech, and real estate services, agents play a crucial role in connecting companies with customers.

If you are a student, small shop owner, homemaker, or working professional looking for an additional or full-time income, this detailed guide will help you understand what agent registration is, how it works, and which type of agent business is best for you.

What Is Agent Registration?

Agent registration is the official process of enrolling yourself or your business with a company, government body, or digital platform to sell their products or services legally and earn commission.

Once registered, you receive:

- An Agent ID or login

- Access to an online agent portal

- Permission to sell services

- Commission on every successful transaction

Why Agent Registration Is Growing Fast in India

Agent-based businesses are growing because:

- Low investment compared to traditional businesses

- No need to manufacture products

- High demand for services like travel, insurance, banking, and real estate

- Digital platforms have made online agent registration simple

- Even rural and semi-urban areas now depend on agents

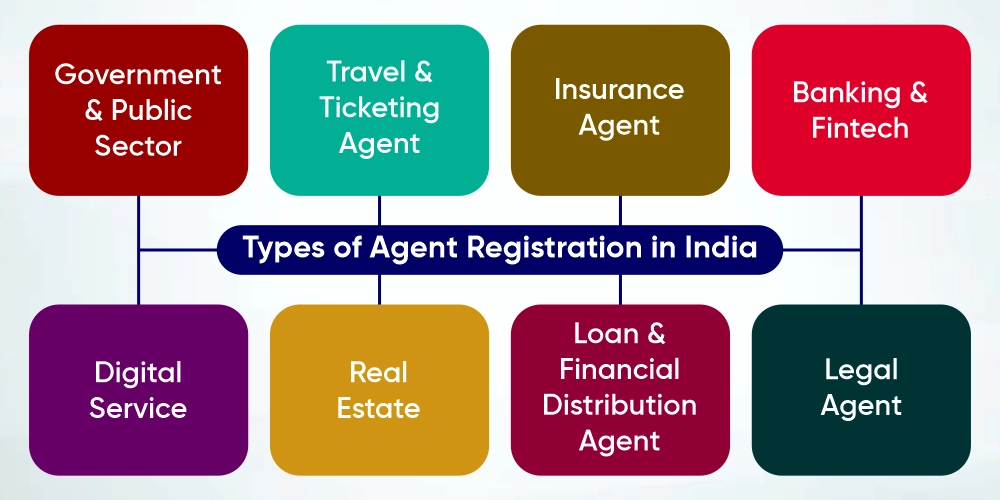

Types of Agent Registration in India – Industry-wise

India offers multiple agent registration opportunities. Let’s understand them one by one.

Indian Government & Public Sector Agent Registration

IRCTC Agent Registration

The Indian Railway Catering and Tourism Corporation (IRCTC) manages online railway ticket bookings across India. By completing IRCTC agent registration, individuals and businesses can legally book train tickets for customers and earn commission.

Key Benefits of IRCTC Agents:

- Book confirmed railway tickets for customers

- Earn commission up to 40 rupees on each successful booking

- Operate a legal railway ticket agent business

- Suitable for cyber cafés, CSCs, retailers, and travel agents

IRCTC Agents Registration Highlights:

- IRCTC agent registration online via authorised providers

- IRCTC agent ID & login registration provided after approval

- IRCTC authorised agent registration fee usually ranges between ₹1,200–₹5,000 (varies by provider)

How to Do IRCTC Agent Registration (Step-by-Step)

The Indian Railway Catering and Tourism Corporation (IRCTC) allows authorised agents to book railway tickets for customers legally. Below is the simplified process:

- Select an IRCTC Authorised Service Provider: IRCTC does not allow direct public registration. You must apply through an IRCTC-approved principal service provider or distributor like Biznext, eRail & IRCTC Tourism.

- Submit Documents and Business Details: You need to provide basic KYC documents such as Aadhaar card, PAN card, passport-size photo, address proof, and shop or business details if applicable.

- Pay IRCTC Agent Registration Fees: A one-time registration fee is charged by the authorised provider. The amount may vary depending on the service package.

- Get IRCTC Agent ID Registration: After successful verification, your IRCTC agent ID is created, allowing you to book tickets through the agent portal.

- Login and Start Ticket Booking: Use the provided IRCTC agent login credentials to access the system and begin railway ticket booking for customers.

Important: Always avoid fake or unofficial websites and register only through verified IRCTC-authorised partners like Biznext. Do an IRCTC agent registration today at just ₹1,299.

India Post Agent Registration

India Post allows individuals to work as authorised agents for its financial and postal services, especially in rural and semi-urban areas.

India Post Agent Services offered:

- Postal savings schemes (RD, TD, MIS, etc.)

- Insurance products

- Money transfer services

Why it’s popular:

- High trust among customers

- Stable demand in villages and small towns

- Low competition compared to private agents

Post PLI Agents: PLI Agents login/Registration

PAN Card Agent Registration

PAN card agents assist individuals and businesses with PAN-related services.

PAN Card Agent services include:

- New PAN card applications

- PAN correction and update requests

Advantages:

- Year-round demand

- Simple process and low operational cost

- Ideal as an add-on service with other agent businesses

This category is best for agents looking for a regular income with minimal investment. Register yourself as a Pan Card agent.

Insurance Agent Registration in India

LIC Agent Registration

The Life Insurance Corporation of India (LIC) is the most trusted and widely known insurance organisation in India. Becoming an LIC agent is a popular choice for people looking for long-term and stable income.

LIC Agent Key Points:

- LIC agents sell life insurance policies such as term plans, endowment plans, pension plans, and child plans.

- One of the biggest advantages is renewal commission, which means agents continue earning income as long as the policy remains active.

- This model is suitable for individuals who want to build relationships and earn steadily over many years.

- The registration process includes basic eligibility, document submission, mandatory training, and clearing a simple exam.

- LIC agent registration is ideal for part-time agents, retirees, homemakers, and professionals looking for additional income.

LIC agent registration: https://agencycareer.licindia.in/agt_req/index1.php

Private Insurance Agent Registration

Apart from LIC, agents can also work with private insurance companies and online insurance platforms.

Key points for Private insurance agents:

- Private insurance agents can sell multiple products like health insurance, motor insurance, travel insurance, and business insurance.

- Compared to traditional insurance models, private insurance platforms offer faster onboarding and digital dashboards.

- Agents can compare plans from different insurers and suggest the best option to customers, which increases trust and conversions.

- Commission payouts are usually quicker and performance-based.

- This option is suitable for agents who prefer technology-driven selling and want flexibility in product selection.

Private Insurance Agent Registration Companies List

You can register with private insurance companies and aggregators:

- Tata AIG agent registration

- Policybazaar agent registration

- New India Assurance agent portal registration

- United India Insurance agent portal registration

- Oriental Insurance agent portal registration

Why Insurance Agent Registration Is a Smart Choice

- Growing awareness of insurance in India

- Recurring income potential

- Low initial investment

- Long-term career opportunity with scalable earnings

Insurance agent registration remains one of the most reliable commission-based businesses in India today. You can join Biznext as a incurece agnet and sell multiple insurance in single platform.

Also Read: How to Become an Insurance Agent

Travel & Ticketing Agent Registration

Air Ticket Agent Registration

Air ticket agents help customers book domestic and international flight tickets and earn commission on every booking. This business is suitable for travel agencies, cyber cafés, and individuals who want to start a travel-related service with low infrastructure.

Key points of Air ticket agents:

- Agents can book flight tickets for customers who are not comfortable using online apps or need guidance.

- Registration is done through airlines or authorised travel platforms that provide an agent login and booking dashboard.

- Agents can earn commission, service charges, or incentives based on booking volume.

- This business works well in both urban and semi-urban areas where people prefer assisted booking.

- Agents can also upsell services like travel insurance, hotel booking, and holiday packages.

Air ticket agents often work with platforms linked to Air India, IndiGo, MakeMyTrip, EaseMyTrip, and Akbar Travels.

Major airline and OTA agent registration options:

- Air India agent registration

- Indigo agent registration

- MakeMyTrip agent registration

- EaseMyTrip agent registration

- Akbar Travels agent registration

You can also start:

- B2B travel agent registration

- Free travel agent registration in India (via some platforms like Biznext)

Bus Ticket Agent Registration

Bus ticket agents book intercity and interstate bus tickets for passengers.

Key points:

- High demand from daily travellers and rural passengers

- Easy to operate from small shops, CSC centres, or cyber cafés

- Good add-on service with other agent businesses

- Low investment and quick commission settlement

Travel and ticketing agent registration is a practical option for a stable, service-based income. Join today bus ticketing agent earns up to 4% commission on every ticket booking.

Banking, Fintech & Digital Service Agent Registration

BC Agent Registration (Banking Correspondent)

Banking Correspondent (BC) agents act as a bridge between banks and customers, especially in rural and semi-urban areas where bank branches are limited.

Key points of BC agents:

- BC agents provide essential banking services such as cash withdrawal, cash deposit, balance enquiry, and basic account opening.

- This model supports financial inclusion by bringing banking services closer to people.

- BC agents work through banks or payment banks and operate using micro-ATMs or biometric devices.

- Income is earned through commission on each transaction, making it suitable for small shop owners and CSC operators.

- BC agent registration usually requires basic documents and a small setup cost.

Many agents work with payment banks like Airtel Payments Bank and Jio Payments Bank, which have strong digital infrastructure.

Fintech & Digital Service Agent Registration

Fintech agents offer modern digital financial services that are in high demand across India.

Key points:

- Agents provide services such as AEPS transactions, FASTag recharge and issuance, mobile recharges, and bill payments.

- These services are widely used in both urban and rural areas due to convenience and speed.

- Fintech platforms offer easy onboarding, digital dashboards, and quick commission settlement.

- Agents can bundle multiple services to increase daily footfall and income.

- Platforms like Biznext, Paytm and PhonePe are commonly used for digital agent services.

This category is ideal for agents looking for daily transactions and regular commission-based income.

Fintech Agent Registration List

Fintech agents provide digital services like:

- AEPS agent registration

- FASTag agent registration

- Paytm agent registration

- PhonePe agent registration

These services work well in both cities and villages.

Also Read: AEPS Agent Registration Guide

Real Estate & Legal Agent Registration

RERA Agent Registration

If you are involved in property buying, selling, or renting, RERA agent registration is compulsory under the Real Estate (Regulation and Development) Act.

Key points of RERA registration:

- RERA registration makes real estate agents legally authorised to deal in property transactions.

- It increases transparency, trust, and credibility among buyers and sellers.

- Agents must apply through the state-specific RERA portal, as rules and fees differ from state to state.

- Registration requires basic documents such as identity proof, address proof, business details, and photographs.

- RERA agent registration fees vary by state; for example, MahaRERA charges higher fees compared to some other states.

- Without RERA registration, agents may face penalties or legal action.

Maha Rera Agent Registration: https://maharerait.maharashtra.gov.in/register/

UP Rera Agent Registration: https://www.up-rera.in/NewAgent

Patent Agent Registration

Patent agents assist individuals and companies in protecting inventions.

Key points:

- This is a specialised legal profession.

- Applicants must meet educational eligibility requirements and pass a government-conducted examination.

- Patent agents mainly work with startups, innovators, and businesses.

This category suits professionals seeking high-skill, long-term legal careers.

Loan & Financial Distribution Agent Registration

DSA Loan Agent Registration

DSA (Direct Selling Agent) loan registration allows individuals to work as authorised loan agents for banks and NBFCs.

Key points of DSA Agent:

- DSA agents help customers get personal loans, business loans, home loans, and sometimes credit cards.

- The agent’s role includes lead generation, document collection, and coordination with lenders.

- Commission is paid after loan approval and disbursement and usually depends on the loan amount.

- No office setup is mandatory; many agents work part-time or from home.

- This model is suitable for people with good local contacts and basic financial understanding.

DSA loan agent registration is a low-investment, high-earning opportunity for financially aware individuals.

Step-by-Step Agent Registration Process & Fees in India

Although every company or department has its own system, the basic agent registration process in India usually follows these steps:

- Choose Your Agent Category: Decide the type of agent business you want to start, such as travel, insurance, banking, fintech, real estate, or loan distribution. Your choice should depend on demand, investment capacity, and long-term income goals.

- Check Eligibility Criteria: Each platform defines minimum eligibility such as age, education, location, and business setup. Some agent registrations are open to individuals, while others require a shop or office.

- Prepare Required Documents: Common documents include Aadhaar card, PAN card, passport-size photograph, address proof, bank account details, and sometimes shop or business proof.

- Apply Through Online Agent Registration Portal: Most agent registrations are now online. You need to fill out the application form carefully with your correct personal and business details.

- Pay Registration Fees (If Applicable): Some agent registrations are free, while others require a one-time or annual fee. Always make payments only on authorised platforms.

- Complete Training or Verification: Certain categories like insurance, banking, or travel, may require basic training, KYC verification, or system orientation before approval.

- Receive Agent ID and Login: After approval, you receive an agent ID, login credentials, and access to the agent dashboard to start providing services.

Agent Registration Fees in India (Indicative Range)

- IRCTC authorised agent: ₹1,000–₹5,000

- RERA agent registration: ₹10,000–₹25,000 (varies by state)

- Insurance agent registration: Usually free (training mandatory)

- Fintech & BC agent registration: ₹0–₹5,000

- Travel agent registration: ₹0–₹20,000

Important Tip: Always verify the official website or authorised partner before paying any agent registration fees to avoid fraud.

How to Choose the Right Agent Registration for You

Choosing the right agent registration depends on your personal goals, location, and investment capacity.

Key points to consider:

- Decide whether you want part-time income or a full-time business.

- Understand your target customers: urban, semi-urban, or rural.

- Check how much you can invest and whether you prefer low-risk or high-commission work.

- Evaluate daily-demand services versus long-term commission-based services.

Practical examples:

- Rural areas: Banking, AEPS, PAN, FASTag, and payment service agents work well due to daily transaction needs.

- Urban areas: Travel booking, insurance, loan, and real estate agents have higher earning potential.

Choosing a service that matches your area and skills increases success and income stability.

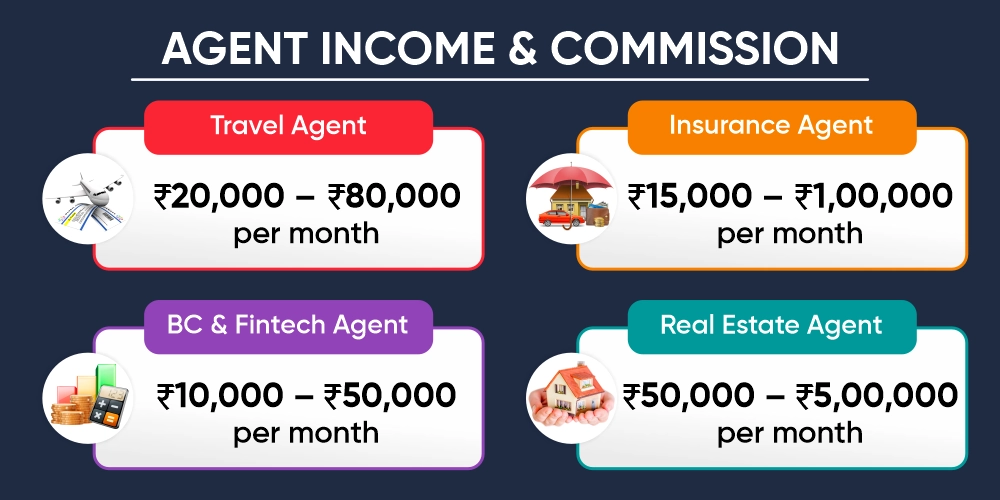

Income & Commission After Agent Registration

Average earnings depend on effort:

- Travel agent: ₹20,000–₹80,000/month

- Insurance agent: ₹15,000–₹1,00,000+/month

- BC & fintech agent: ₹10,000–₹50,000/month

- Real estate agent: Highly variable, high potential

Multiple agent registrations increase income stability.

Challenges Faced by New Agents & Practical Solutions

Starting an agent-based business is simple, but new agents often face a few common challenges in the initial phase. Understanding these early helps avoid mistakes and grow faster.

Common Challenges

- Application rejection: Many registrations get rejected due to incorrect documents, mismatched details, or incomplete KYC information.

- Low initial customers: In the beginning, customers may hesitate to trust a new agent, resulting in slow business growth.

- High competition: Multiple agents may already be offering similar services in the same area, making customer acquisition difficult.

- Lack of training: Without proper knowledge of products, portals, or rules, agents may struggle to explain services confidently.

- Technology issues: New agents sometimes find digital dashboards, apps, or devices difficult to use initially.

Practical Solutions

- Always register through genuine and authorised platforms only.

- Double-check documents before submission to avoid rejection.

- Learn each service properly before offering it to customers.

- Start with one or two services and expand gradually.

- Build trust by providing honest guidance, not false promises.

Best Practices to Succeed as an Agent

Following the right practices can turn a small agent setup into a stable income source.

Best Practices

- Offer multiple services from one location to increase daily footfall and income.

- Maintain transparency in pricing, charges, and processes to gain customer trust.

- Use WhatsApp and local marketing such as posters, referrals, and word-of-mouth promotion.

- Keep proper records of transactions, commissions, and customer details for better management.

- Upgrade skills regularly by learning new services, rules, and digital tools.

Agents who focus on trust, service quality, and consistency grow faster and build long-term success.

FAQs on Agent Registration in India

Below are commonly asked questions by new agents who want to start an agent-based business in India. These answers are written in simple language for easy understanding.

1. What is agent registration?

Agent registration is the official process of enrolling with a company, platform, or authority to sell services legally and earn commission.

2. Who can apply for agent registration?

Any Indian citizen above 18 years, including students, homemakers, shop owners, retirees, and professionals, can apply if the eligibility criteria are met.

3. Is agent registration free in India?

Some agent registrations are free, while others require a one-time or annual fee, depending on the service and authority.

4. Can I do multiple agent registrations at the same time?

Yes. Many agents register for multiple services like travel, banking, insurance, and fintech to increase income.

5. Is online agent registration safe?

Yes, if done through official websites or authorised partners. Avoid unknown or fake portals.

6. How long does agent registration approval take?

Approval time can range from a few hours to a few weeks, depending on document verification and training requirements.

7. Is training required for agent registration?

Some categories like insurance, banking, or travel may require basic training or certification before activation.

8. What documents are generally required?

Common documents include Aadhaar card, PAN card, photograph, address proof, and bank account details.

9. Is RERA registration mandatory for real estate agents?

Yes. Real estate agents must register under the state RERA authority to operate legally.

10. How much can an agent earn monthly?

Income depends on service type and effort. Some agents earn ₹10,000–₹20,000 per month, while experienced agents earn much more.

Tip: Choosing the right agent category and providing honest service are the keys to long-term success.

Conclusion: Is Agent Registration Worth It in 2026?

Yes. Agent registration in India is one of the safest and most flexible business models. With low investment, growing demand, and digital platforms, agents can build a stable income and even scale into a full business.

If you start with the right category and a genuine platform, agent registration can become your long-term income source.

Also Read: Commission Based Business in India – Best Way to Earn Commission Income in 2026