India’s digital banking ecosystem has changed rapidly in the last decade. The government’s push towards financial inclusion, along with digital infrastructure like Aadhaar, UPI, and micro-ATMs, has made banking accessible to millions. Among all these services, one feature that plays a very big role, especially for rural and semi-urban citizens, is the AEPS Debit Facility.

Many people still search online for questions like:

- “What is AEPS Debit Facility?”

- “AEPS Debit Facility means what?”

- “Why is AEPS debit facility disabled in my account?”

- “What is AEPS Debit Facility in Indian Bank?”

- “NPCI guidelines AEPS debit facility”

This detailed guide answers everything in a simple way, making it easy for everyone to understand how AEPS works, why it sometimes gets disabled, and what NPCI rules are behind it.

What is AEPS Debit Facility? (AEPS Debit Facility Meaning)

AEPS (Aadhaar Enabled Payment System) Debit Facility is a banking service that allows customers to use their Aadhaar number and fingerprint to perform basic financial transactions.

It removes the need for:

- ATM/Debit Card

- Smartphone

- Internet connection

- ATM PIN

With AEPS, users can perform transactions through micro-ATMs operated by:

- Banking Correspondents (BCs)

- CSP Agents

- Franchise outlets

- Retailers offering banking services

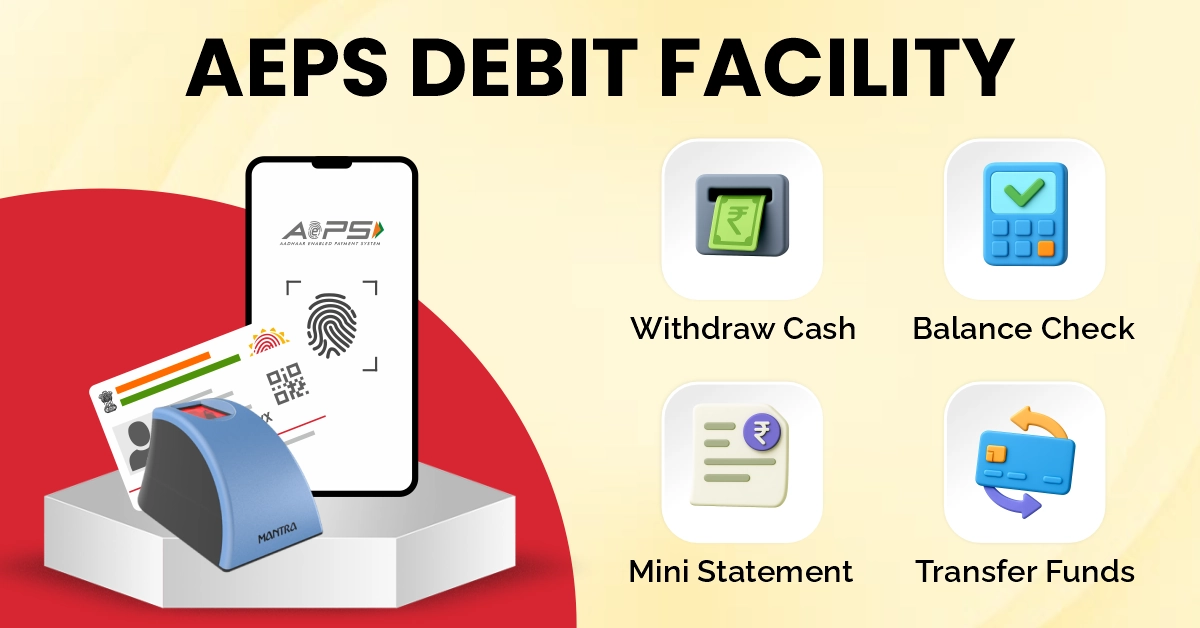

Key Transactions Possible with AEPS

Using the AEPS Debit Facility, customers can:

- Withdraw cash

- Check account balance

- Get a mini statement

- Transfer funds

- Authenticate identity for banking services

All you need is:

- Aadhaar number

- Bank account linked with Aadhaar

- Fingerprint authentication

Why AEPS is a Game-Changer for India

AEPS brings banking to the doorstep of millions, especially where ATMs and branches are rare. It plays a huge role in:

- Financial inclusion

- Digital empowerment

- Government subsidy distribution

- Cash withdrawal in remote villages

- Helping people without smartphones

For many people, AEPS works like a portable ATM that is always available nearby through a shop or BC agent.

How AEPS Debit Facility Works (Simple Explanation)

AEPS transactions happen through biometric verification. Here’s a step-by-step breakdown:

Step 1: Visit a BC Agent or AEPS Centre

You can find these at rural shops, micro-ATM counters, mobile recharge shops, and bank CSP centres.

Step 2: Provide Your Aadhaar Number

The agent enters your Aadhaar number in the AEPS portal device.

Step 3: Select Your Bank

You choose the bank where your Aadhaar-linked account exists.

Step 4: Select the Transaction Type

- Cash Withdrawal

- Balance Inquiry

- Mini Statement

- Fund Transfer

Step 5: Give a Fingerprint for Authentication

Your fingerprint is matched with UIDAI records.

Step 6: Transaction Completed

Money is dispensed or transaction details are printed.

This simple flow is the reason AEPS is widely trusted and adopted across India.

Benefits of AEPS Debit Facility

AEPS has made banking simple for crores of people. Here are its biggest advantages:

Card-Free Banking

You don’t need a debit card, which is useful for people who misplace cards or don’t want to carry them.

No Need for Internet or a Smartphone

Even if you don’t have a mobile phone, AEPS works smoothly.

Available in Remote Areas

Villages without ATM machines depend heavily on AEPS centres.

Helps Senior Citizens

Elderly people who avoid complicated ATM screens can just use fingerprints.

Secure Authentication

Fingerprint verification reduces fraud and ensures only the real account holder can transact.

Supports Government Schemes

Many government subsidies and benefits are withdrawn through AEPS.

Cost-Effective and Fast

No extra fees and no long queues like at bank branches.

What Does “AEPS Debit Facility Disabled” Mean?

Many people receive messages or search for:

- “AEPS Debit Facility is disabled in your account.”

- “NPCI guidelines AEPS debit facility is disabled.”

- “AEPS debit facility disabled meaning in Hindi.”

This message simply means that your Aadhaar-based banking services are temporarily not working.

Reasons Why AEPS Debit Facility Gets Disabled

Let’s look into the common reasons:

Reason 1: Aadhaar Not Properly Linked

If your Aadhaar is not mapped or updated with your bank, AEPS won’t work.

Reason 2: KYC Not Updated

Banks sometimes disable AEPS if the customer’s KYC is incomplete.

Reason 3: Technical Issues

Sometimes, backend servers of banks or NPCI face downtime.

Reason 4: Account Restrictions

If your account is temporarily frozen or under review, AEPS gets disabled automatically.

Reason 5: NPCI Compliance Update

Sometimes NPCI updates guidelines for security purposes, leading to temporary suspension.

Reason 6: Multiple Accounts Linked to the Same Aadhaar

Incorrect mapping may lead to AEPS failure.

Reason 7: Bank-Specific Issues

Indian Bank, SBI, PNB, and others may disable AEPS during:

- System upgrades

- Security checks

- Regulatory audits

AEPS Debit Facility Disabled Meaning in Hindi

“AEPS Debit Facility Disabled” का मतलब है कि आधार के जरिए पैसा निकालने या बैलेंस चेक करने की सुविधा अभी आपके खाते पर काम नहीं कर रही है। यह अस्थायी होता है और इसे बैंक या KYC अपडेट करके ठीक किया जा सकता है।

Also Read: How to Activate (Enable) AEPS Service

How to Fix AEPS Debit Facility Disabled

If you are seeing the message “AEPS Debit Facility is Disabled in Your Account”, don’t worry, this is a common issue and can be fixed easily. AEPS services mainly depend on your Aadhaar linking, KYC status, biometric verification, and bank settings. Below is a detailed, step-by-step guide to help you reactivate your AEPS debit facility.

1. Check if Aadhaar is Properly Linked to Your Bank Account

AEPS works only when your Aadhaar is correctly mapped with your bank account in the NPCI (National Payments Corporation of India) system. Sometimes Aadhaar gets unlinked or mismatched due to system updates.

Solution: Visit your bank branch or CSP and ask them to confirm your Aadhaar seeding status. If it shows “Not Mapped,” request them to link it again.

2. Update or Re-Do Your Biometric KYC

Banks disable AEPS services if your KYC is outdated or incomplete. This is a common reason behind AEPS failures.

Solution: Submit your Aadhaar, PAN, and fingerprint again at the bank to complete biometric KYC. Once updated, AEPS starts working within 24 – 48 hours.

3. Submit a Request for Aadhaar Seeding / Aadhaar Remapping

If your Aadhaar is linked to multiple bank accounts, NPCI may not know which one to use for AEPS.

Solution: Ask the bank to submit an “Aadhaar Seeding or Remapping Request” to NPCI. This makes your chosen bank account the primary account for AEPS.

4. Ensure Your Bank Account Is Active

Inactive or dormant accounts automatically lose AEPS access.

Solution: Reactivate your account by making a small deposit or withdrawal at the branch.

5. Select Your Primary Bank for AEPS (If Multiple Accounts Exist)

If your Aadhaar is linked to two or more banks, AEPS may not work properly.

Solution: Visit the bank you prefer and request them to make it your Primary AEPS Bank.

NPCI Guidelines on AEPS Debit Facility

The National Payments Corporation of India (NPCI) is the organisation that manages the AEPS (Aadhaar Enabled Payment System) across the country. To ensure that AEPS remains safe, transparent, and easy to use for every citizen, NPCI has created a set of strict rules and operating guidelines. These guidelines help banks, BC agents, retailers, and customers avoid fraud, errors, or misuse of Aadhaar-related financial services.

1. Secure Biometric Handling

NPCI clearly states that Aadhaar numbers and biometrics (fingerprints) must be handled with the highest level of security. Banks and agents cannot save, store, or misuse the biometric data of customers. All fingerprint authentication must be done in an encrypted form to prevent fraud.

2. Zero Extra Charges for Customers

NPCI prohibits banks, CSPs, and BC agents from charging customers extra money for AEPS withdrawals, balance enquiries, or mini statements. The service must remain free for the public to encourage financial inclusion.

3. Standard Transaction Limits

To prevent large-scale fraud, NPCI sets daily transaction limits for AEPS cash withdrawals. Banks and AEPS service providers must follow these limits strictly. This controls the risk of misuse in case of biometric theft or system errors.

Also Read: AEPS Cash Withdrawal Limit

4. Strong Privacy Protection

NPCI instructs all banks and agents that customer Aadhaar information cannot be shared with anyone. Even the last four digits of Aadhaar must be protected unless required for authentication logs.

5. Proper Training for BC/CSP Agents

AEPS agents must receive training on how to operate micro-ATMs, authenticate customers safely, avoid errors, and manage digital receipts. NPCI insists on proper onboarding to avoid operational mistakes.

6. Customer Awareness & Safe Usage

NPCI expects banks to educate customers about safe AEPS usage, such as keeping Aadhaar private, avoiding unknown agents, and verifying receipts. Awareness helps reduce fraud cases in rural and urban areas.

These guidelines together ensure that the AEPS Debit Facility stays secure, simple, and trustworthy for millions of users across India.

AEPS Debit Facility in Indian Bank

Indian Bank provides AEPS services at thousands of Customer Service Points and micro-ATM centres. Many customers search “what is AEPS debit facility in Indian Bank” because this service is widely used in rural branches.

Services Offered by Indian Bank AEPS

- Cash withdrawal

- Balance check

- Mini statement

- Aadhaar-enabled fund transfer

Common AEPS Issues in Indian Banks

Indian Bank customers frequently face:

- Aadhaar mapping delays

- Biometric mismatches

- Account restrictions

- AEPS is disabled due to NPCI audits

But most issues can be fixed by visiting the nearest Indian Bank branch or CSP centre.

Challenges & Limitations of AEPS Debit Facility

While AEPS is very useful, it has some limitations:

1. Fingerprint Recognition Issues

Worn-out fingerprints (common among farmers/labourers) may fail.

2. Internet Issues at Agent Location

The AEPS machine requires network connectivity.

3. Fraud at Unauthorised Centres

Some fake agents misuse Aadhaar details.

4. Limits on Withdrawal Amount

Daily transaction limits apply.

5. Dependency on Aadhaar Authentication

If the UIDAI server is down, AEPS won’t work.

How AEPS Supports Government Schemes

AEPS is used widely for:

- MNREGA payments

- Old-age pension withdrawals

- DBT subsidy withdrawals

- PM Kisan payments

- Gas subsidy

- Scholarships

It ensures beneficiaries get their money easily without travelling long distances or paying middlemen.

Also Read: AEPS Advantages and Disadvantages

Future of AEPS Debit Facility in India

AEPS will continue to play an important role in India’s rural banking. The government is also planning to:

- Improve biometric accuracy

- Introduce face authentication

- Expand micro-ATM networks

- Increase transaction limits

- Strengthen NPCI security guidelines

AEPS will remain a key pillar of India’s financial system, especially for low-income and rural households.

Conclusion

The AEPS Debit Facility is one of India’s most powerful digital banking services. It allows customers to withdraw money and perform basic banking transactions using only their Aadhaar and fingerprint. While issues like “AEPS debit facility disabled” sometimes occur, they can usually be fixed through Aadhaar linking, KYC updates, or bank support.

NPCI guidelines ensure that AEPS remains secure, simple, and fair for all users. Banks like Indian Bank have integrated AEPS effectively, helping millions gain easy access to cash and banking services.

In short, AEPS has transformed India’s banking landscape, making financial services accessible to every citizen, regardless of location, age, or digital skill level.

FAQs on AEPS Debit Facility

1. What is AEPS Debit Facility?

AEPS Debit Facility allows users to withdraw cash, check their balance, and transfer money using Aadhaar and fingerprint authentication through micro-ATMs.

2. What does AEPS Debit Facility mean?

It means Aadhaar-based banking services that let you do cash withdrawal and basic transactions without a debit card or PIN.

3. Why is my AEPS Debit Facility Disabled?

Your AEPS facility may be disabled due to Aadhaar not linked, KYC issues, NPCI guidelines, biometric mismatch, or technical errors at the bank.

4. What is AEPS Debit Facility Disabled Meaning?

It means Aadhaar-based banking is temporarily unavailable on your account. You cannot withdraw cash or check balance using AEPS until re-enabled.

5. How to fix AEPS Debit Facility Disabled?

Update Aadhaar linking, complete KYC, select a primary AEPS bank, reactivate your account, or visit your branch to enable AEPS again.

6. What are the NPCI Guidelines for AEPS Debit Facility?

NPCI mandates secure biometric use, no extra customer charges, privacy protection, transaction limits, and proper training for AEPS agents.

7. What is AEPS Debit Facility in the Indian Bank?

Indian Bank offers AEPS services for cash withdrawal, balance inquiry, and mini statements using Aadhaar authentication at BC or CSP centres.

8. Can AEPS work without Aadhaar Link?

No. AEPS requires your Aadhaar to be linked and mapped to your bank account.

9. Is AEPS Debit Facility safe to use?

Yes. AEPS uses biometric (fingerprint) authentication, making it highly secure and safe for rural and urban users.

10. What is AEPS Debit Facility Disabled Meaning in Hindi?

इसका मतलब है कि आपके खाते में आधार-आधारित निकासी या बैलेंस चेक की सुविधा फिलहाल बंद है और इसे दोबारा सक्रिय किया जा सकता है।

Also Read: AEPS Agent Registration Guide