The Rise of Aadhaar-Based Digital Payments

India is rapidly moving toward a cashless economy. With the success of UPI, AEPS, and mobile wallets, digital payments have reached every corner of the country. Yet, millions of citizens in rural and semi-urban areas still face challenges in using debit cards, smartphones, or mobile banking.

To solve this, the government introduced Aadhaar Pay, a payment system that allows people to make digital transactions using only their Aadhaar number and fingerprint. No smartphone, card, or internet access for the customer is required.

Aadhaar Pay is an important step in promoting financial inclusion under the Digital India mission, helping small shopkeepers, customers, and local merchants move toward digital and secure payments.

What is Aadhaar Pay?

Aadhaar Pay is a digital payment system that enables customers to make cashless payments to merchants directly from their Aadhaar-linked bank account using biometric authentication (fingerprint or iris scan).

It eliminates the need for debit cards, credit cards, UPI apps, or cash. The payment happens through the Aadhaar-enabled Payment System (AePS), managed by the National Payments Corporation of India (NPCI).

In simple terms, Aadhaar Pay allows customers to pay by:

- Sharing their Aadhaar number,

- Selecting their bank name, and

- Verifying the transaction using their fingerprint.

This system makes digital transactions possible even for those who do not have smartphones or internet access.

How Does BHIM Aadhaar Pay Work?

The Aadhaar Pay system is built on a simple, yet secure, process that connects a person’s Aadhaar number to their bank account. Here’s how it works:

- Aadhaar Linking: The customer’s bank account must be linked with their Aadhaar number.

- Merchant Setup: The merchant downloads the Aadhaar Pay app on a smartphone and connects a biometric fingerprint scanner to it.

- Payment Process: The customer enters their Aadhaar number and bank name on the merchant’s app. The merchant enters the amount, and the customer authenticates the payment using their fingerprint.

- Verification: The Aadhaar authentication happens through UIDAI’s secure servers, and the money is transferred instantly from the customer’s account to the merchant’s account.

This process makes Aadhaar Pay one of the most inclusive digital payment methods for people in villages and remote areas where smartphones and internet access are limited.

Also Know: Aadhaar ATM for cash withdrawal

Key Features and Benefits of Aadhaar Pay

BHIM Aadhaar Pay offers several features that make it unique and beneficial for both customers and merchants:

- No Need for Cards or OTPs: Customers don’t need a debit card, credit card, or even a smartphone to make payments.

- Instant and Secure: Transactions are completed in real-time with biometric verification, ensuring high security.

- Free for Customers: There are no transaction fees for customers, making it accessible for everyone.

- Financial Inclusion: Aadhaar Pay allows people in rural areas without smartphones or internet to make and receive digital payments.

- Easy for Merchants: Merchants can easily accept payments using just a smartphone and a fingerprint scanner.

- Government-Backed System: Since Aadhaar Pay is powered by NPCI and UIDAI, it’s a reliable and safe payment method.

BHIM Aadhaar Pay

BHIM Aadhaar Pay is the official Aadhaar-based payment application launched by the Government of India under the Digital India initiative.

It allows merchants to receive payments from customers directly through their Aadhaar-linked bank accounts using biometric authentication.

Key Highlights of BHIM Aadhaar Pay:

- Developed by NPCI (National Payments Corporation of India).

- Works for all major banks connected to Aadhaar.

- Helps small shopkeepers, retailers, and micro-business owners accept digital payments easily.

- No transaction charges for customers.

- Secure fingerprint-based verification to avoid fraud.

BHIM Aadhaar Pay is especially useful in rural and semi-urban areas where people may not use cards or mobile banking.

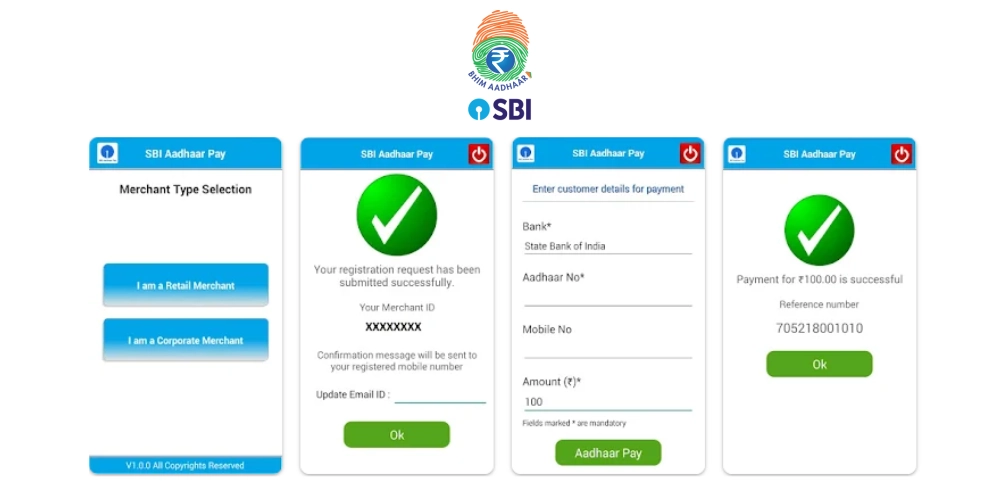

BHIM Aadhaar Pay Registration: Step-by-Step Process

To use BHIM Aadhaar Pay, a merchant or retailer needs to register and set up the system. Here’s the complete registration process:

- Link Your Bank Account with Aadhaar: Ensure your Aadhaar is linked with your primary bank account.

- Get the Required Equipment: You’ll need an Android smartphone and a biometric fingerprint scanner compatible with the BHIM Aadhaar Pay app.

- Download the App: Visit your bank branch or the official website to get the Bank BHIM Aadhaar Pay app download link, or search & download from the Google Play store.

- Merchant Registration: Open the app, register as a merchant using your Aadhaar number, and select your bank.

- Start Accepting Payments: After successful registration, you can start collecting payments from customers using Aadhaar authentication.

This process is simple and takes only a few minutes. Merchants can start earning through digital transactions immediately after activation.

SBI BHIM Aadhaar Pay: A Leading Bank’s Aadhaar Payment Service

The State Bank of India (SBI) is one of the leading banks providing Aadhaar Pay services to merchants and customers. Through SBI BHIM Aadhaar Pay, merchants can accept digital payments from customers without cards, cash, or OTPs. It works seamlessly using Aadhaar-linked bank accounts.

How SBI Aadhaar Pay Works:

- The merchant downloads and registers on the SBI Aadhaar Pay App.

- The customer provides their Aadhaar number and selects SBI as their bank.

- The merchant enters the payment amount.

- The customer authenticates using their fingerprint.

- The payment is completed instantly.

SBI Aadhaar Pay supports real-time transfer, ensuring instant credit to the merchant’s account. This service is widely used by small retailers, kirana shops, and service providers across India.

Aadhaar Pay App Download and Setup Guide

Many banks and financial service providers offer their own Aadhaar Pay apps. Here’s how you can download and set it up:

- Check with Your Bank: Visit your bank’s website or nearest branch to get the official Aadhaar Pay app download link or search on the Google Play store.

- Use an Android Smartphone: Most Aadhaar Pay apps work on Android devices. Make sure your phone supports USB or Bluetooth biometric scanners.

- Install and Register: Install the app and register with your Aadhaar and bank details.

- Connect Biometric Device: Link the fingerprint scanner to your smartphone using OTG or Bluetooth connection.

- Start Transactions: After setup, you can start accepting payments instantly.

For example, SBI Aadhaar Pay or others banks BHIM Aadhaar Pay apps are the most commonly used options in India.

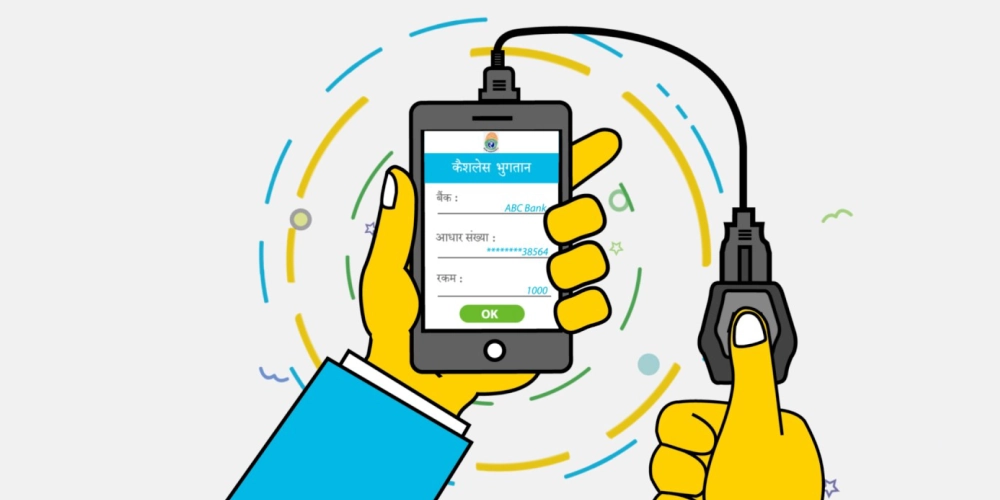

How to Use BHIM Aadhaar Pay as a Customer or Merchant

For Customers:

- Visit a merchant who uses Aadhaar Pay.

- Provide your Aadhaar number and select your bank name.

- The merchant enters the payment amount.

- Verify the transaction using your fingerprint.

- You’ll receive a payment confirmation instantly.

For Merchants:

- Open the BHIM Aadhaar Pay app on your smartphone.

- Enter the transaction amount.

- Ask the customer for their Aadhaar number and bank name.

- Take the customer’s fingerprint to authenticate the payment.

- The amount will be credited to your account instantly.

This process takes less than 30 seconds and provides a secure, paperless transaction experience.

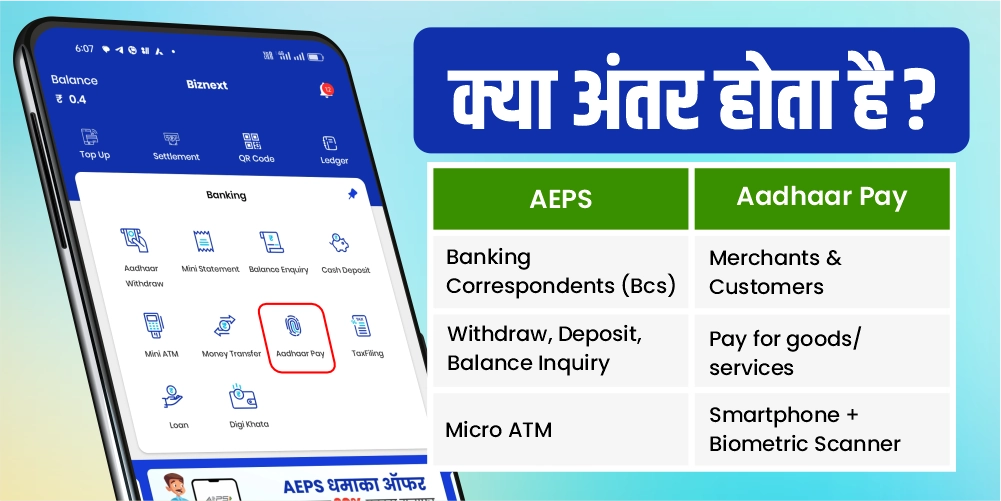

AEPS vs Aadhaar Pay: Understanding the Difference

Although both AEPS (Aadhaar Enabled Payment System) and Aadhaar Pay are Aadhaar-based payment systems, they serve different purposes.

Here’s a quick comparison:

| Feature | AEPS | BHIM Aadhaar Pay |

|---|---|---|

| Users | Banking Correspondents (BCs) | Merchants & Customers |

| Purpose | Withdraw, Deposit, Balance Inquiry | Pay for goods/services |

| Device | Micro ATM | Smartphone + Biometric Scanner |

| Internet | Required | Merchant’s device only |

| Authentication | Fingerprint/Iris | Fingerprint/Iris |

| App | AEPS Service Provider Portal/App | Aadhaar Pay App |

Summary:

- AEPS is mainly used for banking services like withdrawal or deposit through BC points.

- Aadhaar Pay is used for retail transactions, helping customers pay merchants using Aadhaar-linked bank accounts.

Both systems play a vital role in promoting digital and inclusive banking in India.

Free AEPS Registration and Aadhar Pay Registration

Challenges and Limitations of Aadhaar Pay

While Aadhaar Pay is highly beneficial, there are a few challenges:

- Connectivity Issues: Rural areas may face slow or unstable internet, affecting merchant devices.

- Biometric Failures: Sometimes, fingerprint scans may not work due to skin texture or sensor quality.

- Awareness Gap: Many merchants and customers are still unaware of the system’s benefits and availability.

- Limited Bank Support: Not all banks provide direct Aadhaar Pay app downloads or integration yet.

Despite these challenges, Aadhaar Pay is expanding steadily with strong government support and increasing adoption among local retailers.

How Biznext Helps Retailers with Aadhaar Pay Services

Biznext is a growing digital platform that empowers retailers and entrepreneurs with advanced financial services, including Aadhaar Pay, AEPS, bill payments, and money transfers.

Biznext helps small business owners and shopkeepers accept digital payments easily and earn commissions on every transaction.

How Biznext Supports Retailers:

- Simple Aadhaar Pay and AEPS integration for any shop.

- Instant commission on every Aadhaar Pay and AEPS transaction.

- Access to multiple services like mobile recharge, DTH, and utility bill payments.

- 24×7 support for agents and merchants.

- Easy onboarding process through a single Biznext dashboard.

Biznext helps retailers boost income, attract more customers, and become a part of India’s growing digital ecosystem.

If you’re a retailer or business owner, you can join Biznext today and start earning through Aadhaar Pay and AEPS services.

Future of Aadhaar Pay in India

The future of Aadhaar Pay looks bright as India continues to digitise its economy. With over a billion Aadhaar users, this system has the potential to become one of the most accessible payment platforms for both urban and rural citizens.

In the coming years, Aadhaar Pay is expected to:

- Integrate more deeply with UPI and other payment systems.

- Offer higher transaction limits and faster processing.

- Enable wider acceptance across all banks and financial institutions.

- Support merchants through simplified onboarding and lower equipment costs.

Aadhaar Pay will continue to bridge the gap between cash and digital payments, ensuring every citizen can participate in India’s digital economy.

Conclusion: Aadhaar Pay – A Step Toward Cashless India

Aadhaar Pay has made digital payments accessible to everyone, even those without smartphones or internet access. By using Aadhaar and biometric authentication, it ensures secure, simple, and inclusive transactions for all.

Whether it’s BHIM Aadhaar Pay, SBI Aadhaar Pay, or through platforms like Biznext, this technology empowers both customers and small merchants to embrace the digital economy.

As India moves toward becoming a cashless and connected nation, Aadhaar Pay stands as a powerful tool for financial inclusion and convenience.

FAQ on Aadhaar Pay

1. What is Aadhaar Pay?

Aadhaar Pay is a digital payment system that allows customers to pay merchants using their Aadhaar number and fingerprint.

2. How can I register for BHIM Aadhaar Pay?

Merchants can register by linking their Aadhaar with their bank, downloading the BHIM Aadhaar Pay app, and completing registration using their Aadhaar and biometric verification.

3. Is Aadhaar Pay safe?

Yes, Aadhaar Pay is backed by NPCI and UIDAI, and all transactions are verified using secure biometric authentication.

4. How is AEPS different from Aadhaar Pay?

AEPS is mainly for banking services like withdrawal or deposit, while Aadhaar Pay is for merchant payments.

5. Can I download Aadhaar Pay on any phone?

Most Aadhaar Pay apps work on Android smartphones with a compatible fingerprint scanner.