What is a Digital Payment?

A digital payment, often known as an electronic payment, is the transfer of funds via a digital device or channel from one payment account to another. Digital payments in India are done using bank transfers, mobile money, QR codes, UPI, and credit, debit, and prepaid cards.

These payments may be made entirely digital, for instance paying for groceries using a mobile wallet which involves scanning a QR code or tapping a phone at the checkout, allowing for a swift and contactless experience.

They may also be mostly digital for example when purchasing items online, customers browse products, place orders, and make payments through a website or app, yet the delivery of physical goods may still occur at a later date.

Or they can be partially digital and the prime example is paying bills through online banking. Users may set up automatic payments or make one-time payments online, but the bills themselves could be received in paper form. They are convenient, fast, and secure, allowing users to make transactions anytime and anywhere without the need for physical money. In general, they make things easier and simplify how we deal with money on a regular basis just like:

- Shopping at a Store: You can use mobile payment apps like Paytm or Google Pay at checkout to buy groceries or clothes without cash.

- Online Shopping: When you purchase items from websites like Amazon or Flipkart, you can pay using credit cards, debit cards, or other digital wallets.

- Bill Payments: Many utilities and service providers allow you to pay your bills online through their websites or apps.

- Food Delivery: Food delivery apps like Zomato & Swiggy let you pay for meals using digital payment options when placing an order.

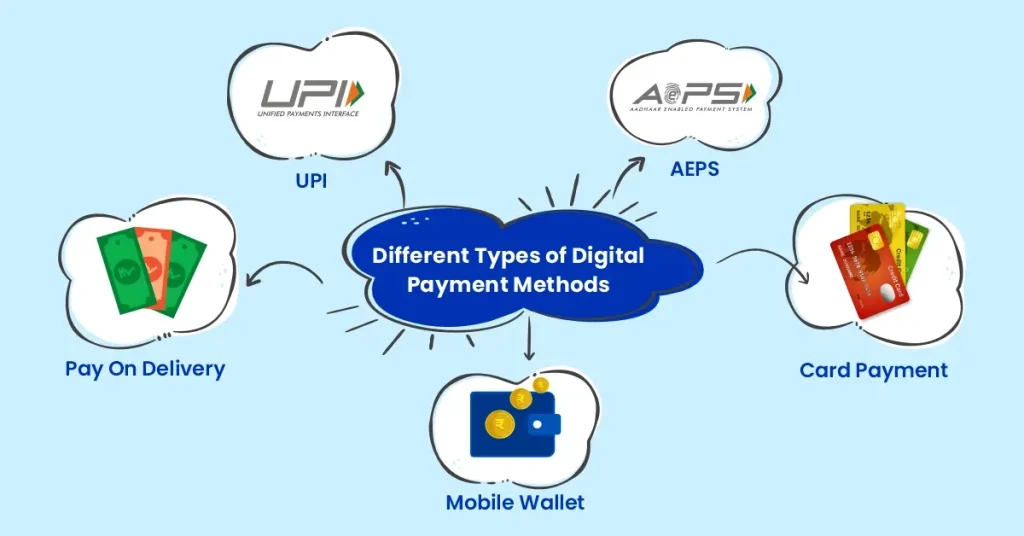

What Are Different Digital Payment Methods?

The use of digital payment methods has revolutionized transaction processing, resulting in faster and more secure transactions. There is something for everyone, with choices ranging from cryptocurrencies to mobile wallets. By investigating these different approaches, people can gain the ability to make wise financial decisions. Here’s a simple overview of the most popular & commonly used ones.

Unified Payments Interface (UPI)

- What It Is: A system that lets people transfer money between bank accounts instantly using digital payment apps using their smartphones.

- How It Works: You link your bank account to a UPI app (like PhonePe, Google Pay, or Paytm). To send money, you can use someone’s phone number or a unique UPI ID. The money transfers quickly, usually within seconds.

Mobile Wallets

- What It Is: Apps that store money and allow you to make payments easily.

- How It Works: You load money into the wallet using your bank account or a card. You can then use this wallet to pay for shopping, bills, or recharges without needing cash.

Net Banking

- What It Is: An online service that lets you manage your bank account over the Internet.

- How It Works: You log into your bank’s website or app and can transfer money, pay bills, or check your account balance. It’s secure and convenient for online transactions.

Aadhaar Enabled Payment System (AEPS)

- What It Is: A payment method that uses your Aadhaar number (a unique ID) for transactions.

- How It Works: You go to a micro ATM or a store with an AEPS machine. You provide your Aadhaar number and use your fingerprint to confirm your identity. This allows you to send money or make payments, especially useful in rural areas.

Card Payments

- What It Is: Using debit or credit cards to make payments.

- How It Works: For online shopping, you enter your card details. In stores, you can swipe or tap your card on a machine. It’s a common way to pay and is accepted almost everywhere.

Pay on Delivery (POD)

- What It Is: Paying for goods when they are delivered to you.

- How It Works: You place an order online and pay the delivery person in cash (or sometimes through a digital method) when you receive your product. Many people prefer this method because it’s safe.

Digital payment methods are now quicker, simpler, and more convenient thanks to these variety of options. People are free to select the approach that best suits their needs because each has unique advantages.

History of Digital Payment in India

The digital payment system in India has evolved significantly over the decades. It began in the 1980s with the introduction of credit cards, allowing consumers to make purchases without cash. In the early 2000s, internet banking emerged, enabling online fund transfers and bill payments, which laid the groundwork for cashless transactions.

The real turning point came in the 2010s with the rise of mobile wallets like Paytm and Mobikwik, allowing users to store money on their smartphones for easy payments. The launch of the Unified Payments Interface (UPI) in 2016 revolutionized the digital payment landscape.

Top 3 Digital Payment Banks in India

Airtel Payment Bank

Airtel Payments Bank is a digital bank launched by Airtel, a major telecom company, aimed at making banking accessible to all, especially in rural areas. One key feature is the ability to make online payments, allowing users to pay utility bills, recharge mobile phones, and transfer money to friends using their smartphones.

The bank offers a digital wallet for secure storage of funds, making online and in-store shopping easy. Customers can open savings accounts that earn interest, helping their money grow over time. They can also withdraw cash from thousands of Airtel retail stores and ATMs nationwide. Overall, Airtel Payments Bank is transforming banking in India by combining technology with Airtel’s extensive network & providing essential financial services.

Fino Payments Bank

It started with a focus on providing financial services to people who don’t have access to traditional banks. One of its key features is a large network of agents who help customers deposit and withdraw cash. This makes it easier for people to manage their money, even in remote locations.

It also provides services like micro-insurance and small loans, helping customers with their financial needs. By combining technology with a strong physical presence, Fino Payments Bank is helping millions of people in India access banking services and improve their financial lives.

India Post Payments Bank

Using its vast network of post offices, India Post operates the digital bank India Post Payments Bank (IPPB), reaching customers who might not have access to regular banks. IPPB provides a range of user-friendly basic services, including bill payment, money transfers, and savings accounts.

IPPB prioritizes in-person banking through post offices, in contrast to Airtel Payments Bank, which places a strong emphasis on digital payments and app-based services. Unlike Fino Payments Bank, which conducts cash transactions through a vast agent network, IPPB uses the postal system to offer services at post offices.

It is distinct because it integrates banking with the dependable postal service, assisting millions in efficiently managing their finances and conveniently obtaining government advantages.

Also Read: Payment Banks in India

Top 7 Digital Payment Apps in India

- PhonePe: Recharging mobile phones, sending and receiving money, and paying bills are all possible with this widely used app. It provides a range of financial services and facilitates UPI transactions.

- Google Pay: With this app, users can effortlessly pay their bills, send money, and make payments. For speedy transactions, Google Pay leverages UPI and frequently offers cashback.

- Paytm: Paytm is a feature-rich app with bill-paying, shopping, and a digital wallet. Paytm Bank services for investments and savings are also available to users.

- Amazon Pay: Using their Amazon account balance, customers may pay for goods, recharge phones, and pay bills with Amazon Pay, which is integrated into the Amazon shopping app.

- BHIM (Bharat Interface for Money): The National Payments Corporation of India (NPCI) is the developer of this UPI-based application. Simple money transfers and payments from bank accounts are made possible by it.

- Mobikwik: Mobikwik is a digital wallet that enables online payments, bill payment, and recharge. It also provides investment alternatives and lending services.

- Jio Pay: The MyJio app is a free platform offering digital payment options like JioPay, JioAutoPay, UPI, and JioMoney. It also enables users to recharge services, manage Jio devices, access entertainment, and utilize JioMart and JioHealth, along with customer support. Users can customize their profiles and app language for a tailored experience.

Read More: Top 29 Money Transfer Apps in India

Growth of Digital Payment in India

India has quickly started using digital payment methods in recent years. The government launched the Digital India campaign and UPI to make online payments easier. This shift has been fueled by increasing smartphone usage and internet access, enabling millions to use mobile wallets and apps for transactions. The COVID-19 pandemic also led to the growth of digital payments in India as many wanted safer, contactless ways to pay. Now, it is an important part of daily life.

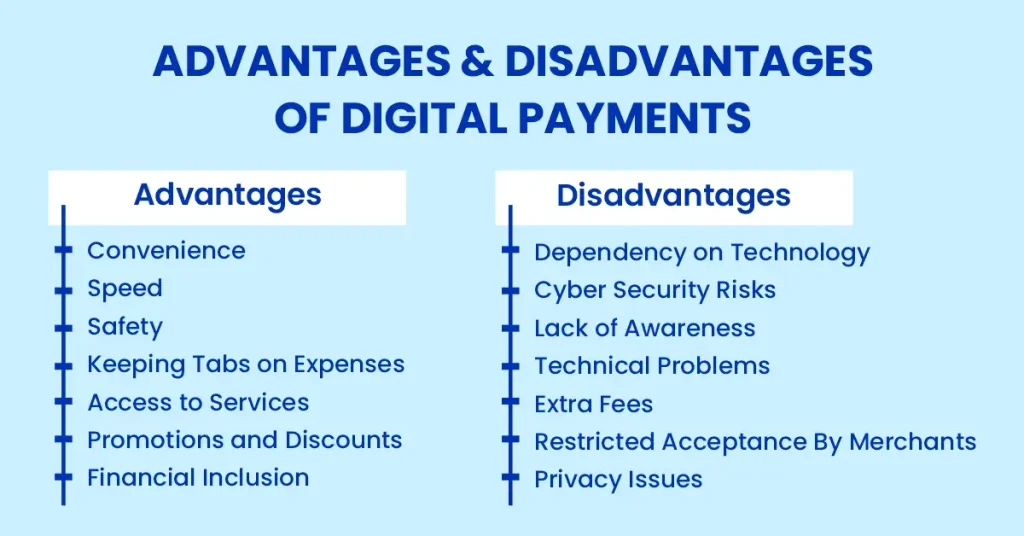

Advantages & Disadvantages of Digital Payments

While digital payments in India have numerous advantages, including speed and simplicity, they also have certain drawbacks, such as reliance on technology and cybersecurity threats. Users can choose their payment options more wisely if they are aware of all pros and cons of digital payment in India.

Advantages of Digital Payments

- Convenience: Making payments online is simple and quick. You don’t need cash to pay for purchases made with your computer or phone. Time and effort are saved by doing this, especially when purchasing online.

- Speed: Exchanges take place virtually instantaneously. At banks and ATMs, there are lengthy lines to wait in. This speeds up purchasing and selling considerably.

- Safety: Compared to carrying cash, digital payments may be safer. Cash is lost if it is lost. However, if you notice an issue with digital payments, you may typically get your money back.

- Keeping Tabs on Expenses: Since digital transactions provide a record, keeping tabs on your expenditures is simple. Being able to track your spending makes budgeting and saving easier.

- Access to Services: Digital payments make it simpler to pay bills and reserve tickets, among other services. You don’t need to visit a real place to perform it; you may do it from anywhere at any time.

- Promotions and Discounts: A lot of businesses provide cashback or discounts to customers who use digital payment methods. You can save money on purchases by doing this.

- Financial Inclusion: More people can access the financial system thanks to digital payments. Mobile banking services enable people in remote places to access banking services, which helps to better their financial circumstances.

Disadvantages of Digital Payments

- Dependency on Technology: To make digital payments, you’ll need a computer or smartphone with internet connectivity. In remote places with little access to technology, this could be an issue.

- Cybersecurity Risks: Fraud and hacking are possible. Your financial information could be taken if you’re not vigilant, which could result in damages.

- Lack of Awareness: It’s possible that some individuals, particularly those in older generations, are unaware of digital payment methods. They may become confused as a result and be unable to use these services.

- Technical Problems: Apps may stop working or servers may go down. When you have an urgent payment to make, this can be annoying.

- Extra Fees: A few online payment systems impose a fee for each transaction. Over time, these minor fees may accumulate and surpass the cost of cash payments.

- Restricted Acceptance By Merchants: Not every retailer or seller takes electronic payments. Cash is still preferred in some places, which may restrict your usage of digital alternatives.

- Privacy Issues: Using digital payments exposes you to the tracking of your buying patterns. The knowledge that their financial actions are being watched over may make people uneasy.

Digital Payment Market in India

The digital payment market in India has transformed remarkably over the past few years. Once dominated by cash transactions, the landscape shifted dramatically after the introduction of initiatives and the push for cashless transactions.

The government’s demonetization move in 2016 accelerated this change, encouraging people to embrace digital payment methods. Today, a wide variety of options are available for consumers that have made it easy for anyone to make payments with just a few taps on their smartphones.

This shift not only benefits consumers but also helps merchants reach a broader customer base without the hassle of handling cash. The convenience of digital payments has attracted millions of users, with India witnessing over 7 billion digital transactions in 2021 alone. In 2022, 46% of global digital payment volume came from India.

Experts predict that this trend will continue to grow, with the market expected to reach a value of $1 trillion by 2026. With the rise of fintech companies and continuous innovation in payment solutions, the future looks bright for digital payments in India. In summary, the digital payment market has evolved from cash to a dynamic ecosystem. As we move forward, it promises even more convenience and accessibility, making everyday transactions easier for everyone. The journey has just begun, and the best is yet to come!

Read more- The Future of AePS in India’s Digital Economy