Employees’ Provident Fund (EPF) is a savings scheme introduced by the Government of India to help employees build a financial cushion for their retirement. It is managed by the Employees’ Provident Fund Organisation (EPFO) and applies to most salaried employees in the private sector.

Every month, both the employee and employer contribute a fixed percentage of the employee’s basic salary and dearness allowance into the EPF account. This fund earns interest and can be withdrawn under certain conditions, such as retirement or emergencies.

Benefits of EPF for Employees

1. Retirement Savings

EPF helps employees accumulate a substantial savings amount by the time they retire, ensuring financial stability.

2. Employer Contribution

Unlike a regular savings account, in EPF, the employer also contributes a matching amount, increasing the overall savings.

3. Tax Benefits

EPF contributions qualify for tax deductions under Section 80C of the Income Tax Act. The interest earned and the final withdrawal amount are also tax-free under certain conditions.

4. Loan Facility

Employees can take loans against their EPF balance for purposes like home purchase, medical emergencies, or education.

5. Emergency Fund

EPF allows partial withdrawals in case of emergencies like medical expenses, marriage, or home renovation.

6. Higher Returns

The interest rate on EPF is generally higher than regular savings accounts, making it a secure and profitable investment.

7. Insurance and Pension Benefits

Along with EPF, employees also get benefits under the Employee Deposit Linked Insurance (EDLI) scheme and the Employees’ Pension Scheme (EPS), providing financial security to their family in case of an untimely demise.

Role of EPF India & EPFO (Employees’ Provident Fund Organisation)

What is EPFO?

The Employees’ Provident Fund Organisation (EPFO) is a statutory body that manages the EPF scheme across India. It ensures smooth operations, fund management, and timely payments to employees.

Key Roles of EPFO:

- Managing Provident Fund Accounts – EPFO keeps track of employees’ EPF contributions and withdrawals.

- Ensuring Compliance – It ensures companies follow EPF rules and deposit funds regularly.

- Processing Claims & Withdrawals – Employees can apply for withdrawals, and EPFO processes them.

- Providing Pension Benefits – It manages the Employee Pension Scheme (EPS) for post-retirement financial security.

- Online Services – EPFO offers online facilities like UAN (Universal Account Number) for easy access to EPF accounts.

- Grievance Redressal – Employees can raise complaints and get their issues resolved through EPFO portals.

EPF Member Portal & Login Process – Complete Guide

Employees’ Provident Fund (EPF) is an essential savings scheme for salaried employees in India. The EPF Member Portal allows employees and employers to manage their EPF accounts online. From checking balances to withdrawing funds, the portal makes everything convenient. In this blog, we will explain how to register, log in, and use the EPF online portal step by step.

What is the EPF Member Portal?

The EPF Member Portal is an online website where employees can:

- Check their EPF balance and passbook

- Withdraw EPF funds for emergencies

- Update personal details like Aadhaar and bank account

- Transfer their EPF account from one employer to another

To use this portal, employees need a Universal Account Number (UAN), which is a unique ID given by the EPFO.

How to Register on the EPF Member Portal?

Before logging in, employees must first activate their UAN. Here’s how:

- Visit the UAN Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Click on ‘Activate UAN’ on the homepage.

- Enter your UAN, PF number, Aadhaar, PAN, date of birth, and mobile number.

- Click on ‘Get OTP’. You will receive a one-time password on your mobile.

- Enter the OTP and submit.

- Set a new password for your EPF account.

Once this process is complete, you can log in anytime using your UAN and password.

How to Log in to the EPF Member Portal?

Once registered, follow these steps to log in:

- Visit the EPF Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Enter your UAN and password.

- Fill in the captcha and click ‘Sign In’.

After logging in, you can check your EPF balance, update your details, or withdraw funds.

Understanding the EPF Member Home Page

Once logged in, you will see your EPF Member Home Page. This is where you can access different EPF services.

Transfer EPF Account: Move your EPF balance from an old employer to a new one.

View Passbook: Check your EPF balance and past contributions.

Update KYC: Add or update Aadhaar, PAN, and bank details.

Withdraw EPF: Apply for full or partial withdrawal of your EPF money.

How to Log in to the EPF UAN Portal?

The EPF UAN Portal is the same as the EPF Member Portal. Employees can use their UAN and password to log in.

- Visit the UAN Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Enter your UAN and password.

- Fill the captcha and click ‘Login’.

This portal allows employees to manage all EPF-related services in one place.

EPF Employer Login Guide

Employers also have a separate portal to manage employee EPF contributions.

- Visit the EPFO Employer Portal: https://unifiedportal-emp.epfindia.gov.in/

- Enter the Employer Username and Password.

- Fill in the captcha and click ‘Sign In’.

Through this portal, employers can:

- Submit employee EPF contributions

- Approve employee KYC updates

- Verify and approve EPF withdrawals

How to Use the EPF Online Portal?

The EPF Online Portal is designed to help both employees and employers access EPF services from anywhere.

Employees can use the portal to:

- Check EPF Balance – View monthly contributions and total savings.

- Download Passbook – Get a record of all EPF transactions.

- Withdraw EPF – Apply for full or partial withdrawals online.

- Update KYC – Add Aadhaar, PAN, and bank details for verification.

- Transfer EPF Account – Move the EPF balance when switching jobs.

Employers can use the portal to:

- Make EPF Payments – Deposit monthly EPF contributions.

- Approve Employee KYC Updates – Verify employee documents.

- Process EPF Withdrawals – Approve employee withdrawal requests.

EPF Passbook: Checking Balance & Downloading Statement

The EPF Passbook is an online record of an employee’s EPF account. It shows details of monthly contributions made by both the employee and the employer. Employees can check their EPF balance and download their passbook from the EPFO website without visiting any office.

In this guide, we will explain how to log in, check the EPF passbook balance, and download the passbook statement step by step.

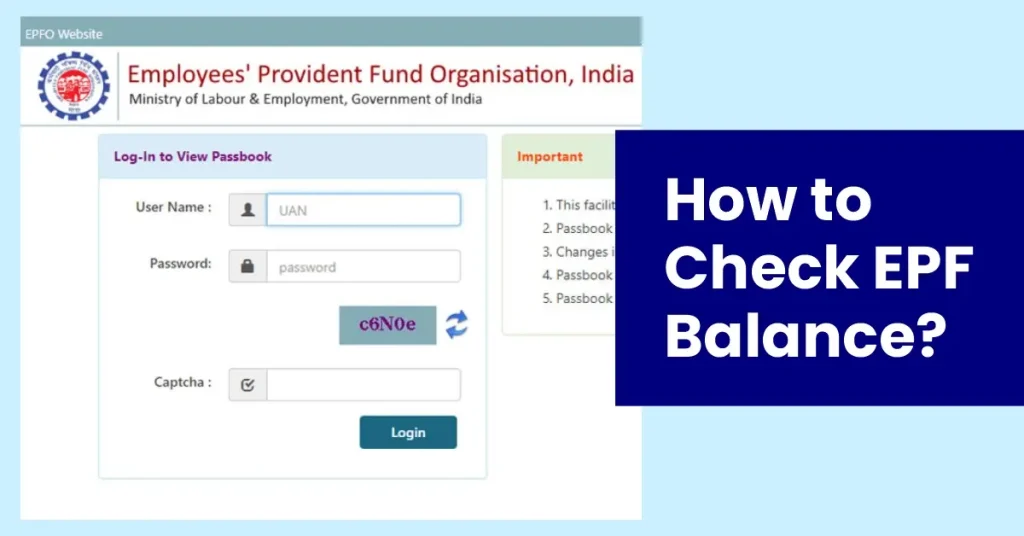

EPF Passbook Login: Step-by-Step Guide

The EPFO provides an online passbook facility that employees can access anytime. However, employees must first activate their UAN (Universal Account Number) to use this service.

Steps to Log in to the EPF Passbook Portal:

- Visit the EPF Passbook Portal: https://passbook.epfindia.gov.in/MemberPassBook/Login

- Enter your UAN and password.

- Fill in the captcha and click ‘Login’.

- Once logged in, you will see your EPF account details.

Employees can now check their passbook balance and download the statement.

How to Check EPF Passbook Balance

Employees can check their EPF balance online using two methods:

1. EPF Passbook Portal

- Log in to the EPF Passbook Portal using your UAN and password.

- Click on your EPF Member ID to open the passbook.

- The passbook will show monthly contributions, withdrawals, and total balance.

2. UMANG App

- Download the UMANG App from the Google Play Store or Apple App Store.

- Register using your mobile number linked to your UAN.

- Select ‘EPFO’ and then ‘View Passbook’.

- Enter your UAN and OTP to check your EPF balance.

EPF Passbook Download Process

To download your EPF passbook statement, follow these steps:

- Log in to the EPF Passbook Portal: https://passbook.epfindia.gov.in/MemberPassBook/Login

- Click on your EPF Member ID.

- Your EPF passbook will open with details of contributions.

- Click on the ‘Download Passbook’ button.

- The passbook will be saved as a PDF file, which you can print if needed.

EPF Member Passbook Login

Employees can access their EPF passbook only after their employer has deposited at least one contribution. The passbook will not be available if:

- UAN is not activated

- No EPF contributions have been made yet

- The employer has not updated payment details in the system

Employees must also ensure that their UAN is linked to Aadhaar for smooth access to EPF services.

How to Check EPF Balance? A Step-by-Step Guide

The Employees’ Provident Fund (EPF) is a retirement savings scheme where both employees and employers contribute a fixed amount every month. Employees can check their EPF balance online or offline using different methods.

In this guide, we will explain how to check EPF balance using the UAN portal, missed call service, SMS, and the UMANG app.

EPF Balance Check Online via UAN Portal

The UAN (Universal Account Number) Portal allows employees to check their EPF balance anytime. Before using this method, employees must activate their UAN.

Steps to Check EPF Balance Online:

- Visit the EPF Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Log in using your UAN and password.

- Click on ‘View’ and select ‘Passbook’.

- The EPF passbook will open, showing the monthly contributions and total balance.

This method provides a detailed view of all transactions in your EPF account.

EPF Balance Check via Missed Call & SMS

If you do not have internet access, you can check your EPF balance using a missed call or SMS service.

EPF Balance Check Number & Missed Call Service

- Give a missed call to 99660 18007 from your registered mobile number.

- The call will disconnect automatically.

- You will receive an SMS with your EPF balance and last contribution details.

Important:

- Your UAN must be linked to Aadhaar, PAN, and your bank account to use this service.

- The missed call should be made from the mobile number registered with EPFO.

EPF Balance Check via SMS

- Send an SMS in the format: EPFOHO UAN <LANGUAGE CODE> to 7738299899.

- For example, if you want the message in English, send: EPFOHO UAN ENG.

- You will receive an SMS with your EPF balance details.

Available Languages & Codes:

- English – ENG

- Hindi – HIN

- Tamil – TAM

- Telugu – TEL

- Malayalam – MAL

- Bengali – BEN

- Kannada – KAN

- Punjabi – PUN

- Gujarati – GUJ

- Marathi – MAR

Using UMANG App for EPF Balance Enquiry

The UMANG (Unified Mobile Application for New-age Governance) app is an official government app that provides EPF services on mobile.

Steps to Check EPF Balance on UMANG App:

- Download the UMANG App from Google Play Store or Apple App Store.

- Open the app and search for ‘EPFO’.

- Select ‘View Passbook’.

- Enter your UAN and OTP (sent to your registered mobile number).

- Your EPF balance and transaction history will be displayed.

This method allows employees to check their EPF details anytime using their smartphone.

EPF Withdrawal Process: A Complete Guide

The Employees’ Provident Fund (EPF) is a savings scheme for salaried employees in India. Employees can withdraw their EPF balance partially or fully under certain conditions. The EPFO (Employees’ Provident Fund Organisation) allows online and offline withdrawal options.

In this guide, we will explain:

- How to apply for EPF withdrawal online

- EPF withdrawal rules & eligibility

- Tax implications of EPF withdrawal

- How to fill Form 15G for tax exemption

- Checking EPF withdrawal status

How to Apply for EPF Withdrawal Online?

EPFO allows employees to withdraw their EPF balance using the UAN portal without visiting any office.

Steps to Apply for EPF Withdrawal Online:

- Visit the EPF Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Log in using your UAN and password.

- Click on ‘Online Services’ and select ‘Claim (Form-31, 19 & 10C)’.

- Enter your bank account number (linked with EPFO) and click ‘Verify’.

- Select the type of withdrawal:

- Form 19 – Full EPF withdrawal

- Form 10C – Pension withdrawal

- Form 31 – Partial withdrawal for specific reasons (marriage, medical emergency, house purchase, etc.)

- Upload scanned copies of required documents (if applicable).

- Click on ‘Submit’ to process your withdrawal request.

Once submitted, you can track your EPF withdrawal status online.

EPF Withdrawal Rules: Eligibility & Tax Implications

EPF Withdrawal Eligibility Criteria

| Type of Withdrawal | Eligibility |

|---|---|

| Full EPF Withdrawal | Allowed after retirement or if unemployed for 60+ days |

| Partial EPF Withdrawal | Allowed for specific needs like marriage, home loan repayment, education, or medical emergencies |

| Pension Withdrawal (EPS) | Available after 10+ years of service |

Tax Implications on EPF Withdrawal

- Tax-Free Withdrawal: If EPF is withdrawn after 5 years of continuous service, no tax is applicable.

- TDS Deducted: If EPF is withdrawn before 5 years, TDS @ 10% is deducted (if withdrawal amount is above ₹50,000).

- No TDS: If Form 15G/15H is submitted and annual income is below taxable limit.

How to Fill EPF Form 15G for Tax Exemption?

Employees withdrawing before 5 years of service can avoid TDS by submitting Form 15G.

Steps to Fill Form 15G Online for EPF Withdrawal

- Download Form 15G from the EPFO website or obtain it from your employer.

- Fill in your details: Name, PAN, Address, and Estimated Income.

- In “Previous Year”, enter the financial year in which you are applying for withdrawal.

- Mention your EPF Account Number and UAN.

- Sign and upload the filled Form 15G while submitting the online withdrawal request.

EPF Withdrawal Online via Mobile (Using UMANG App)

Employees can withdraw their EPF balance through the UMANG app on their mobile phones.

Steps to Apply for EPF Withdrawal via UMANG App

- Download the UMANG App from the Google Play Store or Apple App Store.

- Open the app and select ‘EPFO’.

- Tap on ‘Raise Claim’ and enter your UAN & OTP.

- Select the withdrawal type (Full/Partial).

- Upload required documents (if applicable).

- Submit the request and note the claim reference number.

You can track your EPF claim status from the same app.

EPF Withdrawal Login & Status Check

After applying for withdrawal, employees can check the EPF withdrawal status online.

Steps to Check EPF Withdrawal Status:

- Visit the EPF Member Portal and log in with your UAN and password.

- Click on ‘Online Services’ → ‘Track Claim Status’.

- The status will show: Under Process / Approved / Settled.

Alternatively, you can check the status using:

- EPFO Missed Call Service: Dial 99660 18007 from your registered mobile.

- EPFO SMS Service: Send EPFOHO UAN ENG to 7738299899.

EPF Amount Withdrawal: Step-by-Step Guide

- Decide the type of withdrawal – Full, partial, or pension withdrawal.

- Log in to the EPF Portal and submit the online claim.

- Upload required documents (if applicable).

- Track claim status online or via SMS/missed call.

- Receive money in your bank account within 7-20 days.

EPF Claim Status & Transfer Process: A Complete Guide

The Employees’ Provident Fund (EPF) allows employees to withdraw or transfer their funds when needed. You can check your EPF claim status and transfer your EPF balance online without visiting an office.

How to Check EPF Claim Status Online?

You can check your EPF withdrawal or transfer claim status using these methods:

1. EPF Member Portal

- Visit https://unifiedportal-mem.epfindia.gov.in/

- Log in with UAN and password.

- Click ‘Track Claim Status’ under ‘Online Services’.

2. UMANG App

- Open the UMANG App, select EPFO → Track Claim.

- Enter UAN and OTP to view the claim status.

3. Missed Call or SMS

- Give a missed call to 99660 18007 from your registered mobile.

- Send EPFOHO UAN ENG to 7738299899 for an SMS update.

What to Do If EPF Claim Status Shows “Payment Under Process”?

If your status shows “Payment Under Process”, it means EPFO has approved the claim, and the bank is processing it. The payment usually takes 7-10 days.

What to do:

- Wait for a few days as payments are usually settled within a week.

- Check your bank details in the EPF portal.

- Raise a complaint at https://epfigms.gov.in/ if there’s no update after 15 days.

EPF Transfer Process: Moving Funds to a New Employer

If you switch jobs, you must transfer your EPF balance to your new employer.

How to Transfer EPF Online?

- Log in to the EPF Member Portal.

- Click ‘One Member – One EPF Account (Transfer Request)’.

- Enter your previous employer details and select approval by the previous or current employer.

- Submit the request and get it approved.

Once approved, your EPF balance will be transferred automatically.

Tracking Your EPF Claim Online

To track your EPF claim status, use:

Missed Call (99660 18007) or SMS (7738299899)

EPF Member Portal (https://unifiedportal-mem.epfindia.gov.in/)

UMANG App (EPFO → Track Claim)

EPF Interest Rate & Contribution Details

The Employees’ Provident Fund (EPF) helps employees save for their future with monthly contributions from both the employee and the employer. The savings grow with interest, which is set by the EPFO (Employees’ Provident Fund Organisation) every year.

This guide covers:

- Current EPF interest rate and its calculation

- How to use the EPF calculator for future savings

- Difference between employee and employer contributions

- EPF pension calculation and expected pension amount

Current EPF Interest Rate & How It’s Calculated

The EPF interest rate for 2023-24 is 8.15% per annum. This interest is compounded monthly but credited to the EPF account at the end of the financial year.

How EPF Interest is Calculated?

- Interest is calculated on the closing balance of each month.

- The balance includes previous deposits + new contributions.

- The formula for interest calculation: Monthly Interest = (Total EPF Balance × Interest Rate) ÷ 12

For example, if your EPF balance is ₹1,00,000 and the annual interest rate is 8.15%, the interest for one month will be:

(1,00,000 × 8.15%) ÷ 12 = ₹679.16

At the end of the year, all monthly interest amounts are added and credited to your EPF account.

How to Use the EPF Calculator for Future Savings?

An EPF calculator helps employees estimate their total savings at retirement.

How to Use an EPF Calculator?

- Enter your basic salary + dearness allowance.

- Enter your current age and expected retirement age.

- The calculator will consider monthly contributions, employer’s share, and interest rate to estimate your future EPF balance.

This tool helps in planning retirement savings by giving a clear picture of how much you can accumulate over time.

Difference Between EPF Employee & Employer Contributions

| Category | Employee Contribution | Employer Contribution |

|---|---|---|

| Percentage of Salary | 12% of Basic + DA | 12% of Basic + DA |

| EPF Account Share | Full 12% goes to EPF | 8.33% to EPS (pension) + 3.67% to EPF |

| Who Pays? | Deducted from employee’s salary | Paid by the employer |

Key Points:

- Employee contributes 12% of the basic salary + DA to EPF.

- Employer’s 12% contribution is divided:

- 8.33% goes to EPS (Employees’ Pension Scheme)

- 3.67% goes to EPF

EPF Pension Calculator: How Much Pension You Can Expect?

The Employee Pension Scheme (EPS) provides a pension to employees after retirement. The pension amount depends on years of service and last drawn salary.

EPS Pension Formula:

Monthly Pension = (Pensionable Salary × Service Years) ÷ 70

Where:

- Pensionable Salary = Average of the last 60 months’ basic salary (capped at ₹15,000 per month).

- Service Years = Total number of years worked.

Example Calculation:

If the average salary in the last 60 months is ₹15,000, and the service period is 25 years:

(15,000 × 25) ÷ 70 = ₹5,357 per month

The pension amount increases with more years of service.

EPF Grievance & Customer Support

If you face issues related to EPF withdrawal, transfer, claim delays, or incorrect details, you can file a complaint through the EPF Grievance Portal. The EPFO also provides customer support through helplines and regional offices.

This guide explains:

- How to file a complaint on the EPF Grievance Portal

- How to track your EPF grievance status

- EPF customer care helpline & complaint number

- How to contact EPF regional offices

How to File a Complaint on the EPF Grievance Portal?

If your EPF withdrawal, transfer, or claim is delayed, you can raise a complaint online.

Steps to File an EPF Complaint Online:

Upload supporting documents

Visit the EPF Grievance Portal: https://epfigms.gov.in/

Click on ‘Register Grievance’.

Enter your UAN, Name, Mobile Number, and Email ID.

Select the PF Number and grievance category (Withdrawal, Pension, Transfer, etc.).

EPF Grievance Status Check: Track Your Complaint

Once you have registered a grievance, you can check its status online.

Steps to Track EPF Grievance Status:

- Visit EPF Grievance Portal: https://epfigms.gov.in/

- Click on ‘View Status’.

- Enter your registration number and password.

- Click ‘Submit’ to check the complaint status.

Most grievances are resolved within 7-15 working days.

EPF Complaint Number & Customer Care Helpline

If you need urgent assistance, you can contact the EPF customer support helpline.

EPF Toll-Free Helpline Number:

📞 14470

EPFO Helpdesk Email:

EPFO WhatsApp Helpline:

Many regional EPFO offices provide support via WhatsApp. You can check your regional EPF office website for the latest WhatsApp helpline numbers.

Contacting EPF Regional Office (e.g., EPF Gurugram Office)

You can also visit or contact your nearest EPFO regional office for support.

Example: EPF Gurugram Office Contact Details

- Address: Bhavishya Nidhi Bhawan, Plot No. 43, Sector 44, Gurugram, Haryana – 122003

- Phone: 0124-2578631

- Email: ro.gurgaon@epfindia.gov.in

To find contact details of other EPFO regional offices, visit:

🔗 https://www.epfindia.gov.in/site_en/Contact_us.php

EPF KYC Update & Account Management

Keeping your EPF account details updated ensures smooth withdrawals, transfers, and claim settlements. The EPF portal allows employees to update KYC, change passwords, and link their UAN with Aadhaar, PAN, and bank details.

This guide covers:

- How to update KYC in the EPF portal

- Steps to change EPF password

- EPF account activation and UAN linking

How to Update KYC in EPF Portal?

Updating KYC details like Aadhaar, PAN, and bank account helps in faster claim processing.

Steps to Update KYC in EPF Portal:

- Log in to EPFO Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Click on ‘Manage’ → ‘KYC’.

- Select the details you want to update (Aadhaar, PAN, or Bank Account).

- Enter the correct details and click ‘Save’.

- The details will be sent for employer verification.

- Once EPFO verifies, your KYC will be updated.

✅ Tip: Ensure that your mobile number is linked to Aadhaar for OTP verification.

How to Change EPF Password?

If you forget your EPF login password, you can reset it easily.

Steps to Change EPF Password:

- Visit EPF Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Click ‘Forgot Password?’ on the login page.

- Enter your UAN and click ‘Submit’.

- Verify your registered mobile number with OTP.

- Set a new password and confirm it.

Your password is now updated, and you can log in with the new credentials.

EPF Account Activation & UAN Linking

Your Universal Account Number (UAN) must be activated to access EPF services like withdrawals, transfers, and passbook checking.

How to Activate UAN?

- Go to UAN Member Portal: https://unifiedportal-mem.epfindia.gov.in/

- Click ‘Activate UAN’.

- Enter UAN, mobile number, and Aadhaar/PAN details.

- Verify with OTP sent to your mobile.

- Set a password and activate your UAN.

Once activated, you can log in to your EPF account and manage your details.

EPF Online Payments & Employer Contributions

Employers are responsible for deducting EPF contributions from employees’ salaries and depositing them with the Employees’ Provident Fund Organisation (EPFO). This process is done online through the EPFO portal.

This guide explains:

- How to make EPF online payments

- Step-by-step EPF challan payment process

- EPF registration process for employers

How to Make EPF Online Payment?

Employers must pay EPF contributions every month using the EPFO e-Sewa portal. The payment is made through challans generated on the portal.

Steps to Make EPF Online Payment:

- Visit the EPFO Employer Portal: https://unifiedportal-emp.epfindia.gov.in/

- Log in with your Employer Username and Password.

- Click ‘ECR Upload’ under ‘Payments’.

- Upload the Electronic Challan cum Return (ECR) file.

- Verify the details and generate the challan.

- Click ‘Proceed for Payment’ and select online banking (Net Banking, UPI, etc.).

- Make the payment and download the receipt for records.

✅ Tip: Employers must deposit EPF contributions before the 15th of each month to avoid penalties.

EPF Challan Payment Guide

Employers must generate and pay EPF challans for each payroll cycle.

Steps to Generate & Pay EPF Challan Online:

- Log in to the EPFO Employer Portal.

- Click ‘ECR Upload’ and enter the required details.

- Verify employee PF contributions and wages.

- Click ‘Generate Challan’ and note the TRRN (Temporary Return Reference Number).

- Choose ‘Pay via Net Banking’ and complete the payment.

- Download the acknowledgment receipt for future reference.

✅ Note: Late payments attract penalties and interest, so timely submission is important.

Also read – How to Change Name in Aadhar Card

EPF Registration Process for Employers

Employers must register their business with the EPFO before making EPF contributions.

Steps to Register as an Employer with EPFO:

- Visit the EPFO Employer Registration Portal: https://unifiedportal-emp.epfindia.gov.in/

- Click on ‘Register Establishment’.

- Enter business details like Company Name, PAN, and Address.

- Provide Bank Account & Digital Signature details.

- Submit the application and receive the EPF Establishment Code.

Once registered, employers can enroll employees, deposit EPF contributions, and generate challans online.

Additional EPF Services & FAQs

The Employees’ Provident Fund (EPF) is a crucial part of financial security for salaried employees in India. Understanding its additional services, rules, and troubleshooting common issues can help employees manage their EPF account efficiently.

What is EPF Joint Declaration Form & How to Use It?

The EPF Joint Declaration Form is used for correcting errors in an employee’s EPF account, such as name, date of birth, father’s name, or other details. Both the employer and the employee must sign the form and submit it to the EPFO office along with supporting documents like Aadhaar, PAN, or a birth certificate.

How to Use It?

- Download the Joint Declaration Form from the EPFO website or get it from your employer.

- Fill in the correct and incorrect details.

- Attach the required documents.

- Get the employer’s signature and company seal.

- Submit it to the regional EPFO office for correction.

How to Track EPF Payments & Transactions?

Employees can track EPF contributions and transactions through multiple methods:

- UMANG App: Check passbook, claim status, and contribution details.

- EPFO Member Portal: Log in with your UAN to view transaction history.

- SMS Service: Send “EPFOHO UAN ENG” to 7738299899 from your registered mobile number.

- Missed Call Service: Dial 9966044425 from your registered mobile to receive details via SMS.

EPF Pension Status Check & Rules

Employees eligible for an EPF pension (EPS) can check their pension status online:

- Visit EPFO Pension Portal: Log in with your UAN and password.

- Use Jeevan Pramaan: Pensioners must submit a Digital Life Certificate annually for pension continuation.

- Offline Inquiry: Visit the regional EPFO office with your UAN and Aadhaar card.

EPF Pension Rules:

- Minimum 10 years of service required for pension eligibility.

- Pension amount depends on salary and years of service.

- The pension starts at the age of 58 years.

Common EPF Issues & How to Resolve Them

1. Wrong Name or Date of Birth

Solution: Use the Joint Declaration Form for corrections.

2. EPF Passbook Not Updating

Solution: Wait for 48 hours after an update or contact EPFO if the issue persists.

3. Claim Rejected

Solution: Ensure correct bank details, Aadhaar linking, and KYC updates.

4. Employer Not Depositing EPF Contribution

Solution: Raise a complaint on EPFO’s grievance portal.

Importance of EPF for Employees

- Retirement Savings: Secure fund accumulation for post-retirement life.

- Tax Benefits: Contributions qualify for tax deductions under Section 80C.

- Emergency Withdrawals: Funds can be withdrawn for medical emergencies, home loans, or higher education.

- Pension Benefits: Provides financial security in old age through EPS.

Future of EPF India & Digital EPF Services

EPF services are continuously evolving with digital enhancements:

- E-Passbook & E-Nomination: Easy access and online nomination update.

- Auto KYC Updates: Faster processing with Aadhaar linking.

- Instant Claim Settlements: Faster processing through online submission.

- Mobile App Integration: UMANG app provides all EPF services in one place.

How to Stay Updated with www.epf.gov.in & EPFO Announcements

- Visit the EPFO Official Website: Regularly check for circulars and updates.

- Follow Social Media Pages: EPFO shares updates on Twitter and Facebook.

- Subscribe to Email Alerts: Get notifications on new rules and announcements.

- Use the UMANG App: Access all EPF services on the go.

By staying informed about EPF services, employees can ensure their savings are secure and manage their accounts with ease.

Also read – How to Link Aadhar to Voter ID