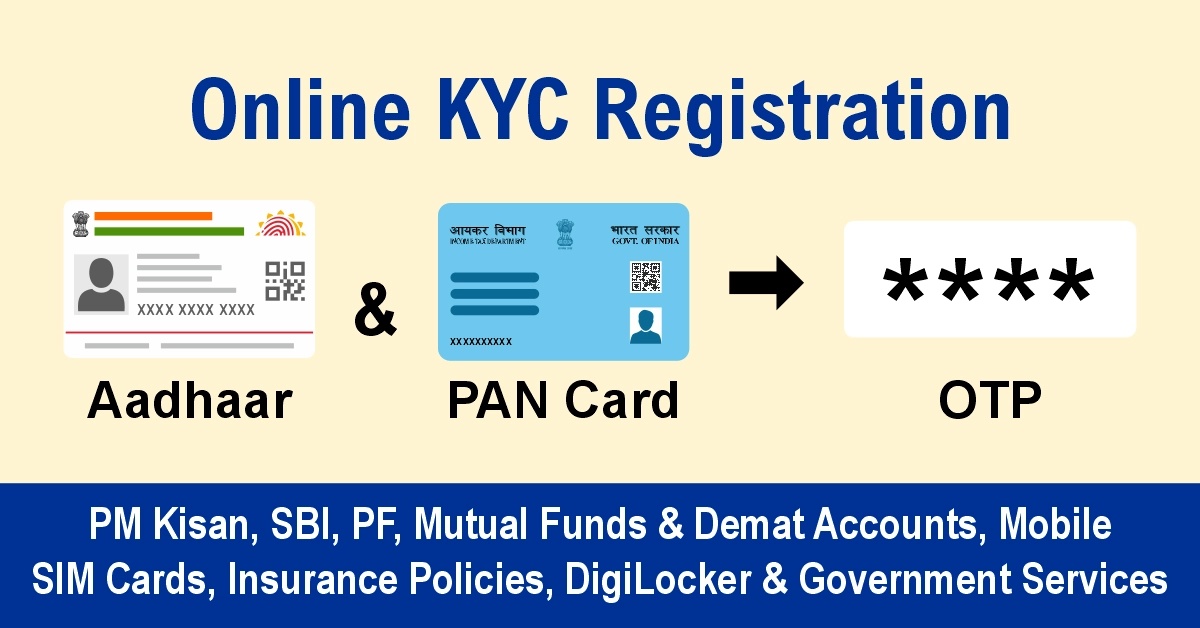

In India, almost every financial service today requires KYC (Know Your Customer). From opening a bank account in SBI to receiving government benefits like PM Kisan Yojana or managing your PF (Provident Fund) account, online KYC registration is a must.

Earlier, KYC meant filling forms, attaching documents, and visiting banks or offices. Today, with the help of technology and Aadhaar authentication, the process has become paperless, instant, and online. This is called e-KYC (Electronic KYC).

In this blog, we will explain:

- What is online KYC, and why is it important

- Step-by-step process for PM Kisan KYC online registration

- How to complete SBI online KYC registration

- Process of PF KYC online registration via UAN

- Common issues and solutions in e-KYC

- Benefits of keeping KYC updated

By the end, you will clearly understand how to complete online KYC registration for different services without confusion.

What is KYC and e-KYC?

KYC (Know Your Customer) is a process to verify your identity using valid documents. It helps banks, government departments, and financial institutions ensure that the right person is using the service.

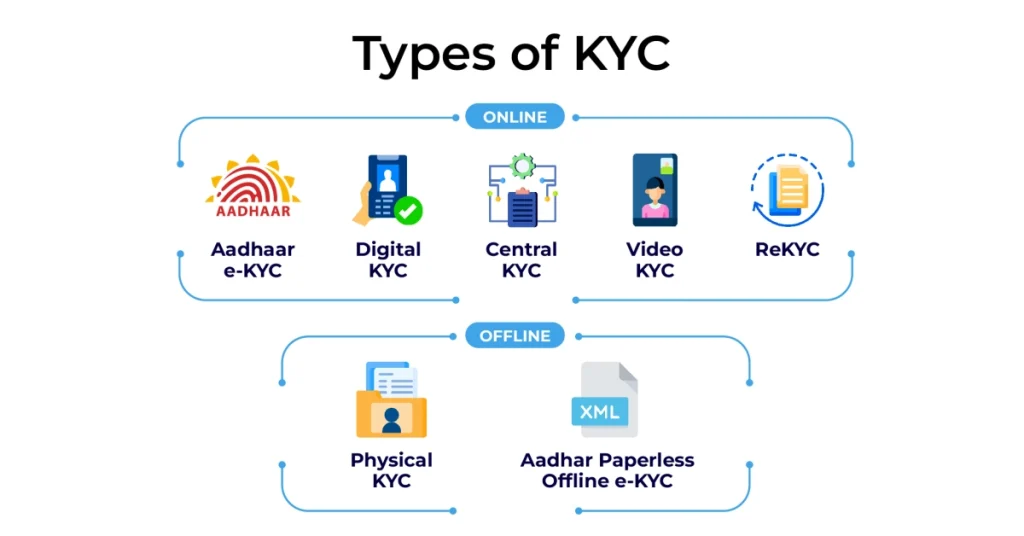

Types of KYC:

- Offline KYC:

- Submit physical copies of Aadhaar, PAN, or other ID proofs at the branch.

- Takes more time as documents are verified manually.

- Online KYC (e-KYC):

- Verification is done electronically using Aadhaar and OTP.

- No paperwork, quick approval, safe and secure.

Benefits of Online KYC:

- Saves time and effort

- Paperless and eco-friendly

- Can be done from home using an Aadhaar-linked mobile

- Required for receiving subsidies, salary credits, PF withdrawals, and more

PM Kisan KYC Online Registration

The Pradhan Mantri Kisan Samman Nidhi (PM-Kisan) is a scheme that provides ₹6,000 yearly financial support to farmers. To continue receiving the money, farmers must complete e-KYC.

Why KYC is Important for PM Kisan?

- Without KYC, farmers will not receive instalments.

- Helps the government verify genuine beneficiaries.

- Ensures money is directly credited to the right bank account.

Steps for PM Kisan e-KYC Online:

- Go to the official PM Kisan Portal

- On the homepage, click on ‘e-KYC’

- Enter your Aadhaar number

- Submit the OTP received on the Aadhaar-linked mobile

- If details match, KYC is successful

If the mobile number is not linked with Aadhaar, visit the nearest CSC (Common Service Centre) for biometric KYC.

Common Problems in PM Kisan KYC:

- Aadhaar is not linked to a bank account

- Wrong mobile number

- Server not responding

- Biometric mismatch

Solution: Update Aadhaar, link mobile number, and retry.

Online KYC Registration in SBI (State Bank of India)

SBI, like all banks, requires customers to keep their KYC updated. Without KYC, your account may be frozen or limited.

Documents Needed for SBI KYC:

- Aadhaar Card

- PAN Card

- Passport-size photo

- Address proof (if different from Aadhaar)

Methods of SBI e-KYC:

- Through YONO App:

- Open YONO App → Go to “Services” → Select “Update KYC”

- Upload scanned Aadhaar/PAN → Submit

- Through SBI NetBanking:

- Login to SBI NetBanking → Profile → Update KYC

- Upload Aadhaar, PAN, and photo

- By Visiting Branch:

- Carry documents → Fill KYC update form → Submit at the counter

How to Check SBI KYC Status:

- Call customer care (1800 1234 / 1800 2100)

- Login to SBI NetBanking → Profile → View KYC status

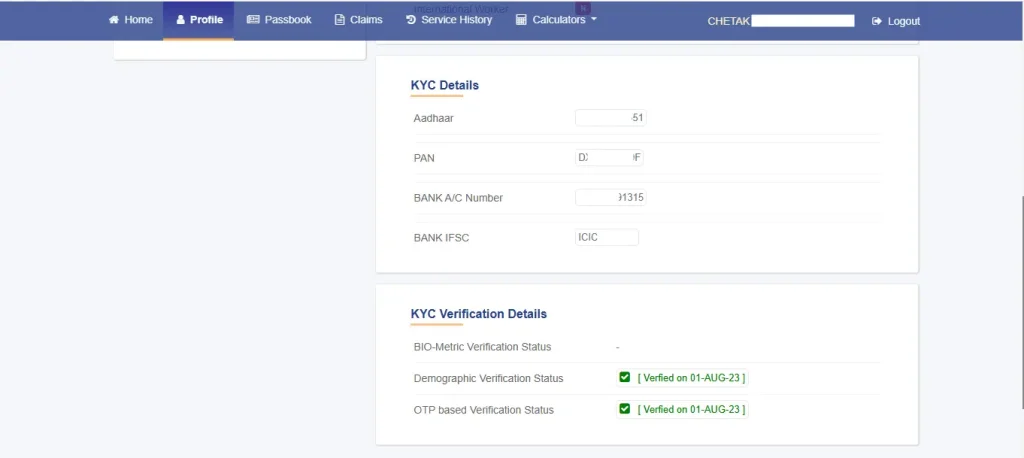

PF KYC Online Registration (EPFO / UAN Portal)

For employees, KYC in Provident Fund (PF) accounts is very important. Without KYC, you cannot withdraw PF or transfer money.

Documents Required for PF KYC:

- Aadhaar Card

- PAN Card

- Bank account details

Steps to Update PF KYC via UAN:

- Visit EPFO UAN Portal

- Log in with your UAN number and password

- Go to ‘Manage’ → ‘KYC’

- Add Aadhaar, PAN, and bank details → Save

- The employer will approve the request

- Status will change from “Pending” to “Approved”

Once approved, your PF account is fully verified and active.

Other Services Where e-KYC is Used

Online KYC is not just for PM Kisan, SBI, or PF. It is now required almost everywhere:

- Mutual Funds & Demat Accounts – For investment verification

- Mobile SIM cards – Airtel, Jio, and VI use Aadhaar-based e-KYC

- Insurance policies – For health, term, and life insurance

- DigiLocker & Government Services – For safe digital document storage

Common Issues in Online KYC Registration

Even though e-KYC is simple, users often face issues:

- Aadhaar not linked with mobile → Cannot receive OTP

- Name mismatch between Aadhaar and PAN → Application rejected

- Slow server on government portals → Delay in registration

- Bank account not linked with Aadhaar → Transaction failure

Solutions:

- Link Aadhaar with mobile at the Aadhaar Seva Kendra

- Update PAN details through the NSDL portal

- Try again during non-peak hours

- Link Aadhaar with bank account via branch/NetBanking

Benefits of Keeping KYC Updated

Keeping your KYC up to date ensures:

- Hassle-free banking transactions

- Timely government benefits like PM-Kisan instalments

- Easy PF withdrawal and transfer

- Smooth investment in mutual funds, stocks, and insurance

- Safe and verified digital identity

FAQs on Online KYC Registration

Q1. Is online KYC safe?

Yes, online KYC is secure when done on official portals like SBI, EPFO, or PM-Kisan.

Q2. How long does e-KYC take?

It is usually instant, but approval in PF and bank accounts may take 1–3 days.

Q3. Can I do PM Kisan KYC without Aadhaar OTP?

No. If the mobile is not linked, visit the CSC centre for biometric KYC.

Q4. What happens if I don’t update KYC?

Your bank account may become inactive, PF withdrawal will be blocked, and PM-Kisan money will stop.

Q5. Is KYC required for all bank accounts?

Yes, KYC is compulsory for savings, current, and salary accounts.

Conclusion

Online KYC registration is now essential in India. Whether you are a farmer under PM Kisan Yojana, a bank customer in SBI or another bank, or an employee with a PF account, updating your e-KYC is mandatory.

With Aadhaar-based OTP, the process has become simple, fast, and paperless. By completing your KYC on time, you ensure uninterrupted services, timely benefits, and smooth transactions.

Always use official websites or apps for KYC to stay safe from fraud. Keep Aadhaar, PAN, and mobile number ready, and finish your KYC today!