AEPS stands for “Aadhaar Enabled Payment System.” It’s a digital payment system that uses micro ATMs to enable financial transactions. It uses an Aadhaar number and biometric authentication. The AEPS system promotes financial inclusion. It provides basic banking services to individuals lacking access to traditional banking facilities.

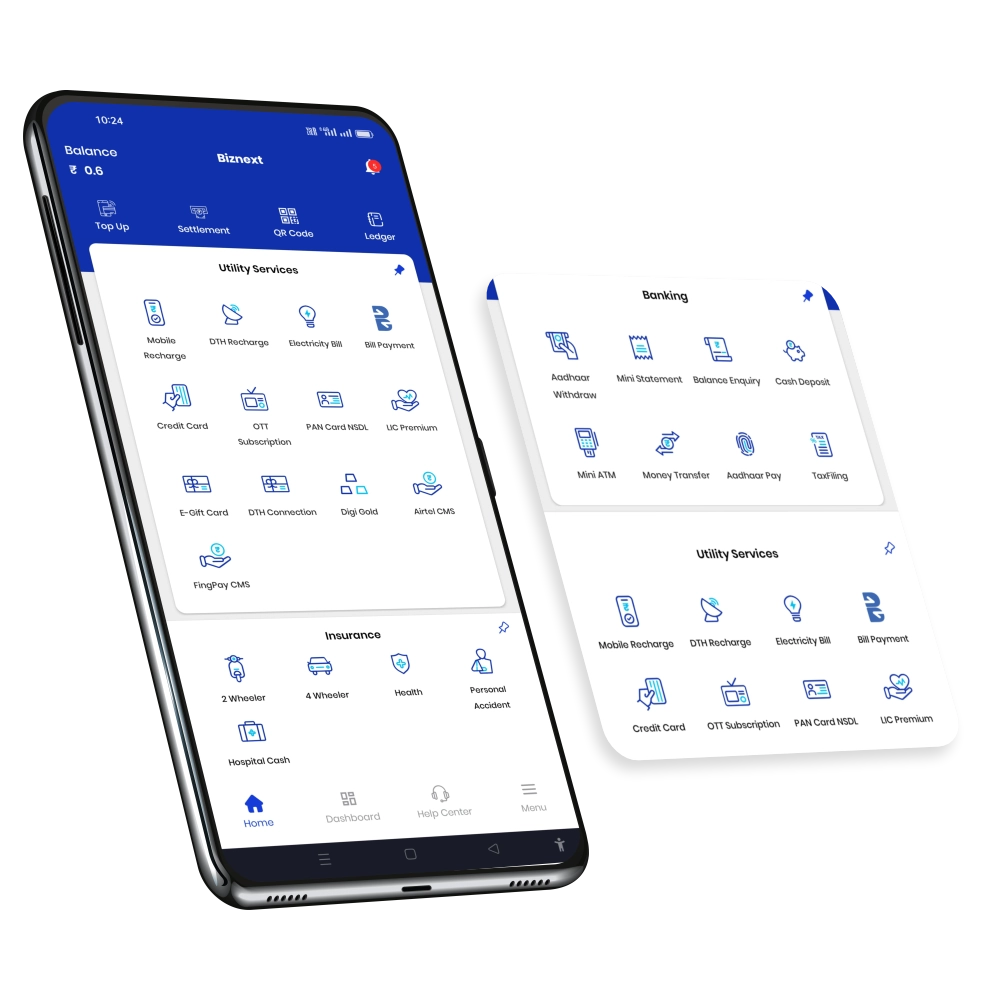

Customers can perform various financial transactions using the AEPS system. These transactions include cash deposits, cash withdrawals, balance inquiries, and fund transfers. Aadhaar Enabled Payment Service is an initiative by the NPCI. Several banks and financial institutions across India have integrated with it. This makes it accessible to the general public.

1) Cash withdrawal

The Aadhar-based payment system allows bank users to withdraw cash through their unique Aadhar number and biometric verification. People can withdraw their cash at any retail place with Aadhar-enabled payment system authorization. They can withdraw cash easily, just like at any other ATM.

2) Mini Statement check

AEPS allows its users to check their mini statements after any transaction.

3) Bank balance inquiry

The Aadhar-enabled payment system allows its users to check their daily, monthly, and weekly balances.

What is the future of the AEPS?

The National Payments Corporation of India (NPCI) and the Indian government introduced the Aadhaar Enabled Payment System (AEPS) to improve financial transactions. They wanted to use an Aadhaar card for this. It’s a revolutionary payment system. The designers created this payment system. They want to offer better ways of employment in these rural areas. These areas have limited access to banking infrastructure.

The future of AEPS in India is very bright as more and more people in India become aware of the benefits of AEPS. Several banks in India have already adopted AEPS.

One of the key advantages of AEPS is its ability to enable banking services in remote and rural areas. AEPS can provide financial services to millions of people. They had limited access to banking infrastructure. It does this by leveraging the Aadhaar card. This will reduce the financial exclusion of people in these areas.

Moreover, the Aadhaar-enabled payment service will bring digital payment adoption in India. It will fulfill the dream of Digital India. The government of India continues to push for digital payment adoption. AEPS will play a vital role in enabling people to make digital payments through their Aadhar cards. This will help reduce India’s dependence on cash transactions. It is a key goal of the government’s Digital India campaign.

What is the success rate of AePS?

The Aadhaar Enabled Payment System (AEPS) has brought the digital landscape to India. AEPS stands out as a reliable platform because of its high level of efficiency. It ensures the smooth execution of financial transactions. The commendable success rate is a quantitative indicator of the system’s skill. It shows its ability to help users complete transactions in different settings.

AEPS is effective because it incorporates Aadhaar and biometric authentication. This not only simplifies the user experience but also strengthens the security framework. The success rate quantifies AEPS’s operational strength.

AEPS has achieved numerical success. It has also played a pivotal role in advancing financial inclusion objectives. AEPS has an accessible and friendly interface. It engages with unbanked and underserved populations. This contributes to the broader goal of democratizing access to formal financial services. AEPS also adheres to regulatory guidelines established by the Reserve Bank of India. This underscores its commitment to maintaining the integrity and security of financial transactions.

Conclusion

In conclusion, AEPS in India holds promising prospects and transformative potential. AEPS has a unique way of bringing banking services to underserved and remote areas. It is not a technological innovation but a social and economic game-changer. AEPS is addressing the financial inclusion gaps in rural and remote regions. It makes monetary transactions accessible and empowers individuals. This aligns with India’s vision of inclusivity and digital empowerment.

Furthermore, AEPS is a force that aims to bring digitalization in the country. This fosters a culture of trust in digital financial interactions. More banks and financial institutions recognize the importance of AEPS. It bridges financial gaps and improves accessibility. They are ready to play a crucial role in the financial evolution of the country. This is due to the expected increase in its adoption.

AEPS has the potential to revolutionize the financial landscape. It’s a catalyst for change. It can steer India towards a more inclusive, digitally-driven economy.

AEPS will transform India’s technological capabilities and change the lives of millions. A growing number of financial entities are adopting AEPS. This heralds a new era in Indian finance. Accessibility, inclusivity, and digital prowess are coming together. They are shaping a more prosperous and fair future for all.