What is AEPS Cash Withdrawal?

AEPS, or Aadhar payment system, is a new payment system. It permits Aadhar card holders to do banking transactions. It is an NPCI-approved initiative. It empowers all parts of society. It gives them access to banking with their Aadhar-linked bank account. One can do this without spending much on infrastructure.

AePS Cash Withdrawal Meaning

AePS Cash Withdrawal is a hassle-free way to get cash from your bank account. You use your Aadhaar card. Instead of using a physical debit card and memorizing a PIN, this system allows you to withdraw money. You do this by providing your Aadhaar number. Then, you confirm your identity with a fingerprint or iris scan. It’s a simple process. It removes the need for cards or complex passwords. This makes banking easier and more convenient for everyone. It’s very helpful for those unfamiliar with traditional banking. Or, for those who find it hard to use.

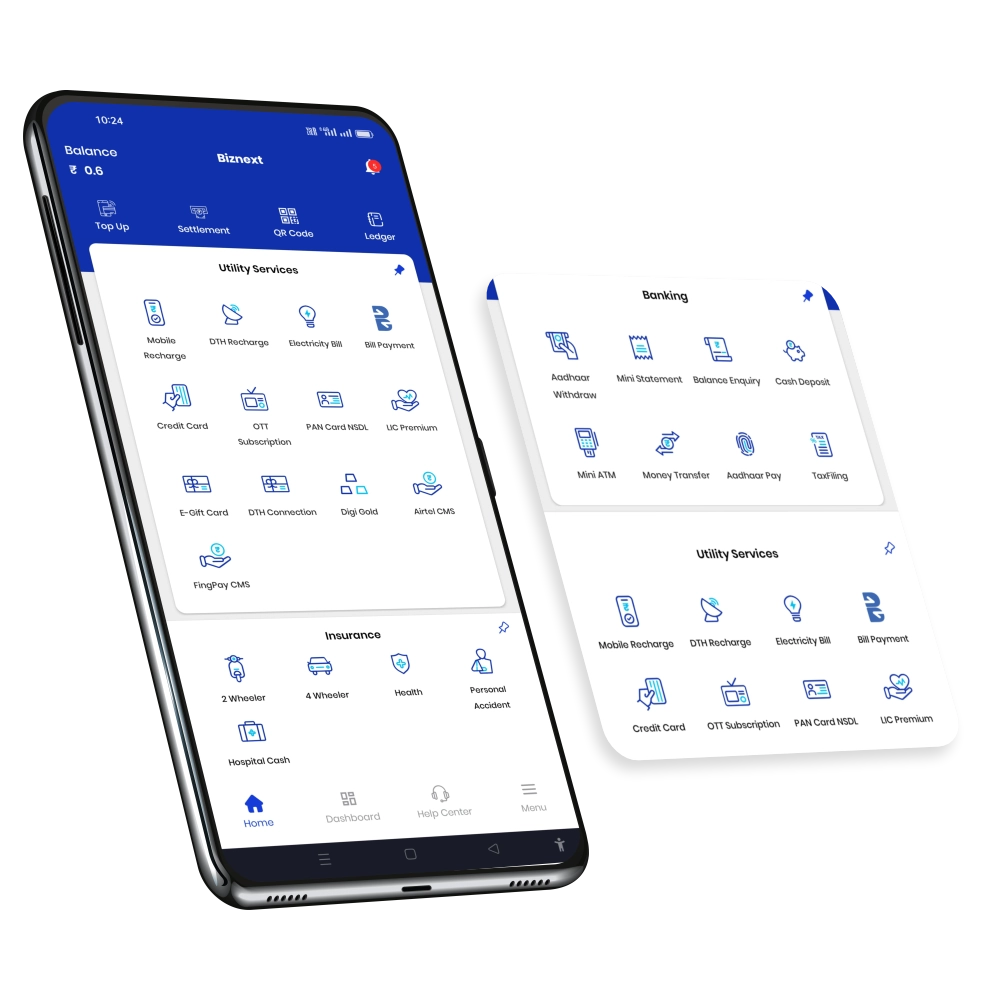

This method of cash withdrawal uses business correspondents or Micro ATM devices. They are often available in local shops or service centers. They bring banking services closer to communities. This includes remote areas where bank branches might be scarce. AePS Cash Withdrawal uses Aadhaar authentication. This ensures a secure and reliable process. It gives individuals peace of mind while doing their financial activities.

Also, AePS Cash Withdrawal is key to promoting financial inclusion. It serves the needs of the unbanked and underbanked in India. It empowers people. They may not have easy access to traditional banking. But, it lets them to, join the formal financial system. This enables them to manage their finances more. AePS Cash Withdrawal shows how tech innovation can simplify banking. It can also make financial services more inclusive and accessible.

How do I withdraw money from AEPS?

Withdrawing money from AePS (Aadhaar Enabled Payment System) is a simple and convenient process designed to make banking accessible to everyone. To start, locate a business correspondent (BC) or a Micro ATM that offers AePS services. These are often available at local shops or service centers.

Once you’ve found a BC or a Micro ATM, provide them with your Aadhaar number. This acts as your identification, linking your bank account to the transaction. Then, the BC or the Micro ATM will prompt you to verify your identity. This is usually done by scanning your fingerprint or iris, which ensures that only you can access your account.

After your identity is confirmed, you’ll be asked to specify the amount you wish to withdraw. Simply enter the desired amount, and the transaction details will be processed. Once everything is confirmed, the BC or the Micro ATM will dispense the requested amount in cash.

One of the significant advantages of AePS is its simplicity. You don’t need a physical debit card or to remember complex PINs, making it accessible to those who might not be familiar with traditional banking methods or find them challenging. Plus, AePS transactions are secure and reliable, providing peace of mind to users.

In essence, withdrawing money from AePS is a user-friendly process that promotes financial inclusion by ensuring that everyone, regardless of their banking experience, can easily access their funds when needed.

What is the AEPS cash withdrawal limit?

The AEPS (Aadhaar Enabled Payment System) has a cash withdrawal limit. It is the most money a person can withdraw. This limit applies to a single transaction or a specific time frame.

The limit is set by the person’s bank. It may vary. This depends on factors like the account type, customer profile, and banking rules. AEPS cash withdrawal limits range from ₹10,000 to ₹25,000. The limit is ₹25,000 per transaction. There are daily or weekly limits. They are to keep transactions secure and prevent misuse. Yet, you should ask your bank. They can tell you the specific limits for your account.

AEPS users receive a balance between convenience and security. This is to safeguard customer funds and stop unauthorized transactions.

What is AEPS cash withdrawal limit per day?

AEPS Cash withdrawal limits vary. They depend on factors. These include the bank’s policies, the account type, and rules. Generally, AePS cash withdrawal limits per day range from Rs. 10,000 to Rs. 25,000. These limits ensure transaction security. They prevent misuse and unauthorized access to funds. Banks set daily withdrawal limits. They do this to protect customers’ finances. But, they also want to provide easy access to their funds through the AePS platform.

People should check with their banks. They need to understand the cash withdrawal limits for their accounts.

What are AePS Cash Withdrawal Charges?

AePS (Aadhaar Enabled Payment System) Cash Withdrawal Charges are fees. You might need to pay them when you take out cash from your bank account using AePS. These charges can vary depending on your bank and the type of account you have. Sometimes, banks might not charge for AePS withdrawals. But, in some cases, they might deduct a small amount as a service fee.

This fee could be a fixed amount or a percentage of the withdrawn sum. You must ask your bank about their AePS withdrawal charges. They can differ from bank to bank. Knowing these fees can help you plan your finances better. It can also help you avoid unexpected deductions from your account.

How to stop AEPS cash withdrawal?

Stopping AePS Cash Withdrawal is easy. It ensures the security of your bank account. If you want to stop AePS withdrawals, you need to contact your bank. You can do this by visiting your nearest bank branch. Or, you can call their customer service helpline. Once you get in touch with the bank, you can ask them to disable or suspend AePS cash withdrawals on your account.

They might ask you to provide some identification details for security purposes. We will stop AePS cash withdrawals from your account once we process your request. You must take this step if you suspect any unauthorized account access. Or, if you want to pause AePS transactions. By stopping AePS cash withdrawals, you can safeguard your finances. You can have peace of mind knowing that your account is secure.

What is AEPS cash withdrawal message?

The AePS (Aadhaar Enabled Payment System) Cash Withdrawal Message is a notification. You get it after a cash withdrawal using AePS. This message has key details about the transaction. It includes the amount withdrawn. It also has the date and time of the withdrawal, the location, and your remaining balance. It serves as a record of your transactions and helps you keep track of your finances. Also, the AePS Cash Withdrawal Message may include any charges or fees.

The withdrawal takes these fees from your account. You must review this message to ensure the transaction’s accuracy. You must also find any unauthorized activity on your account. The AePS Cash Withdrawal Message is vital. It provides transparency and accountability for your banking transactions on AePS.

Also Read – The Advanced Security Features of AePS Transactions