In India, sending money to friends and family has always been challenging thanks to money transfer apps. These apps let you move cash quickly and safely from your phone, without needing to visit a bank or stand in long queues. Whether you want to pay bills, split a restaurant bill, or send money across the country, a money transfer app makes it simple. All you need is an internet connection and a few taps on your smartphone. It’s a fast, secure, and convenient way to handle your finances and stay connected with loved ones.

Money Transfer App in India

Explore India’s top money transfer apps that make sending and receiving money simple and efficient. Whether you’re paying bills, recharging phones, or transferring funds, these apps offer a range of features to meet your needs. Here’s a look at the best money transfer apps available:

1. Google Pay

Google Pay, launched by Google in 2017, is a popular digital wallet and payment app in India. It allows users to make quick and easy payments directly from their smartphones using UPI (Unified Payments Interface). With millions of users across the country, Google Pay has become a trusted choice for seamless transactions. Whether you’re paying for groceries, splitting bills with friends, or recharging your phone, Google Pay offers a simple and secure way to handle your money. Here’s what makes Google Pay stand out:

Top Feature:

- Quick UPI payments and transfers.

- Integration with Google services for added convenience.

- Option to pay bills and recharge phones.

- Ability to send money to anyone using their phone number.

- Secure transactions with Google’s protection.

Play Store Ratings: 4.3

2. PhonePe

PhonePe, introduced in 2015, is a widely used payment app in India. It makes sending and receiving money a breeze with UPI (Unified Payments Interface). With millions of users, PhonePe offers a simple way to pay for things, split bills, and recharge your phone. It’s known for its ease of use and fast transactions. Here’s why PhonePe is a popular choice:

Top Feature:

- Quick UPI payments and transfers.

- Easy bill payments like electricity, water, and gas.

- Mobile recharges and DTH payments.

- Send money to friends or family using their phone number.

- Secure transactions with robust protection.

Play Store Ratings: 4.4

3. Paytm

Paytm, launched in 2014, is one of India’s most popular apps for handling money. It’s like a digital wallet that makes paying for things and sending money super easy. With millions of users, Paytm helps with everything from recharging your phone to paying bills and shopping online. It’s known for its wide range of services and special offers. Whether you need to pay your electricity bill, buy groceries, or book a movie ticket, Paytm makes it simple and quick. Here’s why Paytm is a top choice:

Top Feature:

- Handles money transfers, bill payments, and shopping all in one app.

- Uses Paytm Wallet for easy and quick transactions.

- Recharge phones and pay utility bills effortlessly.

- Get discounts and offers through Paytm’s partner network.

- Enjoy fast and secure transactions.

Play Store Ratings: 4.2

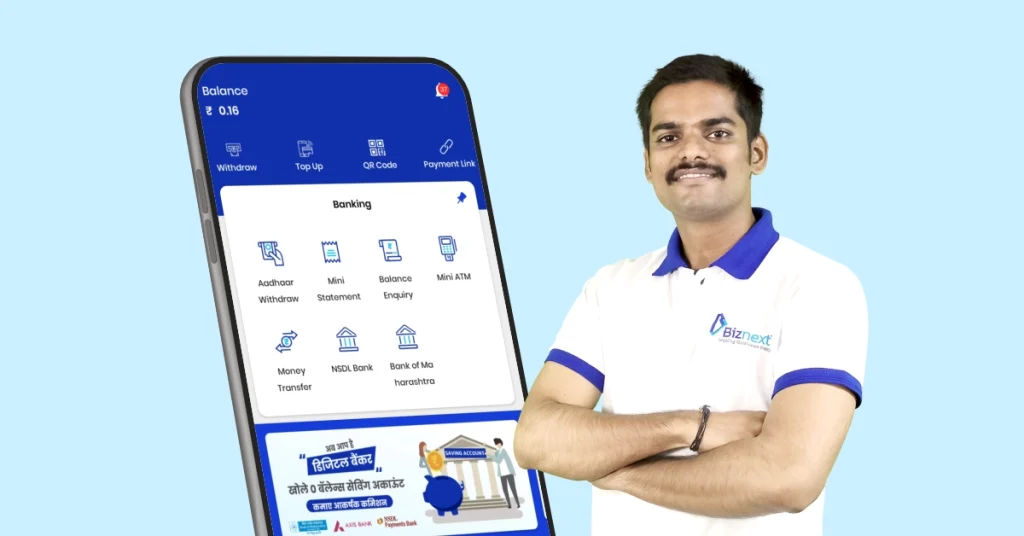

4. Biznext

Biznext launched 14 years ago, is the best money transfer app for Money transfer. It’s user-friendly and available in over 20 languages, making it accessible to a wide range of users. Biznext offers various incentive programs, adding extra value to every transaction. Plus, you earn a commission after each money transfer, making it a great choice for both personal use and earning potential. Whether you need to pay bills, recharge your phone, or book bus tickets, Biznext has you covered. Here’s why Biznext stands out:

Top Feature:

- User-friendly and available in over 20 languages.

- Offers various incentive programs for users.

- Earn commission on every money transfer.

- Simple and fast bill payments and phone recharges.

- Along with money transfer, this app has AEPS, BBPS, Account opening, ticket booking +25, and other services

Play Store Ratings: 4.5

5. BHIM UPI

BHIM UPI, launched by the National Payments Corporation of India (NPCI), is a top choice for easy and secure money transfers. Designed to simplify payments, this app allows you to transfer money quickly using UPI (Unified Payments Interface). It’s user-friendly, supports multiple languages, and is perfect for everyday transactions like paying bills or recharging phones. With BHIM UPI, you can enjoy a seamless payment experience and keep track of your transactions effortlessly. Here’s why BHIM UPI is a great option:

Top Feature:

- Easy and secure UPI payments.

- User-friendly interface for simple transactions.

- Available in multiple languages for convenience.

- Quick and direct money transfers to anyone.

- Efficient bill payments and phone recharge.

Play Store Ratings: 4.0

6. Federal Bank Mobile Banking

Federal Bank Mobile Banking, launched over a decade ago, offers a straightforward and efficient way to manage your finances. With this app, you can easily transfer money, pay bills, and handle other banking needs right from your phone. It’s user-friendly and designed to make banking as simple as possible. Whether you need to check your balance, pay utility bills, or recharge your phone, Federal Bank Mobile Banking provides a secure and reliable platform for all your financial transactions. Here’s why Federal Bank Mobile Banking is a top choice:

Top Feature:

- Easy money transfers and bill payments.

- User-friendly design for quick navigation.

- Secure transactions with Federal Bank’s protection.

- Access to account information and transaction history.

- Mobile recharges and utility payments made simply.

Play Store Ratings: 4.0

7. HDFC Bank Mobile Banking

HDFC Bank Mobile Banking launched over a decade ago, provides a seamless way to manage your HDFC Bank accounts from your smartphone. It’s designed for convenience, allowing you to transfer money, pay bills, and handle various banking tasks with ease. The app is user-friendly and ensures secure transactions, making it a reliable choice for everyday banking needs. Whether you’re checking your balance, paying utility bills, or recharging your phone, HDFC Bank Mobile Banking makes it simple and efficient. Here’s why HDFC Bank Mobile Banking is a preferred option:

Top Feature:

- Manage accounts, transfer money, and pay bills easily.

- User-friendly interface with easy navigation.

- Secure transactions with HDFC’s encryption technology.

- Access to account details and transaction history.

- Mobile recharges and utility bill payments are made hassle-free.

Play Store Ratings: 4.2

Also read – AEPS Cash Withdrawal Limit

8. Axis Bank Mobile Banking

Axis Bank Mobile Banking launched over a decade ago, offers a convenient way to handle your banking needs directly from your phone. The app provides features for transferring money, paying bills, and managing your accounts with ease. It’s designed to be user-friendly and secure, ensuring that your financial transactions are both simple and safe. With Axis Bank Mobile Banking, you can easily check your balance, pay utility bills, and even recharge your phone. Here’s why Axis Bank Mobile Banking is a top choice:

Top Feature:

- Easy money transfers and bill payments.

- User-friendly design for quick access.

- Secure transactions with Axis Bank’s protection.

- View account details and transaction history.

- Simple mobile recharges and utility payments.

Play Store Ratings: 4.1

9. ICICI Bank Mobile Banking

ICICI Bank Mobile Banking, introduced several years ago, offers a seamless way to manage your ICICI Bank accounts right from your smartphone. The app is designed for ease of use, allowing you to transfer money, pay bills, and perform other banking activities quickly and securely. With ICICI Bank Mobile Banking, you can check your balance, pay utility bills, and recharge your phone with just a few taps. Here’s why ICICI Bank Mobile Banking stands out:

Top Feature:

- Quick and easy money transfers and bill payments.

- User-friendly interface with straightforward navigation.

- Secure transactions with ICICI’s advanced security measures.

- Access to account information and transaction history.

- Convenient mobile recharges and utility bill payments.

Play Store Ratings: 4.2

10. SBI YONO

SBI YONO (You Only Need One), launched by the State Bank of India, is a comprehensive mobile banking app that offers a wide range of financial services. This app allows you to manage your SBI accounts, transfer money, pay bills, and even shop online, all in one place. It’s designed to be user-friendly and secure, making your banking experience smooth and convenient. Whether you need to check your account balance, pay your utility bills, or recharge your phone, SBI YONO has you covered. Here’s why SBI YONO is a popular choice:

Top Feature:

- Comprehensive financial services including banking, shopping, and investments.

- Easy money transfers and bill payments.

- User-friendly interface with secure transactions.

- Access to account details, transaction history, and loan information.

- Mobile recharges and utility bill payments with ease.

Play Store Ratings: 4.1

11. Kotak 811

Kotak 811, launched by Kotak Mahindra Bank, is a revolutionary digital savings account that requires no minimum balance. The app provides a range of banking services, making it easy to manage your finances on the go. From transferring money to paying bills, Kotak 811 offers a user-friendly and secure experience. It also provides video-KYC for hassle-free account opening. Here’s why Kotak 811 is a great choice:

Top Feature:

- No minimum balance requirement for savings accounts.

- Quick and easy money transfers via UPI.

- User-friendly interface with video-KYC for instant account opening.

- Secure transactions with Kotak’s robust security measures.

- Convenient bill payments and mobile recharges.

Play Store Ratings: 4.4

12. PayZapp by HDFC Bank

PayZapp, by HDFC Bank, is a versatile payment app that allows you to pay bills, book flights, and transfer money quickly. It’s designed to offer a seamless payment experience with just one click. Whether you’re shopping online, booking movie tickets, or paying your electricity bill, PayZapp provides a secure and convenient way to handle your transactions. Here’s what makes PayZapp stand out:

Top Feature:

- One-click payments for a wide range of services.

- Integration with HDFC Bank accounts for easy access.

- Secure and fast transactions.

- Offers and discounts on shopping and travel bookings.

- Easy utility bill payments and mobile recharge.

Play Store Ratings: 4.0

13. Airtel Thanks

Airtel Thanks, launched by Airtel, is a multi-purpose app that combines banking, recharges, and bill payments with rewards and offers. It provides a simple and secure platform for transferring money, paying bills, and recharging your phone. Additionally, the app offers exclusive deals and cashback on transactions. Here’s why Airtel Thanks is a preferred choice:

Top Feature:

- Easy money transfers and bill payments.

- User-friendly interface with quick mobile recharges.

- Access to rewards, cashback, and exclusive offers.

- Secure transactions with Airtel’s protection.

- Integration with Airtel services for added convenience.

Play Store Ratings: 4.4

14. Freecharge

Freecharge, launched in 2010, is a digital wallet and payment app that allows you to transfer money, pay bills, and recharge your phone with ease. It’s known for its user-friendly interface and quick transactions. Freecharge also offers a variety of deals and cashback on payments, making it a popular choice for everyday financial needs. Here’s why Freecharge is a great option:

Top Feature:

- Quick money transfers and bill payments.

- User-friendly design with easy navigation.

- Offers and cashback on recharges and bill payments.

- Secure transactions with Freecharge’s protection.

- Integration with multiple services for added convenience.

Play Store Ratings: 4.2

15. Amazon Pay

Amazon Pay, launched by Amazon, is a digital wallet that allows you to make payments, transfer money, and manage your finances within the Amazon ecosystem. It’s designed to be seamless and secure, making your shopping and payment experience smoother. With Amazon Pay, you can also pay utility bills, recharge your phone, and enjoy cashback on transactions. Here’s what makes Amazon Pay a top choice:

Top Feature:

- Integrated with Amazon for seamless shopping and payments.

- Quick and secure money transfers.

- Easy bill payments and mobile recharges.

- Cashback and rewards on transactions.

- User-friendly interface with Amazon’s trusted protection.

Play Store Ratings: 4.2

Also Read: How to Choose the Right Money Transfer Business Franchise

16. JioMoney

JioMoney, launched by Reliance Jio, is a digital wallet that offers a range of services including money transfers, bill payments, and mobile recharges. It’s designed to be user-friendly and secure, making it easy to manage your finances on the go. With JioMoney, you can also enjoy exclusive offers and cashback on transactions. Here’s why JioMoney is a popular choice:

Top Feature:

- Easy money transfers and bill payments.

- User-friendly interface with quick mobile recharges.

- Secure transactions with Jio’s protection.

- Access to exclusive offers and cashback.

- Integration with Jio services for added convenience.

Play Store Ratings: 4.0

17. MobiKwik

MobiKwik, launched in 2009, is a digital wallet and payment app that allows you to transfer money, pay bills, and recharge your phone with ease. It’s known for its simple interface and quick transactions. MobiKwik also offers a range of deals and cashback on payments, making it a popular choice for managing everyday finances. Here’s why MobiKwik is a top option:

Top Feature:

- Fast and easy money transfers and bill payments.

- User-friendly design with smooth navigation.

- Cashback and offers on recharges and bill payments.

- Secure transactions with MobiKwik’s protection.

- Integration with multiple services for convenience.

Play Store Ratings: 4.2

18. BHIM SBI Pay

BHIM SBI Pay, launched by the State Bank of India, is a UPI-based payment app that offers a secure and easy way to transfer money, pay bills, and manage finances. It’s designed to be user-friendly and accessible, making it a reliable choice for everyday banking needs. With BHIM SBI Pay, you can enjoy quick and secure transactions along with a host of other features. Here’s why BHIM SBI Pay stands out:

Top Feature:

- Easy and secure UPI payments and transfers.

- User-friendly interface with quick navigation.

- Access to account details and transaction history.

- Fast bill payments and mobile recharges.

- Secure transactions with SBI’s protection.

Play Store Ratings: 4.1

19. IndusInd Bank Mobile Banking

IndusInd Bank Mobile Banking, launched by IndusInd Bank, offers a comprehensive range of banking services right at your fingertips. The app allows you to transfer money, pay bills, and manage your accounts with ease. It’s designed to be secure and user-friendly, making it an ideal choice for managing your finances on the go. Whether you’re checking your balance, paying utility bills, or recharging your phone, IndusInd Bank Mobile Banking provides a reliable platform. Here’s why IndusInd Bank Mobile Banking is a great option:

Top Feature:

- Easy money transfers and bill payments.

- User-friendly design with secure transactions.

- Access to account information and transaction history.

- Convenient mobile recharges and utility payments.

- Integration with multiple services for added convenience.

Play Store Ratings: 4.2

20. Yes Bank Mobile Banking

Yes Bank Mobile Banking, launched by Yes Bank, provides a seamless way to manage your finances. The app allows you to transfer money, pay bills, and access your account details with ease. It’s designed for convenience and security, making it a trusted platform for daily banking needs. Whether you’re paying utility bills, recharging your phone, or checking your account balance, Yes Bank Mobile Banking makes it simple and efficient. Here’s why Yes Bank Mobile Banking is a preferred choice:

Top Feature:

- Easy and secure money transfers and bill payments.

- User-friendly interface with quick navigation.

- Access to account details and transaction history.

- Fast mobile recharges and utility payments.

- Secure transactions with Yes Bank’s protection.

Play Store Ratings: 4.1

21. Union Bank of India UMobile

Union Bank of India UMobile is the official mobile banking app by Union Bank, providing a secure and user-friendly platform for managing your finances. Launched by the bank several years ago, this app allows users to conduct various banking operations like money transfers, bill payments, and checking account balances on the go. It offers an easy and secure way to manage your banking needs directly from your smartphone. Here’s why Union Bank of India UMobile is a great choice:

Top Feature:

- Secure money transfers and bill payments.

- User-friendly interface with easy navigation.

- Access to account details and transaction history.

- Convenient mobile recharges and utility payments.

- Reliable and secure transactions with Union Bank’s protection.

Play Store Ratings: 4.0

22. Bank of Baroda M-Connect Plus

Bank of Baroda M-Connect Plus is a mobile banking app designed to offer a seamless banking experience. With this app, you can transfer money, pay bills, and manage your accounts conveniently from your phone. The app is user-friendly and secure, making it a reliable option for your daily banking needs. Whether you’re checking your balance, paying utility bills, or recharging your phone, M-Connect Plus has you covered. Here’s why M-Connect Plus is a preferred option:

Top Feature:

- Secure and quick money transfers.

- User-friendly design for easy navigation.

- Fast bill payments and mobile recharge.

- Access to account details and transaction history.

- Secure transactions with Bank of Baroda’s protection.

Play Store Ratings: 4.1

23. PNB One

PNB One is a mobile banking app by Punjab National Bank that allows you to manage your finances efficiently. Launched by PNB, the app provides a range of features including money transfers, bill payments, and account management. It’s designed to be user-friendly and secure, making it a convenient option for everyday banking tasks. Whether you need to check your balance, pay utility bills, or recharge your phone, PNB One offers a simple and reliable solution. Here’s why PNB One is a great choice:

Top Feature:

- Secure and easy money transfers.

- User-friendly interface with easy navigation.

- Quick bill payments and mobile recharges.

- Access to account details and transaction history.

- Secure transactions with PNB’s protection.

Play Store Ratings: 4.0

24. UCO mBanking Plus

UCO mBanking Plus is the mobile banking app launched by UCO Bank, offering a range of banking services on your mobile device. The app allows you to manage your accounts, transfer money, and pay bills with ease. Designed to be user-friendly and secure, UCO mBanking Plus makes banking simple and accessible for everyone. Here’s why UCO mBanking Plus is a great choice:

Top Feature:

- Quick and secure money transfers and bill payments.

- User-friendly interface with easy navigation.

- Access to account details and transaction history.

- Convenient mobile recharges and utility payments.

- Secure transactions with UCO Bank’s protection.

Play Store Ratings: 4.1

25. Canara Bank Mobile Banking

Canara Bank Mobile Banking app provides a seamless and secure banking experience. Launched by Canara Bank, the app allows you to manage your accounts, transfer funds, and pay bills directly from your mobile phone. With a simple and user-friendly interface, this app is designed to cater to all your banking needs. Here’s why Canara Bank Mobile Banking stands out:

Top Feature:

- Easy and secure fund transfers via UPI.

- Convenient bill payments and mobile recharges.

- User-friendly design with quick access to banking services.

- Detailed account information and transaction history.

- Robust security for safe and secure transactions.

Play Store Ratings: 4.0

26. IDBI Bank GO Mobile+

IDBI Bank GO Mobile+ is the official mobile banking app by IDBI Bank, offering a wide range of services. The app allows you to transfer funds, pay bills, and manage your bank accounts on the go. It’s designed to be intuitive and secure, providing a reliable platform for your banking needs. Here’s why IDBI Bank GO Mobile+ is a preferred option:

Top Feature:

- Fast and secure money transfers and bill payments.

- User-friendly interface with easy access to banking features.

- Instant mobile recharges and utility payments.

- Detailed transaction history and account management.

- Secure banking with IDBI Bank’s protection.

Play Store Ratings: 4.1

27. Central Bank Mobile Banking

Central Bank Mobile Banking app offers a simple and secure way to manage your finances. Launched by the Central Bank of India, the app provides services like money transfers, bill payments, and account management. It’s designed to be user-friendly and reliable, making banking convenient from your mobile device. Here’s what makes Central Bank Mobile Banking a good choice:

Top Feature:

- Easy and quick money transfers and bill payments.

- User-friendly interface for seamless banking.

- Access to detailed account information and transaction history.

- Convenient mobile recharges and utility payments.

- Secure transactions with the Central Bank’s protection.

Play Store Ratings: 4.0

28. Indian Bank IndOASIS

Indian Bank IndOASIS is the mobile banking app launched by Indian Bank, offering a wide range of services at your fingertips. The app allows you to transfer money, pay bills, and manage your accounts efficiently. With a user-friendly design and secure platform, Indian Bank IndOASIS makes banking simple and convenient. Here’s why Indian Bank IndOASIS is a great option:

Top Feature:

- Secure and fast UPI payments and money transfers.

- Easy bill payments and mobile recharges.

- Detailed account information and transaction history.

- User-friendly design with smooth navigation.

- Secure transactions with Indian Bank’s protection.

Play Store Ratings: 4.2

29. Saraswat Bank Mobile Banking

Saraswat Bank Mobile Banking app provides a comprehensive banking experience, offering services like money transfers, bill payments, and account management. Launched by Saraswat Bank, the app is designed to be user-friendly and secure, making it easy to handle all your banking needs from your smartphone. Here’s why Saraswat Bank Mobile Banking is a preferred choice:

Top Feature:

- Quick and secure money transfers and bill payments.

- User-friendly interface with easy navigation.

- Access to account details and transaction history.

- Convenient mobile recharges and utility payments.

- Secure transactions with Saraswat Bank’s protection.

Play Store Ratings: 4.0

Also read – Women Entrepreneurs in India

Thank you for this helpful post on top money transfer apps in India!