What is AEPS?

AePS is short for Aadhaar Enabled Payment System. It is a groundbreaking digital payment platform in India. It’s designed to make banking easier and more convenient for everyone. This is for those in remote areas. They might not have easy access to traditional banking. AePS uses the Aadhaar card. It is a unique ID number issued by the Indian government to residents. The card enables secure and efficient transactions.

What are the Benefits of Aadhaar Enabled Payment System (AePS)

The Aadhaar Enabled Payment System offers many benefits to individuals and businesses alike. It promotes financial inclusion by providing banking services to underserved populations. AePS allows rural people to access banks through local businesses. These businesses act as banking correspondents.

Also, AePS removes the need for bank cards. It makes transactions simpler and more secure. This is especially helpful. It’s for people who lack access to traditional banks. It can also help those who are unfamiliar with traditional banking. Moreover, AePS reduces the risk of fraud and theft associated with carrying cash.

Furthermore, AePS transactions are efficient, enabling real-time payments and withdrawals. This efficiency saves time. It also lowers transaction costs for customers and banks.

What are the Features of the Aadhaar Enabled Payment System (AePS)?

The Aadhaar Enabled Payment System has several key features. They make it a preferred choice for many people and businesses. These features include:

- AePS uses biometric data like fingerprints or iris scans. It uses them for user authentication, to ensure secure transactions.

- AePS transactions can cross different banks and financial institutions. They promote smooth integration and access.

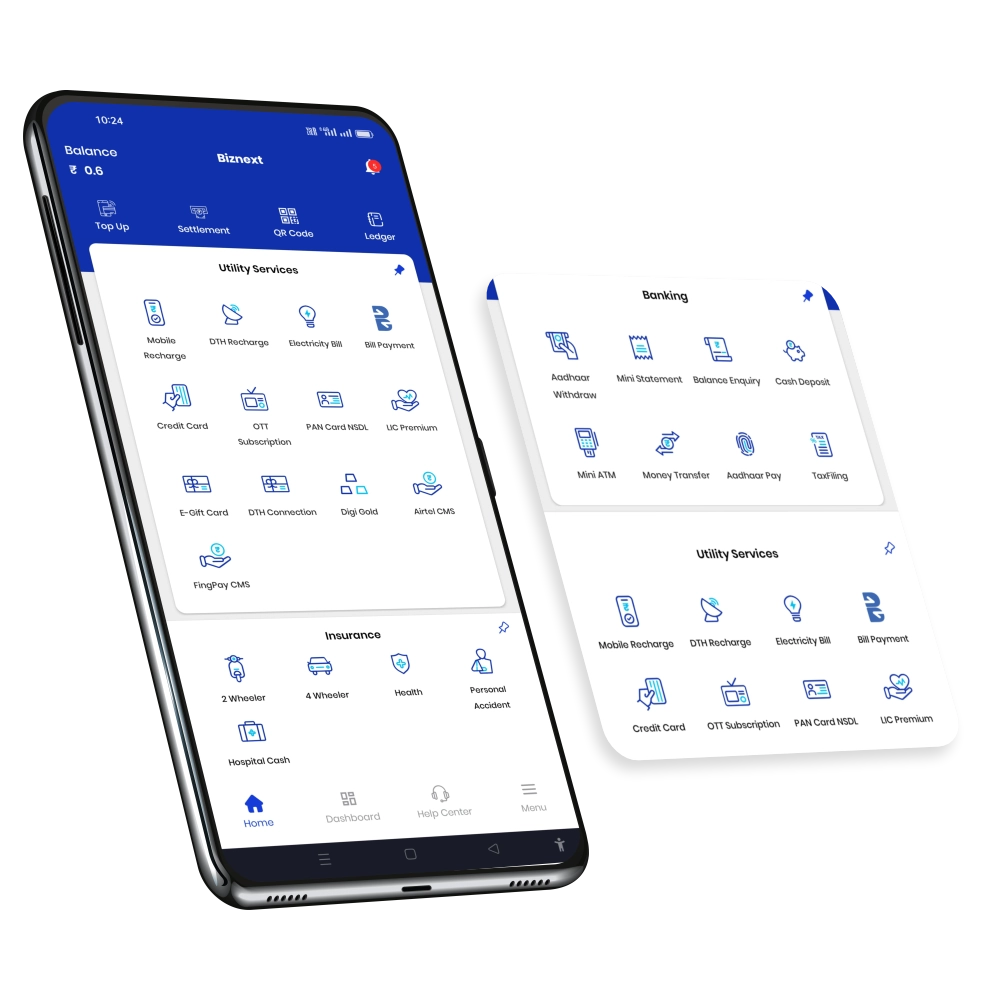

- Local businesses can serve as Micro ATMs. They allow users to bank in their neighborhoods.

- Users can check their account balance and withdraw cash using AePS. This eliminates the need for physical bank branches.

- AePS encrypts and secures transactions, protecting users’ financial information and privacy.

How Does AePS Work?

AePS operates on a simple yet effective mechanism. When a user starts a transaction, they provide their Aadhaar number and biometric data for authentication. This information is verified against the Aadhaar database to ensure the user’s identity.

Once the user’s identity is confirmed, they can perform various banking transactions such as cash withdrawals, balance inquiries, and fund transfers. These transactions are processed in real time, providing instant access to funds.

How to Use the AePs Facility?

Using the AePS facility is easy and convenient. To start, you will require your Aadhaar number and biometric information registered with your bank. Once this is done, you can use AePS services at any Micro ATM or business correspondent location.

What Is Required to Use the AePs Facility?

To use the AePS facility, you need the following:

- Aadhaar Number: You must have an Aadhaar number issued by the government of India.

- Biometric Information: Your biometric data, such as fingerprints or iris scans, must be linked to your Aadhaar number and registered with your bank.

How do I withdraw money from AePS?

To withdraw money from AePS, follow these simple steps:

- Visit a Micro ATM or business correspondent location.

- Provide your Aadhaar number and biometric data for authentication.

- Specify the amount you wish to withdraw.

- Complete the transaction, and the requested amount will be given to you in cash.

Objectives of AePS Service

The primary objectives of the Aadhaar Enabled Payment System are:

- Financial Inclusion: To provide banking services to underserved populations, particularly those in rural areas.

- Convenience: To make banking transactions more accessible and convenient for everyone, regardless of location or banking experience.

- Security: To ensure secure and reliable transactions through biometric authentication and encryption technologies.

- Cost-effectiveness: To reduce the cost of transactions for both customers and banks by leveraging digital payment infrastructure.

Who Developed the Aadhaar-Enabled Payment System?

The Aadhaar-Enabled Payment System was developed by the National Payments Corporation of India (NPCI) in collaboration with the Unique Identification Authority of India (UIDAI). NPCI is an umbrella organization for all retail payment systems in India, while UIDAI is responsible for issuing Aadhaar numbers and managing the Aadhaar database.

In conclusion, the Aadhaar Enabled Payment System (AePS) is a revolutionary payment platform that has transformed banking in India. With its numerous benefits, user-friendly features, and efficient operation, AePS is driving financial inclusion and empowerment across the country. Developed by the National Payments Corporation of India (NPCI) in collaboration with the Unique Identification Authority of India (UIDAI), AePS is poised to continue its growth trajectory, bringing the benefits of digital banking to millions of people in India.

Also read – The Future of AePS in India’s Digital Economy

Thanks you so much for this informative blog post. This blog post clear all the concept of Aadhar enabled payment system and this understand the depth knowledge of AEPS. Thankyou for this informative guide.

Thanks you so much this information. This blog clear all the concept of Aadhaar Enabled Payment System (AePS).