In today’s digital banking world, many customers see a message like “AEPS debit facility disabled” and become confused. What does it mean? Is your money blocked? Can you withdraw cash?

If you are searching for:

- What is AEPS debit facility

- AEPS debit facility meaning

- AEPS debit means

- AEPS debit transaction disabled means

- AEPS debit facility disabled Indian Bank

- NPCI guidelines AEPS debit facility

Then this complete guide will clear all your doubts in simple language.

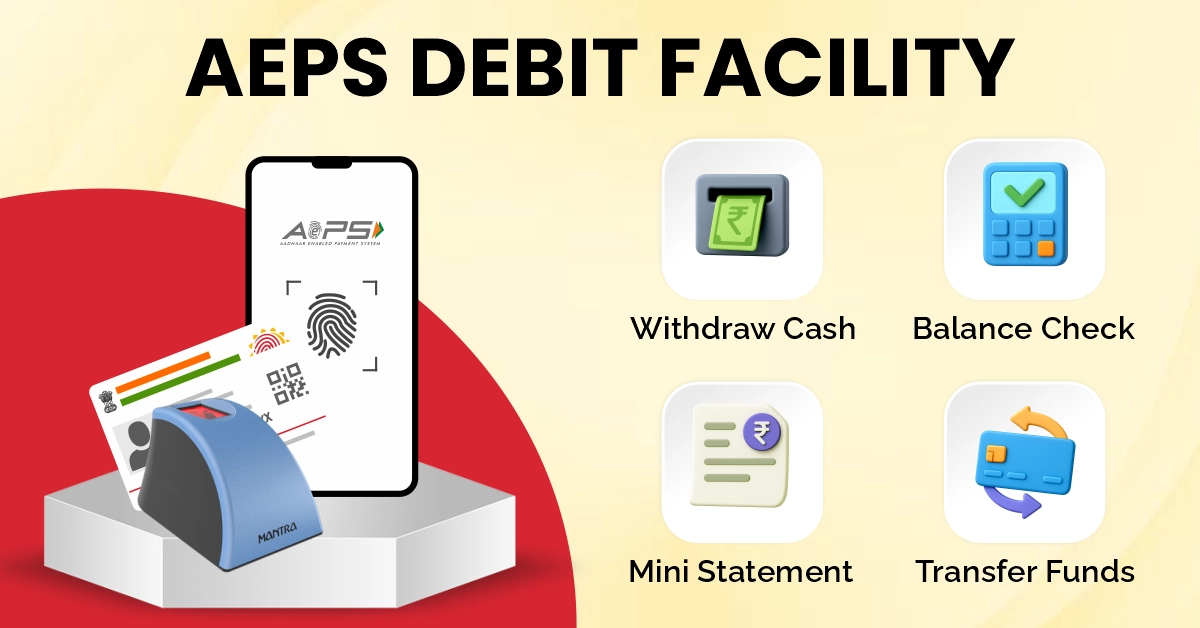

What is AEPS Facility?

AEPS stands for Aadhaar Enabled Payment System. It is a banking service that allows customers to perform basic banking transactions using their Aadhaar number and biometric authentication (fingerprint or iris scan).

It is developed and managed by the National Payments Corporation of India (NPCI).

AEPS Facility Means

AEPS facility means a service that allows you to:

- Withdraw cash

- Check bank balance

- Deposit money (in some cases)

- Transfer funds

- Get mini statement

All this can be done without an ATM card or a cheque book. You only need:

- Aadhaar number

- Bank account linked with Aadhaar

- Biometric verification

AEPS Facility in Bank

Almost all major banks in India provide AEPS facility, including:

- State Bank of India

- Axis Bank

- Yes Bank

- Bank of Baroda

- Union Bank

- Small Finance Bank

- Punjab National Bank

- Indusind Bank

- Indian Bank

- All other Banks, Small Finance Banks and Payment Banks

AEPS is mostly used in rural and semi-urban areas through Business Correspondents (BC) or micro-ATM operators.

What is AEPS Debit Facility?

AEPS Debit Facility Meaning

AEPS debit facility means the permission given by your bank to allow money deduction (debit) from your bank account through AEPS using Aadhaar authentication.

In simple words: When money is deducted from your account using Aadhaar + fingerprint, it is called an AEPS debit transaction.

If this service is active, you can withdraw money through AEPS. If it is disabled, the transaction will fail.

AEPS Debit Means

AEPS debit means:

- Money is deducted from your bank account

- Transaction done using Aadhaar number

- Biometric authentication required

- No ATM card needed

This is different from UPI or ATM withdrawal because here Aadhaar is used instead of card or mobile app.

What is AEPS Debit Transaction?

An AEPS debit transaction means money is deducted from your bank account using Aadhaar authentication instead of an ATM card or UPI.

It works in the following steps:

- Aadhaar Number Provided – The customer shares their 12-digit Aadhaar number with the Business Correspondent (BC) or at a micro-ATM.

- Bank Selection – The correct bank linked with Aadhaar is selected in the system.

- Biometric Verification – The customer scans their fingerprint for identity verification.

- Transaction Type Chosen – Cash withdrawal or debit option is selected.

- Amount Entered – The withdrawal amount is entered in the device.

- Money Debited – After successful authentication, the amount is deducted from the bank account instantly.

- Receipt Generated – A confirmation slip is provided for record.

This process is secure, quick, and usually completed within a few seconds.

What is AEPS Cash Withdrawal?

AEPS Cash Withdrawal Meaning

AEPS cash withdrawal means withdrawing money from your bank account using Aadhaar authentication at a micro-ATM or BC point.

You do not need:

- ATM card

- PIN

- Internet

Only an Aadhaar-linked account and a fingerprint are required.

What is AEPS Cash Withdrawal?

It is mostly used in villages where ATM machines are not easily available. Business Correspondents help customers withdraw money from their bank accounts using AEPS.

AEPS Debit Facility Disabled – What Does It Mean?

This is one of the most searched queries on the internet or Google by the bank’s customers.

AEPS Debit Facility Disabled Meaning

If you see “AEPS debit facility disabled”, it means: Your bank has blocked Aadhaar-based debit transactions from your account. You cannot withdraw money through AEPS until it is enabled again.

AEPS Debit Transaction Disabled Means

It means the system is not allowing money deduction using Aadhaar authentication. Your money is safe. It is not frozen. Only the AEPS service is blocked.

Why is the AEPS Debit Facility Disabled in Your Account?

AEPS debit facility may be disabled due to the following reasons:

- Aadhaar Not Properly Linked: If your Aadhaar number is not correctly linked (seeded) with your bank account, AEPS transactions will not work. Banks require proper Aadhaar seeding for debit permission.

- NPCI Mapper Issue: If your Aadhaar mapping is not updated in the NPCI database, the system cannot identify your bank account, and the AEPS debit facility may fail.

- Bank Security Restrictions: Banks may temporarily disable the AEPS debit facility to prevent fraud or suspicious activity.

- Customer Request: If you previously requested the bank to block Aadhaar-based withdrawals, the facility will remain disabled.

- Biometric Authentication Failure: Multiple fingerprint mismatches can trigger automatic blocking for security reasons.

Contact your bank branch to verify and reactivate the service.

AEPS Debit Facility Disabled Indian Bank – What It Means?

Many customers search:

- AEPS debit facility disabled Indian Bank

- AEPS debit facility disabled Indian Bank means

- What is AEPS debit facility in Indian Bank

What is AEPS Debit Facility in Indian Bank?

In Indian Bank, AEPS debit facility allows customers to:

- Withdraw cash

- Check balance

- Use Aadhaar-based transactions

If it is disabled, Aadhaar withdrawal will not work.

Also Read: AEPS debit facility in Indian banks

How to Enable AEPS Debit Facility in Indian Bank?

Follow these steps:

- Visit nearest branch of the Indian Bank

- Check Aadhaar linking status

- Submit a request for AEPS activation

- Verify biometric details

- Wait for confirmation (1–3 working days)

AEPS Facility in PNB (Punjab National Bank)

Punjab National Bank also provides AEPS services.

Customers can:

- Withdraw money using Aadhaar

- Check balance

- Access basic banking via BC

If AEPS debit facility is disabled in PNB:

- Visit branch

- Update Aadhaar seeding

- Submit activation request

NPCI Guidelines on AEPS Debit Facility

AEPS system is regulated by the National Payments Corporation of India (NPCI).

NPCI Guidelines AEPS Debit Facility

According to NPCI:

- Aadhaar must be seeded with a bank account

- Customer consent required

- Biometric authentication mandatory

- Transaction limit applicable

- Fraud monitoring system is active

NPCI Guidelines AEPS Debit Facility is Disabled – Meaning

If your AEPS debit facility is disabled as per NPCI guidelines, it may be due to:

- Suspicious transactions

- Security alerts

- Aadhaar mapping errors

- Bank compliance requirements

In such cases, contact your bank branch.

AEPS Payment Means – Debit vs Credit

Many people confuse AEPS payment with debit.

AEPS Payment Means

AEPS payment means any transaction done through Aadhaar authentication.

It includes:

- Debit (withdrawal)

- Credit (government subsidy)

- Balance enquiry

Difference Between AEPS Debit & Credit

| Type | Meaning |

|---|---|

| AEPS Debit | Money deducted from the account |

| AEPS Credit | Money received in the account |

| Balance Enquiry | Checking account balance |

AEPS Debit Facility Meaning in Hindi

AEPS Debit Facility Meaning in Hindi

AEPS Debit Facility का मतलब है: आधार नंबर और फिंगरप्रिंट की मदद से आपके बैंक खाते से पैसे निकालने की सुविधा। अगर यह सुविधा चालू है तो आप आधार से पैसा निकाल सकते हैं।

AEPS Debit Facility Disabled Meaning in Hindi

AEPS Debit Facility Disabled का मतलब है: आपके बैंक ने आधार से पैसे निकालने की सुविधा बंद कर दी है। इसे चालू करने के लिए बैंक शाखा से संपर्क करें।

AEPS Debit Facility Meaning in Tamil

AEPS Debit Facility Meaning in Tamil: ஆதார் எண்ணை பயன்படுத்தி உங்கள் வங்கி கணக்கில் இருந்து பணம் கழிக்கப்படும் வசதியே AEPS Debit Facility ஆகும்.

How to Enable AEPS Debit Facility in Bank Account?

If your AEPS debit facility is disabled, follow these simple steps:

- Check Aadhaar Linking Status: Visit your bank branch or use net banking/mobile banking to confirm that your Aadhaar number is properly linked (seeded) with your account. AEPS works only with Aadhaar-linked accounts.

- Verify NPCI Mapper Status: Ask the bank official to check whether your Aadhaar is correctly mapped in the NPCI database. Incorrect mapping can block AEPS debit transactions.

- Submit a Written Activation Request: Provide a simple written application requesting to enable the AEPS debit facility in your account. Carry an Aadhaar card and bank passbook for verification.

- Update Biometric Details (If Required): If a fingerprint mismatch occurs, update your biometric data at an Aadhaar enrollment/update centre.

- Wait for Confirmation: Activation is usually completed within 24–72 working hours after successful verification.

Also Read: How to Activate (Enable) AEPS Service

Important Safety Tips for AEPS Users

To use AEPS safely and avoid fraud, follow these important precautions:

- Never Share Your Aadhaar Number Publicly: Do not post or share your Aadhaar number on social media or with unknown persons. Share it only with authorised banking agents when required for transactions.

- Avoid Giving Fingerprint to Unknown Agents: Biometric authentication is sensitive. Always verify the identity of the Business Correspondent (BC) before giving your fingerprint.

- Always Collect Printed Receipt: After every AEPS transaction, take a printed receipt as proof. It helps in case of disputes or failed transactions.

- Check SMS Alerts Immediately: Ensure your mobile number is linked to your bank account. Always check SMS confirmation after debit transactions.

- Report Suspicious Activity Immediately: If you notice any unauthorised AEPS debit, contact your bank branch or customer care immediately to block further transactions.

Frequently Asked Questions (FAQ) – AEPS Debit Facility

1. What is AEPS debit facility?

AEPS debit facility allows money to be deducted from your bank account using your Aadhaar number and biometric authentication without using an ATM card or PIN.

2. AEPS debit facility disabled means what?

It means your bank has blocked Aadhaar-based debit transactions. You cannot withdraw money through AEPS until it is reactivated.

3. Why is AEPS debit transaction disabled?

It may be due to Aadhaar not linked, NPCI mapping issue, biometric mismatch, security reasons, or bank restrictions.

4. What is AEPS debit facility in Indian Bank?

It is a service that allows Indian Bank customers to withdraw cash using Aadhaar authentication at BC points or micro-ATMs.

5. What are NPCI guidelines for AEPS debit facility?

NPCI requires Aadhaar seeding, biometric verification, customer consent, and fraud monitoring before allowing AEPS debit transactions.

6. What is AEPS cash withdrawal?

It is withdrawing money from your bank account using Aadhaar number and fingerprint instead of an ATM card.

7. How long does it take to activate AEPS debit facility?

Usually, 24–72 working hours after bank verification.

8. Is AEPS debit facility safe?

Yes, it is secure because it uses biometric authentication and bank-level encryption systems.

Conclusion

AEPS debit facility is an important part of India’s digital banking system. It allows customers to withdraw money using Aadhaar authentication without an ATM card.

If your AEPS debit facility is disabled, do not panic. Your money is safe. It only means Aadhaar-based debit is temporarily blocked. Visit your bank branch, verify Aadhaar linking, and request activation.

Understanding AEPS properly helps you avoid confusion, fraud, and unnecessary tension. Always keep your Aadhaar linked and updated for smooth transactions.

Also Read: What is AEPS Offus?