What is AEPS?

The National Payments Corporation of India (NPCI) introduced AEPS. It is an innovative payment mechanism. It stands for the Aadhaar Enabled Payment System. This system uses the Aadhaar card. The Indian government issues this unique identification number. It facilitates various banking transactions and The primary goal of AEPS is to provide a convenient and inclusive banking experience. It focuses on individuals in remote or underserved areas. They may not have easy access to traditional banking services.

Here’s an expanded overview of the Aadhaar Enabled Payment System (AEPS):

- Aadhaar Integration: AEPS relies on the integration of the Aadhaar card. It’s a 12-digit unique ID assigned to each Indian resident. This integration allows individuals to link their Aadhaar numbers with their bank accounts. It creates a secure and standardized way to perform financial transactions.

- Banking Transactions: AEPS enables a range of banking transactions through Aadhaar-linked bank accounts. This includes cash withdrawals, balance inquiries, and checking mini statements. This flexibility empowers individuals to manage their finances. It reduces the need for physical visits to bank branches.

- Financial Inclusion: One of the key benefits of AEPS is its contribution to financial inclusion. Individuals in remote or rural areas access essential banking services by using AEPS. This allows economic participation and empowers them to join the formal financial system.

- NPCI Initiative: The National Payments Corporation of India (NPCI) spearheads the AEPS initiative. It is a pivotal organization in the country’s financial ecosystem. NPCI plays a crucial role in developing and managing retail payment systems. This includes the Unified Payments Interface (UPI) and AEPS. It enhances the efficiency and inclusivity of digital transactions.

- Seamless and Secure: AEPS transactions aim to provide both seamlessness and security. The system uses biometric authentication. It verifies the user’s identity using fingerprint or iris scans. This adds an extra layer of security to the transactions. This ensures the integrity of the financial transactions. It also protects users from unauthorized access.

In summary, AEPS represents a significant step towards making banking services more accessible, efficient, and secure for a broader segment of the population in India, aligning with the government’s vision of financial inclusion and a digital economy.

Why was AEPS service started?

The main purpose of starting AEPS service in India is to make basic banking facilities easily available in all the parts of the nation where banks and ATMs could not reach because of the high cost of operations and no returns due to the smaller and scattered population.

Apart from solving the problem of banking infrastructure, AEPS is also used by the government for financial inclusions i.e. to make government-allocated funds to reach the rightful citizen under various schemes or policies.

AePS Service Providing Companies In India

However, below is the list of the Industry’s best AEPS Services Portal Providers:

- Biznext (VK Venture)

- NSDL Payment Banks

- Fino Bank

- Spice Money

- PayNearBy

- Paytm AEPS

- RapiPay

- Bankit

- Ezulix

- Ezeepay

FinTech companies have started their own AEPS Service Portal:

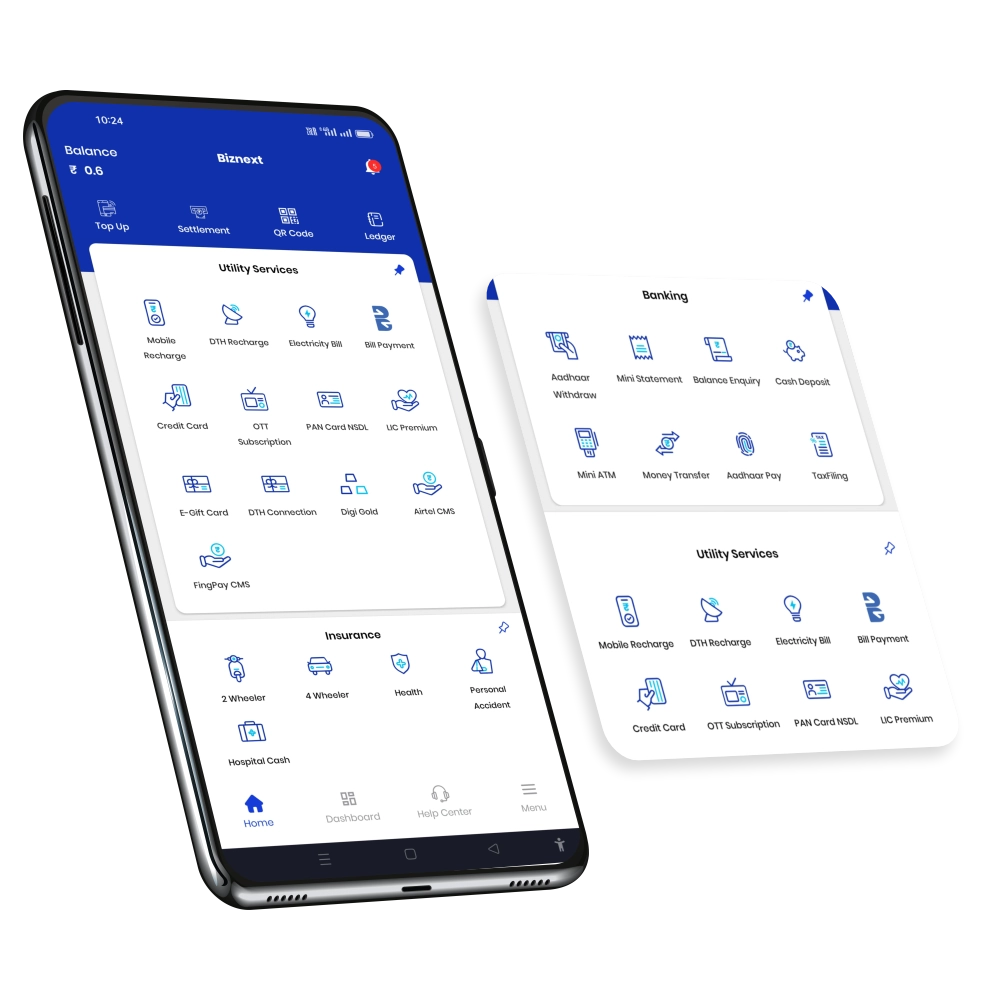

Biznext (VK Venture)

According to a study conducted, Biznext is the industry’s best Aadhar-enabled payment system app as it offers 13+2 rupees commission on every transaction of AEPS which is around 20% more than any other portal.

Apart from commission, Biznext offers a FREE Retailer ID and the most updated dashboard wherein you can check your income, and volume of transactions, get tips to earn more, and widgets that can help you win exciting gifts like a laptop, AC, TV, fridge, etc.

Also, this portal offers great marketing assistance to its associated distributors and white-label partners.

NSDL Payment Banks

NSDL Payment Bank is an Indian Non-Government company. This company is based out of Mumbai and has operations in the entire Nation. This company is known for its speedy AEPS transactions and low downtime

Fino Bank

Fino Bank is a popular FinTech company that is known for microfinance, MSMEs, credit, and banking facilities for the entrepreneurs of the country. This company has a great distributor portal for AEPS with a strong support and technical team.

Spice Money

Spicemoney is a leading rural fintech company that empowers merchants and nanopreneurs to build a successful cash withdrawal business by offering them AEPS portal access at a cost and offering a good market commission

PayNearBy

Paynearby is the biggest in this segment that works on building a strong network of AEPS. This company offers 25+ other services with AEPS and has a fee to begin with.

Paytm AEPS

Paytm a well-known FinTech company has started its new venture in the AEPS industry. Even though it is relatively new, it has gained popularity because of its user-friendly portal.

RapiPay

Rapipay has made a good market position in the FinTech industry because of its strong marketing and industry understanding skills. This company has always been in the news for their work and has provided AEPS service to its patrons.

Bankit

Bankit as the name suggests is a mobile banking application that offers multiple services at an easy click to its users. They offer a user-friendly AEPS portal.

Ezulix

Ezulix is a new name in the industry and are slowly building AEPS users with their aggressive marketing and network building.

Ezeepay

Ezeepay is an emerging AEPS portal that has managed to deliver value and has met all the requirements of its associated partners.

AePS Service Provider Banks or Companies In India

National Payments Corporation of India (NPCI) – Operates & Regulate the Aadhaar Enabled Payment System (AEPS) in India

- Yes Bank

- Axis Bank

- Fino Payments Bank

- Atom Technologies

- Eko India Financial Services

- Oxigen Services (India) Pvt. Ltd.

- RBL Bank

- Maharashtra Gramin Bank

- ICICI Bank

Also Read – AEPS vs Other Payment Methods: Which One is Better?

While choosing from the above, we would recommend going with Biznext as it gives Aeps agent registration free of cost and has the most advanced portal in today’s time. They give world-class service and the Aadhaar-enabled payment system app is frequently updated with new features.