In today’s world, paying bills and topping up accounts online is super handy. You don’t have to wait in lines or fill out forms anymore. With a few clicks on your phone or computer, you can do it all from home or wherever you are. It’s like having a helper who takes care of your money stuff for you!

But there’s more to it than convenience. Online payments are easy to get to – as long as you have internet, you’re good to go, no matter where you are. And they’re super flexible too. Need to pay a bill late at night or top up your phone on a holiday? No problem! Online services work around the clock, so you can do it whenever it suits you best.

And guess what? It’s also safe. They use special tech to keep your info safe, so you don’t have to worry about someone stealing your money. Plus, you can also check your payment history and get alerts. That way, you know what’s happening with your money all the time. Paying bills and recharging online is easy. It’s also safe and keeps you in the loop about your finances.

What are the benefits of using digital bill payments and online recharge

- Convenience: Say goodbye to long queues and waiting times. You can handle your transactions from home or on the go with online payments and recharge. They save you time and hassle.

- Accessibility: No matter where you are, as long as you have an internet connection, you can pay your bills or top up your accounts. It’s as simple as logging into your account from your phone or computer.

- Flexibility: You can use online payment platforms 24/7. They let you make transactions at any time. You can manage your finances on your schedule. It’s early morning or late at night.

- Security: Online payment systems use advanced encryption technology to protect your sensitive information. Your financial data is kept safe from unauthorized access and fraud, giving you peace of mind while making transactions.

- Instant Transactions: No more waiting for checks to clear or payments to process. With online payments, transactions are processed instantly, ensuring that your bills are paid on time and your accounts are topped up without delay.

- Transaction history: Most online payment platforms provide detailed transaction history, allowing you to easily track your expenses. You can review past payments, monitor your spending habits, and plan your finances more effectively.

- Automatic Payments: Many online payment systems offer the option to set up automatic payments for recurring bills. Once you’ve set it up, your bills will be paid automatically each month, saving you the trouble of remembering due dates and avoiding late fees.

Embracing the benefits of online bill payments and recharges not only simplifies our daily financial tasks but also empowers us to take charge of our financial well-being. With convenience, accessibility, security, and flexibility at our fingertips, these digital solutions pave the way for a smoother, more streamlined approach to managing our finances.

Also Read: Highest Mobile Recharge Commission App

Why is the business of online bill payment successful in India?

The success of online bill payment services in India can be attributed to a combination of factors, each contributing to its widespread adoption and popularity. Firstly, India’s rapid digitization, spurred by the government’s push towards a digital economy and the widespread availability of affordable smartphones and internet connectivity, has made online transactions accessible to a large portion of the population.

Secondly, the convenience offered by online bill payment platforms has played a significant role in their success. With hectic lifestyles and busy schedules, consumers are increasingly looking for hassle-free ways to manage their finances. Online bill payment services provide a one-stop solution for settling utility bills, mobile recharges, insurance premiums, and more, saving users valuable time and effort.

Moreover, the security measures implemented by these platforms have instilled trust among consumers, addressing concerns regarding the safety of online transactions. Advanced encryption technologies and robust security protocols ensure that users’ financial information remains secure, fostering confidence in the reliability of online payment services.

Additionally, the competitive pricing and attractive cashback offers provided by online bill payment platforms have further incentivized their usage. With discounts and rewards available for various transactions, consumers are encouraged to opt for online payment methods over traditional offline alternatives.

Overall, the success of the online bill payment business in India can be attributed to its ability to offer convenience, accessibility, security, and cost-effectiveness, catering to the evolving needs and preferences of consumers in an increasingly digital landscape.

Also read – The future of mobile recharge business in India

How to start your own business of digital bill payments and online recharge?

Any person can start their own business of digital bill payments and online recharge by following the below-mentioned 3 points:

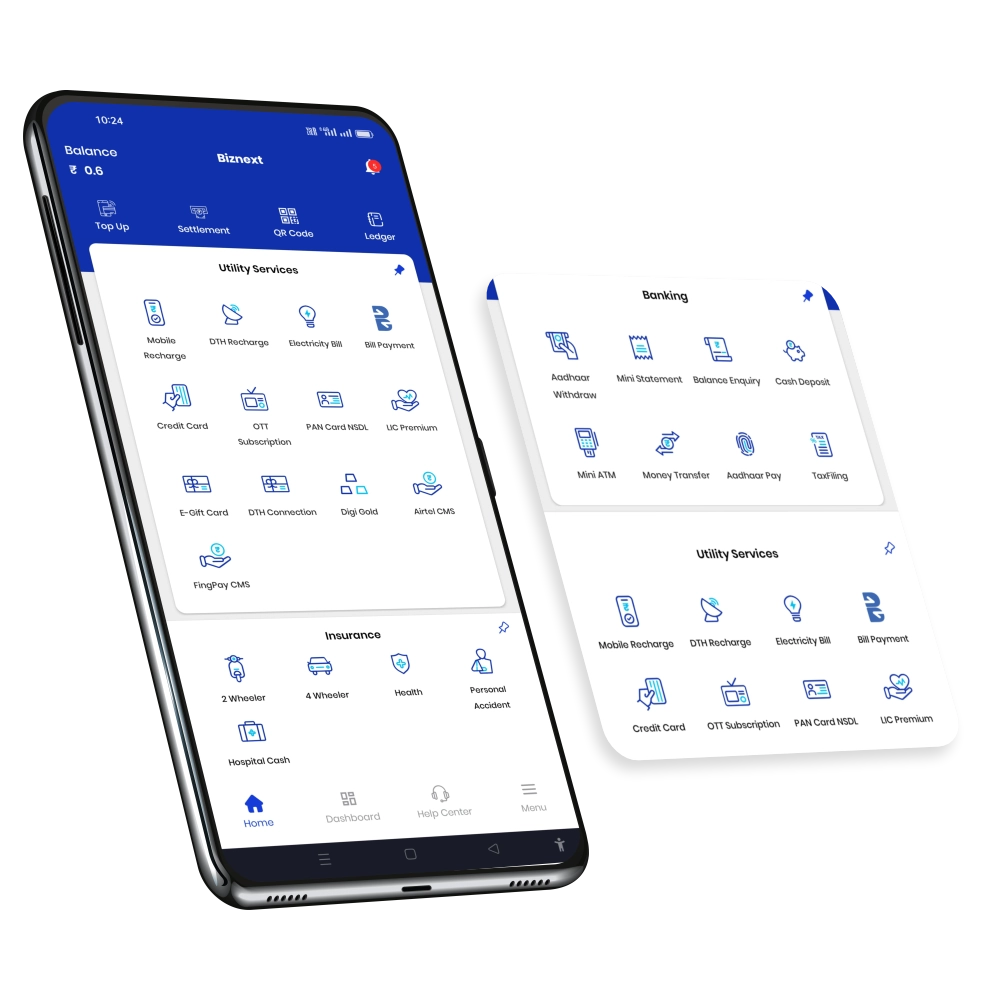

- Download the Biznext mobile application from your Play Store

- Complete the process of login and E-Kyc

- Activate your service of bill payments and online recharge from the left-hand side panel.

If you need any further guidance and training for starting your business, then you can contact them at – 022 42123123