Why Money Transfer Commission Apps Are a Profitable Business in India

In India, millions of people still depend on local shops for banking-related services like money transfer. Daily wage workers, small traders, migrant workers, and rural families regularly send money to their homes. This growing demand has created a strong earning opportunity for retailers through money transfer commission apps.

A money transfer commission app allows a shop owner, kirana store, or digital service provider to offer domestic money transfer (DMT) services and earn commission on every transaction. With minimal investment, no technical knowledge, and fast onboarding, this business has become one of the most reliable income sources for Indian retailers.

Today, platforms like Biznext, PayNearby, Spice Money, DigiPay, Fino, and others are helping lakhs of agents earn daily income through money transfer commissions. If you are looking to understand money transfer commission in India, how much agents earn, and which app gives the best commission, this guide will help you completely.

What Is a Money Transfer Commission App?

A money transfer commission app is a digital platform that allows authorised agents to transfer money from one bank account to another on behalf of customers. In return, the agent earns a commission for every successful transaction.

How It Works in Simple Words:

- A customer visits your shop to send money

- You enter the sender and receiver details in the app

- The money is transferred via IMPS/NEFT

- You earn commission instantly or within a short time

The customer pays a small service charge, and the company shares a part of this charge with the agent as commission.

These apps are especially useful in areas where:

- Banking branches are limited

- People are not comfortable with mobile apps

- Cash-to-bank transfer is still common

This is why online money transfer with commission has become a stable business model in India.

How Money Transfer Commission Works in India

Understanding the commission flow is very important before starting this business.

Step-by-Step Commission Flow:

- Customer requests a money transfer

- The agent performs the transaction using the app

- The company charges a small fee

- A percentage of this fee is given to the agent

Key Points:

- Commission depends on the transaction amount

- Higher volume means higher total earnings

- Commission is usually slab-based

- Some apps offer instant settlement

The money transfer commission structure varies from company to company, but the basic model remains the same.

Money Transfer Agent Commission: How Much Can You Earn?

One of the most common questions is: How much can I earn as a money transfer agent?

Average Commission Range:

- ₹5 to ₹25 per transaction (depending on amount)

- 20–50 transactions per day for active shops

Monthly Earning Potential:

- Small shop: ₹5,000 – ₹8,000

- Medium shop: ₹10,000 – ₹15,000

- Busy location: ₹20,000+

Agents who combine money transfer with AEPS, bill payment, and recharge earn even more.

This is why the money transfer business commission model is considered safe and scalable.

Also Read: Best AEPS commission

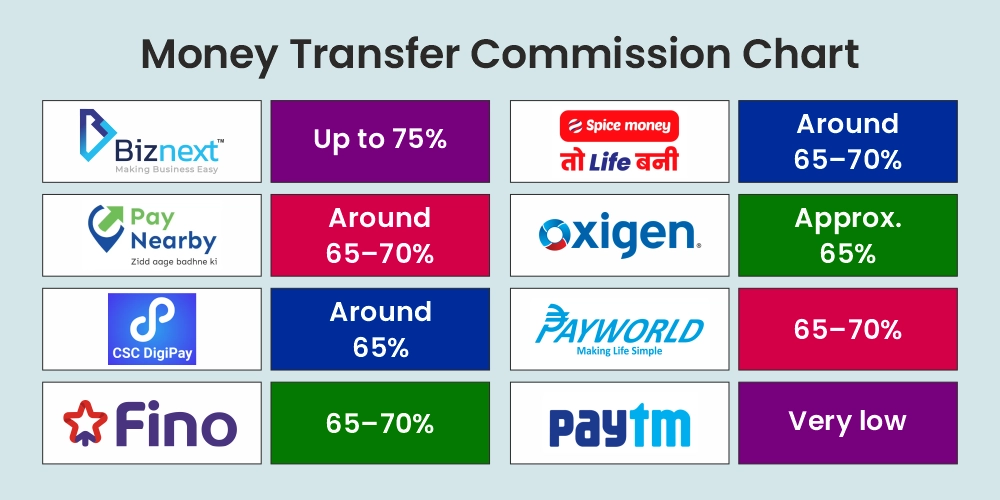

Money Transfer Commission Chart – Company Wise

Below is an indicative money transfer commission chart. Actual commission may vary based on slabs, volume, and location.

Biznext Money Transfer Commission

- Commission share: Up to 75%

- Fast settlement

- High agent margin

- Ideal for long-term earning

PayNearby Money Transfer Commission

- Commission share: Around 65–70%

- Good brand presence

- Slab-based payouts

DigiPay Money Transfer Commission

- Commission share: Around 65%

- PSU-backed ecosystem

- Moderate earnings

Fino Money Transfer Agent Commission

- Commission share: 65–70%

- Strong rural reach

- Bank-linked model

Spice Money Transfer Commission

- Commission share: Around 65–70%

- Popular in tier-2 & tier-3 cities

Oxigen Money Transfer Agent Commission

- Commission share: Approx. 65%

- Older platform

- Limited flexibility

Payworld Money Transfer Commission

- Commission share: 65–70%

- Multi-service platform

Paytm Money Transfer Commission

- Very low or indirect commission

- Mainly customer-focused, not agent-friendly

RIA Money Transfer Agent Commission

- Used mainly for international remittance

- Commission varies by corridor

Important Note: Platforms offering higher revenue share help agents earn more without increasing workload. This is where Biznext stands out with up to 75% commission, compared to others offering 65–70%.

Best Money Transfer Commission Apps in India (Comparison)

Choosing the right money transfer commission app is very important for agents and retailers. Many people only consider brand names, but smart agents compare commission percentages, settlement speeds, ease of use, and long-term earning potential before selecting a platform.

1. Biznext Money Transfer Commission App

Biznext is considered one of the most profitable options for money transfer agents. It offers commission sharing up to 75%, which is higher than most other platforms in India that usually provide 65–70%. Faster settlement, transparent commission tracking, and strong distributor support make Biznext an ideal choice for agents seeking to maximise their margin from the same number of transactions. In addition, Biznext provides multiple earning services like AEPS, bill payments, recharge, and more, helping agents increase their overall income.

2. Spice Money Transfer Commission App

Spice Money is popular in semi-urban and rural areas. It offers a stable but average commission structure, generally between 65–70%. The app has wide reach and good acceptance, but margins are slightly lower compared to high-commission platforms. It suits agents who want brand familiarity over higher earnings.

3. PayNearby Money Transfer Commission App

PayNearby is known for its strong technology and smooth user interface. The commission structure is moderate, and settlement is reliable. However, profit margins are not the highest. It works well for agents who prefer a tech-friendly app but are comfortable with standard commissions.

4. Fino Money Transfer Agent App

Fino operates with a bank-backed model, which brings trust and stability. However, commission payouts are controlled and slightly lower. It is ideal for agents who prioritise compliance and brand trust over higher margins.

5. DigiPay Money Transfer Commission App

DigiPay is a government-linked platform with stable services. While it is secure, it offers limited flexibility and lower earning potential compared to private platforms.

For agents focused on higher income and scalability, choosing a money transfer commission app with better revenue share, like Biznext, is more profitable in the long run than simply choosing a well-known brand.

Also Read: Best Mobile Recharge Commission App 2026

Money Transfer Commission Structure Explained

Types of Commission Structures:

1. Flat Commission

- Fixed commission per transaction

- Easy to understand

- Lower earning potential

2. Slab-Based Commission

- Higher transaction = higher commission

- Encourages volume

- Most commonly used

3. Volume Incentives

- Extra bonus on monthly targets

- Suitable for active agents

Understanding the money transfer commission structure helps agents plan better and increase income.

Money Transfer Distributor Commission vs Retailer Commission

In the money transfer business, income can be earned in two main ways – as a retailer or as a distributor. Both models are legal, profitable, and widely used in India, but they differ in responsibility, risk, and earning potential.

Money Transfer Retailer Commission Model

A retailer is the person who directly deals with customers. This is usually a kirana store owner, mobile shop, or CSC operator. The retailer uses a money transfer commission app to transfer money for customers and earns commission on every transaction.

Key Features of Retailer Model:

- Direct interaction with customers

- Earns commission per transaction

- Daily or instant income

- Low risk and easy to manage

- Ideal for small shop owners and beginners

Retailers do not need to manage other people. Their income depends mainly on daily customer footfall. For many shop owners, this model provides a stable side income with minimal effort.

Money Transfer Distributor Commission Model

A distributor works at a higher level. Instead of serving customers directly, a distributor manages multiple retailers under their network. Every transaction done by these retailers generates a small margin for the distributor.

Key Features of Distributor Model:

- Manages multiple retailers

- Earns commission from retailers’ transactions

- Higher monthly earning potential

- Requires training, support, and coordination

- Suitable for scaling the business

The money transfer distributor commission model is best for entrepreneurs who want to grow beyond a single shop. While it involves more responsibility, it also offers passive income, as earnings continue as long as retailers remain active.

Which Model Is Better?

- Retailer model is best for individuals starting small or running a local shop

- Distributor model is ideal for people who want to build a network and earn higher income

Many platforms, including Biznext, allow agents to start as retailers and later upgrade to distributors, making it easier to grow step by step.

In short, retailers earn from customers, while distributors earn from scale and volume.

How to Start a Money Transfer Business Using a Commission App

Starting this business is simple.

Eligibility:

- Indian citizen

- Small shop or customer base

- Smartphone

Documents Required:

- Aadhaar card

- PAN card

- Bank account

- Shop details

Steps:

- Choose a reliable money transfer commission app

- Complete KYC

- Get agent ID

- Start offering services

Most platforms allow agents to start within 24–48 hours.

Why Biznext Is a Strong Choice for Money Transfer Commission

Biznext has emerged as a strong platform for agents who want higher income and long-term stability.

Key Advantages:

- Up to 75% money transfer commission

- Better margin than competitors (65–70%)

- Fast settlement cycle

- Multiple services in one app

- Distributor and retailer earning model

- Strong support ecosystem

For agents serious about earnings, a higher commission directly means more profit from the same number of transactions.

Start Today, your Money transfer business.

Common Problems and Practical Solutions Faced by Money Transfer Agents

While the money transfer business is profitable, agents often face a few operational challenges. Understanding these problems in advance helps agents run the business smoothly and maintain customer trust.

1. Failed or Pending Transactions

One of the most common issues is transaction failure due to server downtime, incorrect details, or bank-side issues. This creates tension with customers, especially when money gets debited but not credited.

Solution: Agents should use a reliable money transfer commission app with a strong backend system and responsive customer support. Platforms with fast grievance handling and auto-refund systems reduce stress and improve customer confidence.

2. Settlement Delay

Some platforms delay commission settlement or wallet credit, which affects daily cash flow for small shop owners.

Solution: Always choose apps that offer faster settlement cycles, either instant or same-day credit. Faster settlement helps agents manage working capital and continue services without interruption.

3. Customer Trust Issues

Customers may doubt service charges or worry about fraud, especially first-time users.

Solution: Maintain full transparency. Clearly explain charges, provide receipts, and show transaction confirmation messages. Trust is the biggest asset for long-term earnings in the money transfer business.

4. Low Commission Earnings

Many agents struggle because of low commission margins despite good transaction volume.

Solution: Switch to platforms that offer better commission sharing. Even a small increase in commission percentage can significantly improve monthly income.

RBI Guidelines for Money Transfer Commission in India

Money transfer services operate under RBI-regulated frameworks, so compliance is mandatory.

Key RBI Rules Agents Must Follow:

- KYC of customers is compulsory

- Transaction limits are defined by the RBI

- Agents must follow AML and compliance norms

- Only authorised and compliant platforms should be used

Working with legitimate platforms protects agents from legal and financial risks.

Future of Money Transfer Commission Apps in India

Despite rapid UPI adoption, money transfer agents remain highly relevant. Many customers still prefer assisted banking, especially in rural and semi-urban areas. Cash-based transactions, migrant workers, and digitally less-aware users continue to depend on agents.

Agents who choose the right money transfer commission app today, with better margins and strong support, can build a stable and long-term income source for years to come.

Frequently Asked Questions (FAQs) on Money Transfer Commission App

1. What is a money transfer commission app?

A money transfer commission app is a digital platform that allows authorised agents or retailers to transfer money from one bank account to another for customers. For every successful transaction, the agent earns a commission. These apps are widely used by kirana stores, mobile shops, CSC centres, and small business owners across India.

2. How does money transfer commission work for agents?

When a customer transfers money, the platform charges a small service fee. A part of this fee is shared with the agent as commission. The commission amount depends on the transaction value, commission slab, and the platform’s revenue-sharing policy. Higher transaction volume usually means higher earnings.

3. How much commission do money transfer agents earn in India?

Earnings vary based on location, daily transactions, and commission structure. On average:

- Small agents earn ₹5,000–₹8,000 per month

- Medium agents earn ₹10,000–₹15,000 per month

- High-traffic shops can earn ₹20,000 or more

Choosing a platform with higher commission sharing significantly increases income.

4. Which money transfer commission app gives the highest commission?

Most platforms in India offer 65–70% commission sharing. Some platforms, like Biznext, offer commission up to 75%, which helps agents earn more from the same number of transactions. Higher commission directly improves monthly profit.

5. Is the money transfer business legal in India?

Yes, the money transfer business is completely legal when done through RBI-authorised and compliant platforms. Agents must follow KYC rules, transaction limits, and compliance guidelines issued by RBI and partner banks.

6. Can I start a money transfer business from a kirana or mobile shop?

Yes. In fact, kirana stores, mobile shops, and small retail outlets are the best locations for this business. Existing customer trust and daily footfall make it easier to generate regular transactions and steady commission income.

7. What documents are required to become a money transfer agent?

Basic documents are required, such as:

- Aadhaar card

- PAN card

- Bank account details

- Mobile number

- Shop details (if available)

Most platforms complete onboarding within 24–48 hours after KYC verification.

8. What is the difference between customer charges and agent commission?

Customer charges are the fees paid by the customer for transferring money. Agent commission is the share of this fee that the platform gives to the agent. Agents should clearly explain charges to customers to maintain transparency and trust.

9. Can I earn more by becoming a distributor instead of a retailer?

Yes. A money transfer distributor earns commission from multiple retailers under their network. This model offers higher earning potential but requires training, support, and management. Many agents start as retailers and later upgrade to the distributor level.

10. Is money transfer commission income safe for the long term?

Yes. Even with the growth of UPI, many people still depend on assisted money transfer services. Rural users, migrant workers, and cash-based customers ensure long-term demand. Choosing the right money transfer commission app makes this income source stable and sustainable.

Conclusion: Is a Money Transfer Commission App Worth It?

A money transfer commission app is one of the safest and most practical earning opportunities for Indian retailers. It requires low investment, offers daily income, and serves a real customer need.

However, success depends on choosing the right platform. A higher commission structure, faster settlement, and multi-service options can significantly increase earnings. Platforms offering up to 75% commission, compared to the usual 65–70%, give agents a clear financial advantage.

For anyone looking to build a reliable, long-term income, money transfer commission apps remain a smart choice in India.