डिजिटल ग्रामीण सेवा एक ऐसा डिजिटल प्लेटफ़ॉर्म है जो गाँव के लोगों तक बैंकिंग और सरकारी सेवाएँ पहुँचाने का काम करता है। इसका मकसद है ग्रामीण क्षेत्रों में रहने वाले लोगों को ऑनलाइन सेवाओं के ज़रिए आसानी से पैसा भेजने, लेने, बिल भरने, रिचार्ज करने और सरकारी योजनाओं का लाभ लेने की सुविधा देना। जहाँ बड़े शहरों में सब कुछ मोबाइल से हो जाता है, वहीं डिजिटल ग्रामीण सेवा गाँव के दुकानदारों को डिजिटल सुविधाएँ देने का एक मौक़ा देती है, जिससे वे अपना व्यवसाय भी बढ़ा सकें और गाँव के लोगों की मदद भी कर सकें।

Digital Gramin Seva Portal

Digital Gramin Seva Portals are changing the way rural and small-town India accesses digital and banking services. These platforms help local shopkeepers offer services like AEPS, money transfer, recharge, bill payments, and more making them mini digital service centers and boosting their income.

Some popular Digital Gramin Seva Portals that are empowering retailers across India

1. CSC Digital Seva

A government-backed initiative that offers a wide range of services like Aadhaar, PAN, insurance, banking, and other citizen services through Common Service Centres.

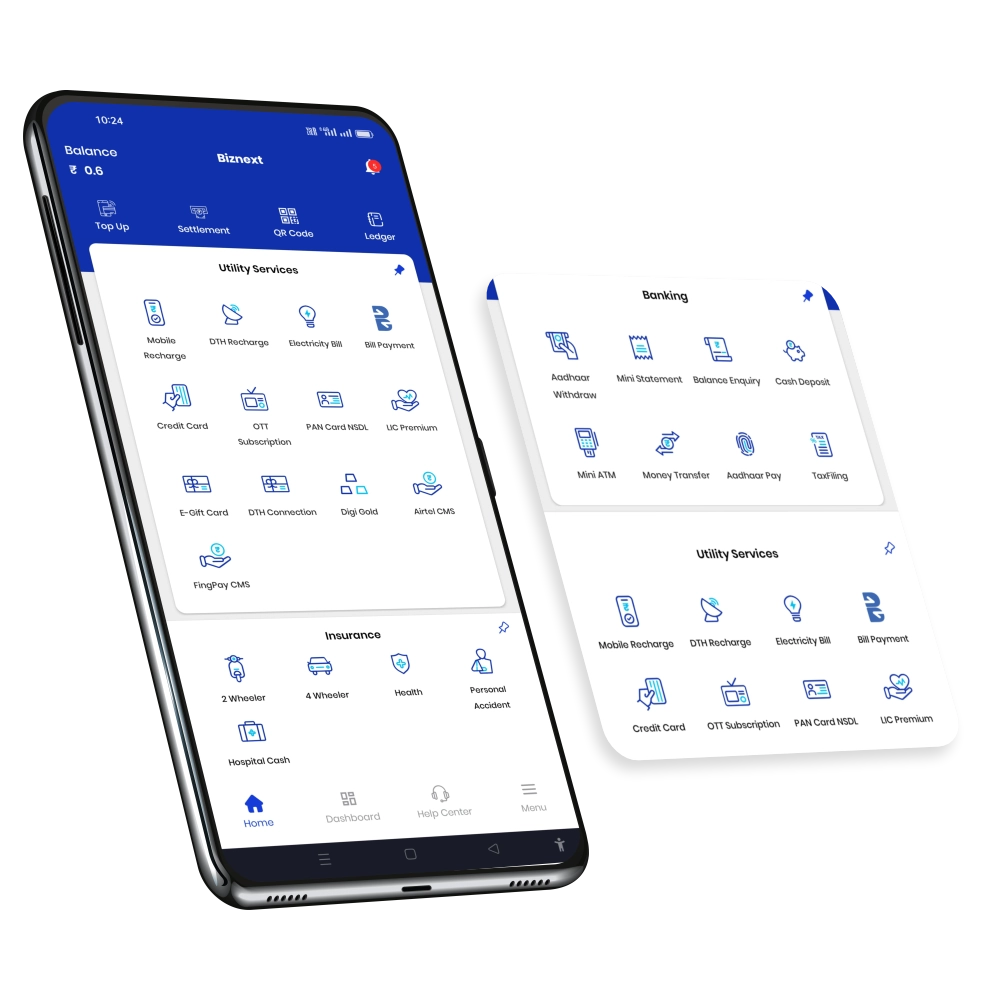

2. VK Venture (Parent company of Biznext)

VK Venture is a trusted name in the fintech space. Under its brand Biznext, it provides services like AEPS, Micro ATM, DMT, recharge, bill payments, PAN card, and more. With a user-friendly app and high commission structure, it supports over 5 lakh+ retailers in India.

3. PayNearby

One of the largest rural fintech platforms offering AEPS, DMT, insurance, and digital payments. Known for its strong support system and wide network.

4. Spice Money

Popular among retailers, Spice Money enables services like banking, travel bookings, PAN card, insurance, and utility bill payments with easy onboarding.

5. Bankit

Bankit offers AEPS, money transfer, cash withdrawals, and other services. Its quick setup and good service support make it a good choice for small businesses.

6. Fino Payment Bank

Fino provides banking and digital services through its agents, especially in rural areas. It offers account opening, deposits, AEPS, and remittance services.

Digital Gramin Seva Registration

Digital Gramin Seva Portals allow local shopkeepers and rural entrepreneurs to offer essential digital services like AEPS, money transfer, mobile recharge, bill payments, and more. If you want to become a part of this growing digital network, here’s how you can register.

Eligibility Criteria

Before you start the registration process, make sure you meet the following basic requirements:

- Minimum age: 18 years

- Valid Aadhaar Card and PAN Card

- A bank account linked with Aadhaar

- An active mobile number linked to Aadhaar

- A small shop or workspace with smartphone or computer and internet access

Step-by-Step Registration Process

- Choose a Service Provider

Select a trusted Digital Gramin Seva portal. Some of the popular platforms include:- VK Venture (Biznext)

- PayNearby

- Spice Money

- Bankit

- Fino Payment Bank

- Visit the Official Website

Go to the official website of the selected service provider. - Find the Registration Option

Look for “Register,” “Join Us,” or “Become a Partner” on the website. - Fill the Registration Form

Enter details such as:- Full Name

- Mobile Number

- Email ID

- Business/Shop Name and Address

- Aadhaar and PAN numbers

- Bank account details

- Upload Documents

You will usually be asked to upload clear copies of:- Aadhaar Card

- PAN Card

- Passport-size photo

- Bank passbook or cancelled cheque

- Address proof of your shop/business

- Submit the Application

After entering all details and uploading documents, submit the form for review. - Verification Process

The company may call you or ask for further information to verify your details. - Approval and Onboarding

Once approved, you’ll receive login credentials and instructions to start offering digital services.

Digital Gramin Seva Registration Fees

Before you register on any Digital Gramin Seva portal, it’s important to know the registration fees involved. Below is a comparison of popular platforms and their approximate charges:

| Service Provider | Registration Fees | Includes |

|---|---|---|

| VK Venture (Biznext) | Free | AEPS, Micro ATM, DMT, Recharge, Bill Payments, PAN Card, etc. |

| PayNearby | Free or up to ₹1,499 (one-time) | AEPS, DMT, Insurance, Bill Payment, Travel Booking, and more |

| Spice Money | Free or up to ₹1,000 (one-time) | AEPS, DMT, Bill Payment, PAN Card, Insurance, and more |

| Bankit | Free or up to ₹1,499 (one-time) | AEPS, Money Transfer, Recharge, Bill Payment, PAN Card |

| Fino Payment Bank | Free or up to ₹1,499 (via distributor) | Banking services, AEPS, Account Opening, Bill Payment, Cash Withdrawals |

| CSC Digital Seva | Free (Government-backed) | Aadhaar, PAN, Insurance, Banking, Utility Payments (VLE application needed) |

Note: Fees may vary based on offers, service packages, or distributor charges. Always confirm with the official provider or their authorized distributor before making any payment.

Digital Gramin Seva Income

Below is a table showing how much a retailer can earn from different services offered through a Digital Gramin Seva portal:

| Service | Approximate Income per Transaction | Remarks |

|---|---|---|

| AEPS (Cash Withdrawal) | ₹5 to ₹15 | Income depends on withdrawal amount and provider |

| Money Transfer (DMT) | ₹5 to ₹20 | Varies with the amount sent |

| Mobile Recharge | ₹2 to ₹5 | Higher commission on higher-value recharges |

| Bill Payment (BBPS) | ₹3 to ₹10 | Includes electricity, gas, water, etc. |

| PAN Card Service | ₹50 to ₹100 | Based on charges taken from the customer |

| Micro ATM (Cash Out) | ₹5 to ₹15 | Similar to AEPS, charges may vary |

| Bank Account Opening | ₹100 to ₹300 | Applicable only for providers offering this service |

| Cash Deposit | ₹5 to ₹10 | Available in limited partner banks |

| Insurance Sale | ₹100 to ₹500 | Income depends on policy type and provider |

| Travel Booking | ₹20 to ₹500 | Includes bus, train, and flight bookings |

Note: Income may vary depending on the platform, services activated, transaction volume, and local demand. Some companies also offer monthly bonuses and target-based incentives.

Benefits of Digital Gramin Seva

Digital Gramin Seva offers a wide range of benefits that can help retailers grow their business while providing essential services to their community. Below are some of the key advantages:

- Increased Earnings Potential: Retailers can earn commissions from various services like AEPS, bill payments, money transfers, insurance sales, and more.

- Low Investment: Minimal investment is required, usually just for the registration fee and basic equipment, making it accessible for small entrepreneurs.

- Access to Digital Services: Retailers can offer services such as mobile recharges, banking, money transfers, bill payments, and more, serving the digital needs of their community.

- Convenience for Customers: Customers benefit from easy access to services, saving time and eliminating the need to visit distant locations for tasks like bill payments and money transfers.

- Improved Business Reputation: Being part of a trusted digital platform enhances the reputation of your business within the community.

- Government Backing: Many platforms are government-backed (e.g., CSC Digital Seva), offering added credibility and security for both retailers and customers.

- Wide Service Range: Retailers can offer a variety of services, such as insurance, banking, account opening, money transfers, and utility bill payments.

- Flexible Working Hours: Retailers can operate during flexible hours, providing convenience to both themselves and their customers.

Also read – Best UPI App in India

FAQs About Digital Gramin Seva

1. What is Digital Gramin Seva?

Digital Gramin Seva is a platform that enables retailers to offer a wide range of digital services like mobile recharges, bill payments, banking services, money transfers, and more to customers in rural and semi-urban areas.

2. How can I register for Digital Gramin Seva?

To register, you need to sign up with a service provider or platform like VK Venture (Biznext), PayNearby, or others. Registration typically involves a nominal fee and submission of basic documentation.

3. What services can I offer through Digital Gramin Seva?

You can offer a variety of services, including:

- AEPS (Aadhaar Enabled Payment System)

- Mobile Recharge

- Bill Payments (BBPS)

- Money Transfers (DMT)

- PAN Card Services

- Bank Account Opening

- Cash Deposit

- Insurance Sales

- Travel Bookings

4. How much can I earn through Digital Gramin Seva?

Your earnings depend on the services you provide and the number of transactions. Commissions range from ₹2 to ₹500 per transaction, depending on the service (e.g., ₹5-₹15 for AEPS, ₹50-₹100 for PAN card applications, etc.).

5. Is there any investment required to start?

Yes, there is usually a one-time registration fee, which varies between ₹500 to ₹1,500. Additional costs may include basic equipment like a smartphone or a POS terminal.

6. Are there any ongoing fees?

Most platforms do not charge ongoing fees, but some may have transaction-based charges, especially for services like money transfers or bill payments. It’s important to check with your service provider for detailed fee structures.

7. Can I offer services like bank account opening or cash deposit?

Yes, many Digital Gramin Seva platforms offer bank account opening and cash deposit services. Retailers earn a commission for each account opened or deposit made.

8. Do I need special training to start?

Most platforms provide basic training and guidance to help you get started. The process is simple and doesn’t require any advanced technical knowledge.

9. Can I offer Digital Gramin Seva services online?

Yes, some platforms allow you to offer services online via their mobile app or website, making it easy to serve customers remotely.

10. What are the benefits of joining Digital Gramin Seva?

- Increased earnings from multiple services

- Low investment to start

- Convenience for your customers

- Wide range of services to offer

- Improved business reputation in your community

- Government-backed credibility (for platforms like CSC Digital Seva)

11. How can I track my earnings and transactions?

Most platforms offer a dashboard or mobile app where you can track your earnings, transactions, and service performance in real-time.

12. What should I do if I face technical issues or need support?

If you face any technical issues or need support, you can contact the customer support team of your service provider. Most platforms have dedicated support channels like phone, email, or chat for assistance.

Also read – Top 10 AEPS Service Provider Company List in India 2025