Retailers and small shop owners in rural and semi-urban areas can now boost their monthly income by offering digital banking services right from their store. With the help of the Aadhaar Enabled Payment System (AEPS), they can provide essential services like cash withdrawal, deposit, balance inquiry, and mini statements to customers who may not have easy access to traditional banks.

All it takes is a smartphone and a fingerprint scanner; no large investment or technical knowledge is required. For every transaction, shopkeepers earn a commission, helping them earn an additional ₹15,000 to ₹25,000 per month by becoming a local banking service point.

AEPS apps are simple to use, secure, and designed specifically for retailers, making them a powerful tool for increasing income and serving the community. In this blog, we’ll cover the best AEPS apps available, their features, how they work, benefits for shop owners, and the easy steps to get started.

Top AEPS Apps for Retailers in 2026

Here are the best AEPS Apps that allow you to easily start AEPS services from your shop, enabling you to offer Aadhaar-based banking services like cash withdrawal, balance enquiry, and mini statements, while also earning extra income through every transaction.

| App Name | Star Rating | Downloads | Reviews | Key Highlights |

|---|---|---|---|---|

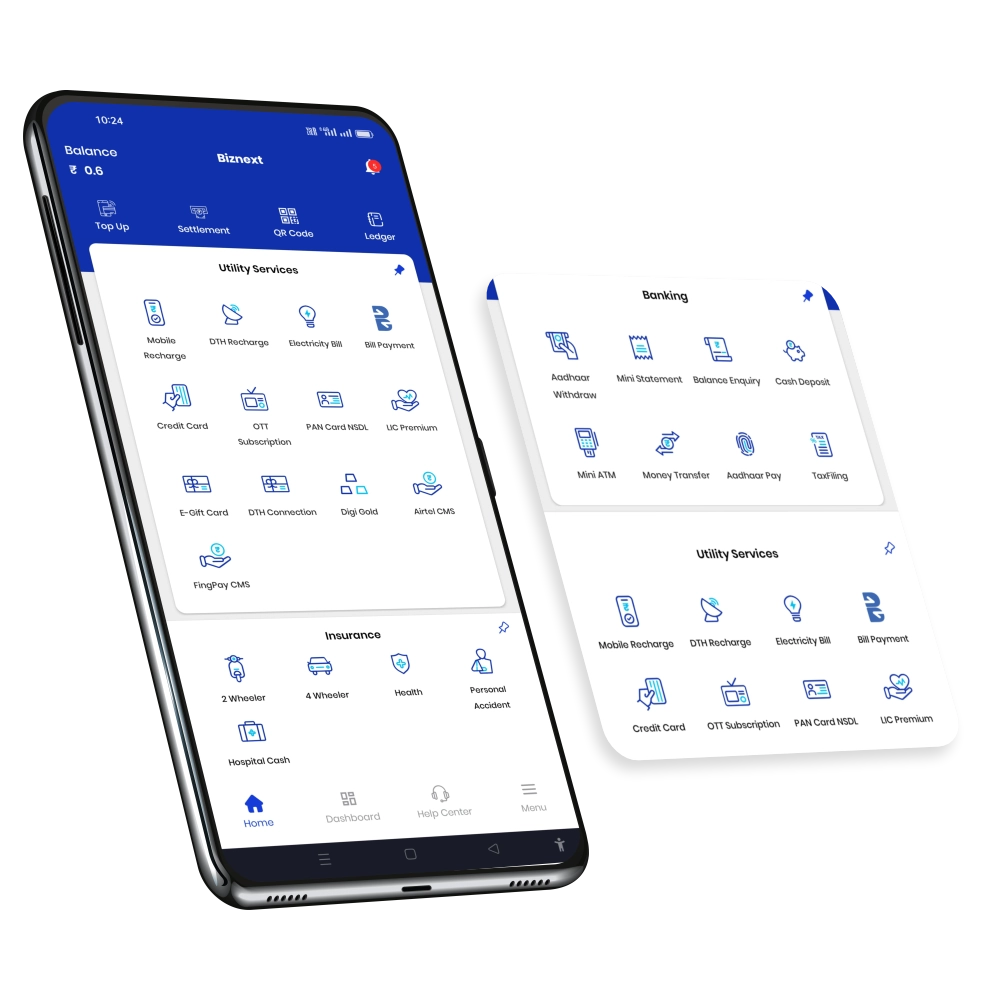

| Biznext | 4.4 | 100K+ | 3.24K | AEPS, DMT, recharge, ticketing, built for Tier II/III retailers with 10 Lac+ happy retailers |

| Spice Money | 4.4 | 5M+ | 159K | AEPS, MATM, PAN card, strong rural network |

| PayNearby | 4.4 | 10M+ | 236K | AEPS, recharge, IRCTC, insurance |

| Digital Gramin Seva (DGS) | 4.4 | 1M+ | 9.04K | AEPS, banking, recharge, and bill payment |

| Ezeepay | 4.2 | 500k | 3.5K | AEPS, recharge, and bill payment services |

| Fino Mitra | 4.2 | 1M+ | 54.9K | Micro ATM, AEPS, trusted as banks |

| Bankit | 4.2 | 1K+ | 5.54K | AEPS, BBPS, bill payment, mini statement |

| Roinet Xpresso | 4.2 | 500K+ | 16.1K | AEPS, recharge, utility services |

| Rapipay | 4.1 | 1M+ | 16.4K | AEPS, DMT, BBPS, agent-friendly setup |

| Payworld | 3.8 | 1M+ | 9.04k | AEPS, recharge, IRCTC, multi-service platform |

Who Can Use AEPS Apps?

Any shop owner, mobile recharge agent, or small business owner with a basic Android phone can offer AEPS services. No special setup is needed beyond a fingerprint device and an internet connection.

AEPS App Helps You Earn Extra Income – With Your Existing Shop

What Is the AEPS App and Why Is It Useful for Retailers?

AEPS (Aadhaar Enabled Payment System) allows customers to do basic banking using just their Aadhaar number and fingerprint. There’s no need for an ATM card or a bank visit.

Why AEPS App Is in Demand in Rural and Semi-Urban Areas

- ATMs often run out of cash or are far from villages

- Limited Access to the bank.

- Easy and safe Transactions

- Bank branches are crowded or limited in small towns

- Many customers don’t have smartphones or mobile banking access.

- Works without internet on the user side.

With the AEPS App service, your shop can become their local banking point.

Read Also: AEPS Agent Registration Guide

How AEPS Apps Work

Setting up AEPS at your shop is easy and fast.

Processes are straightforward

- The customer shares their Aadhaar number and bank name

The customer provides their 12-digit Aadhaar number and selects the bank linked to that Aadhaar. This is required to fetch their account information securely from the UIDAI and NPCI AEPS systems.

- You enter the details in your AEPS mobile app

You open your AEPS mobile app and enter the customer’s Aadhaar number, bank name, and choose the required service (e.g., cash withdrawal, balance check, etc.).

- The customer authenticates using a fingerprint scanner

After entering the customer’s Aadhaar number and bank name, the customer places their finger on the scanner. The device verifies their fingerprint with UIDAI to confirm identity, no PIN or card needed.

- The transaction is processed and money is transferred instantly

Once verified, the AEPS app connects to the bank and processes the request (like withdrawal or balance check) in just seconds. The amount is transferred to the agent’s wallet, and then the shop owner provides cash to the customer. A receipt is shown instantly.

- You get a commission for every successful transaction

You earn a commission on every successful transaction, like ₹5–₹15 for cash withdrawals and ₹1–₹2 for balance checks. It’s a quick and easy way to boost your daily income.

Services Available via AEPS Apps

- Cash Withdrawal

- Balance Enquiry

- Cash Deposit

- Mini Statement

No ATM Card Required

Customers don’t need a debit card or mobile banking. Their Aadhaar and fingerprint are enough to complete transactions.

Benefits of Using AEPS Apps for Retailers

Retailers across India are earning regular side income by offering AEPS services. Here’s why it works.

Earn Commission on Every Transaction

You can earn ₹5 to ₹15 per cash withdrawal and ₹1–₹2 for balance checks. Some apps also offer reward points or coins that can be redeemed for gifts or cashback.

Example:

If you complete 30 AEPS transactions per day with an average commission of ₹7, you could earn approximately ₹6,000–₹10,000 per month.

More Footfall, More Sales

Customers visit your shop to withdraw money, and while they’re there, they may also buy mobile recharge, groceries, or other items. This increases your total daily income.

Low-Cost, High-Earning Setup

All you need is:

- An Android smartphone

- A biometric fingerprint device

- A verified AEPS app

No licenses or big investments required.

Features to Look for in the Best AEPS App

Not all AEPS apps offer the same benefits. Choose one that gives high commission, low failure rates, and strong customer support. Must have AEPS Features in the apps.

- Secure and fast transaction processing: AEPS apps ensure quick and safe payments using Aadhaar and fingerprint verification, reducing fraud and delays.

- Support for multiple banks: You can serve customers from various banks no needing to handle multiple apps or platforms.

- 24/7 customer service (call/WhatsApp/chat): Get help anytime via call, WhatsApp, or live chat, whether it’s a technical issue or transaction query.

- Extra services like mobile recharge, bill payment, ticket booking: Apart from AEPS, offer mobile recharges, utility bill payments, and train or flight ticket bookings to increase income.

- Reports and transaction history in-app: Track all your earnings and transactions directly from the app, simple, transparent, and organised.

This ensures you deliver a professional, smooth experience to your customers.

How to Register and Start Using an AEPS App

You can start using AEPS within 24–48 hours after registration.

Documents Required

- Aadhaar card

- PAN card

- Bank account details

- Mobile number

- Fingerprint device (e.g., Morpho, Mantra)

Step-by-Step Process

- Download the AEPS app from the Google Play Store

- Register with your mobile number

- Upload KYC documents

- Link your fingerprint scanner

- Start transacting and earning

Tips to Earn More With AEPS Services

Want to grow your income faster? Follow these tips:

1. Promote AEPS App in Your Area

Put up posters and tell walk-in customers about the service. Many people still don’t know this option exists.

2. Offer Additional Services

Use your AEPS app to also provide:

- Mobile/DTH recharge

- Electricity and gas bill payment

- Insurance premium collection

- Train and flight ticket booking

This helps you earn more from each customer.

Frequently Asked Questions for AEPS Apps

- Is AEPS safe to use?

Yes. AEPS is regulated by NPCI and uses secure biometric verification. No password or OTP is required, reducing fraud. - Can I use AEPS without a physical shop?

Most platforms prefer agents with a physical location, but some allow field agents or doorstep services with proper approval. - How much commission can I earn?

Each AEPS transaction can earn you ₹5 to ₹15, depending on the service and provider.

Also Read: How to Activate (Enable) AEPS Service

Final Thoughts — Turn Your Shop Into a Mini Bank

AEPS App is not just a service; it’s an opportunity. As a retailer, you already interact with local people every day. Now, you can help them access their money easily and get paid for it.

- No extra rent

- No employees required

- Just your phone and a fingerprint device

Start using the best App for AEPS today and build a daily income stream right from your shop counter.

Read Also: How to start an ATM Business in India