What Is a Utility Bill and Why Does It Matter

Every home, office, and business in India receives one or more utility bills each month. Whether it is electricity, water, gas, or internet, these bills help us pay for the essential services we use daily. Paying utility bills on time ensures that our services continue without interruption and also helps us maintain a good payment record.

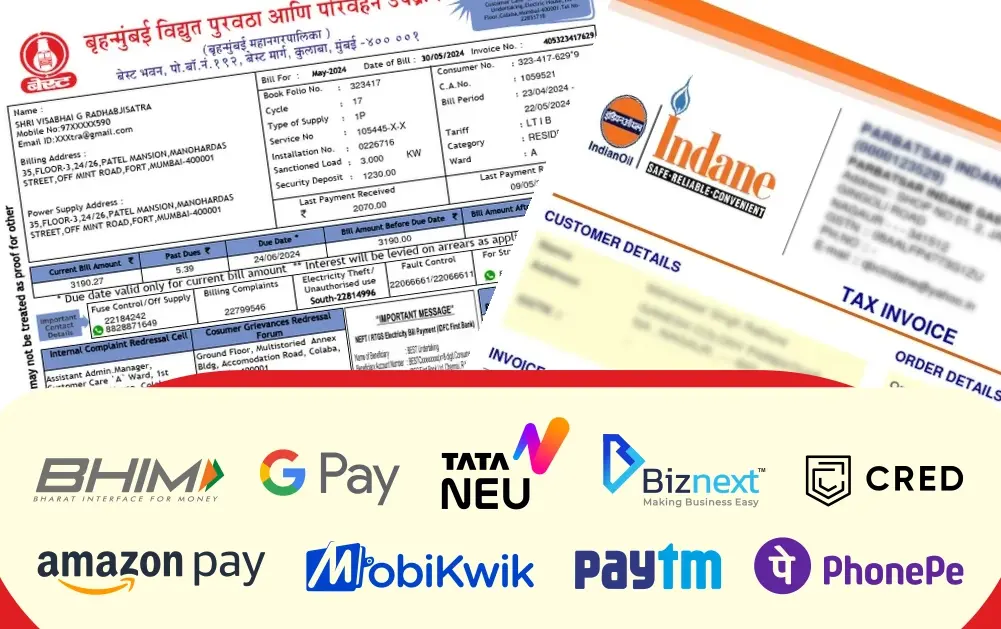

In today’s digital world, utility bill payment has become much easier. You can now pay bills online using apps, websites, or even through platforms like Biznext, which help both consumers and retailers handle multiple payments from one place. Understanding what a utility bill is, how it works, and how to pay it smartly can save you both time and money.

Utility Bill Meaning (In English and Hindi)

Utility Bill Meaning in English:

A utility bill is a statement issued by a service provider that shows how much you need to pay for using essential services such as electricity, water, gas, or internet within a specific period. It includes your usage details, charges, and due date for payment.

Utility Bill Meaning in Hindi:

Utility Bill का मतलब होता है – ऐसे बिल जो हमें हमारे ज़रूरी सेवाओं जैसे बिजली, पानी, गैस या इंटरनेट के लिए हर महीने मिलते हैं। इन बिलों में हमारे इस्तेमाल का हिसाब और भुगतान की तारीख दी होती है।

Simply: A utility bill is proof that you have used an essential public service and are required to pay for it.

What Is a Utility Bill?

A utility bill is a regular statement or invoice sent by companies or government departments that provide essential services. These include electricity boards, gas companies, water supply departments, internet service providers, and others.

Each bill shows important information like:

- Customer name and address

- Account or consumer number

- Billing period (for example, 1st to 30th September)

- Units consumed or service used

- Total amount due

- Due date for payment

- Late payment fees (if applicable)

Utility bills are essential records that not only help you track your usage but also serve as valid proof of residence in many cases.

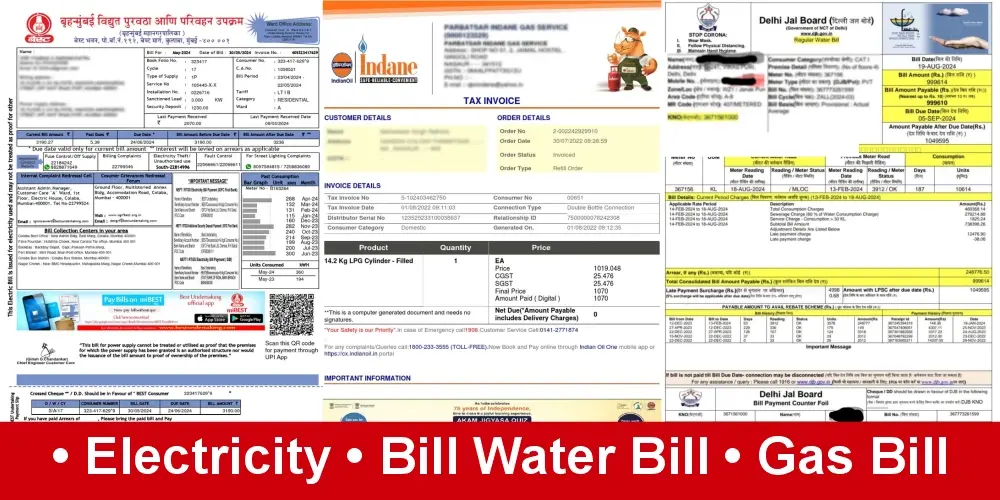

Utility Bill Examples

Here are the most common examples of utility bills in India:

- Electricity Bill: Issued by state electricity boards or private companies like Tata Power or Adani Electricity. It includes meter readings, units consumed, and the total charge for electricity.

- Water Bill: Issued by municipal corporations or local water boards, based on the amount of water consumed in your household.

- Gas Bill: Comes from gas service providers such as Indane, Bharat Gas, or HP Gas for piped gas usage.

- Internet Bill: Provided by internet service providers like JioFiber, Airtel, or BSNL for your broadband or Wi-Fi connection.

- Telephone or Postpaid Mobile Bill: Sent by telecom companies such as Airtel, Vi, or Jio, showing your monthly call, SMS, and data usage.

- DTH or Cable TV Bill: Charged by TV service providers for your monthly subscription plan.

- Property Tax Bill: In some cities, this is also considered a type of utility payment related to local civic services.

Each of these bills plays an important role in maintaining daily life. Without timely payment, services like electricity or internet could be disconnected.

What Is Utility Bill Payment?

Utility bill payment means paying the amount due to the service provider for using their services. Traditionally, people used to pay bills in person at the company’s office or through local collection centers. However, with the rise of digital payment systems, most bills can now be paid online through apps, websites, or bank portals.

Online payment methods include:

- UPI (Google Pay, PhonePe, Paytm)

- Net Banking

- Debit or Credit Card

- AutoPay setup through your bank

Why online bill payment is preferred today:

- It saves time and travel.

- Payment can be made anytime, anywhere.

- You receive instant confirmation and digital receipts.

- Cashback and rewards can be earned using specific payment methods.

Also Read: UPPCL Online Bill Pay: A Complete Guide to Paying Your Electricity Bill Online

Utility Bill Payment Online – Step-by-Step Guide

Paying your utility bill online is simple. Here’s how you can do it in just a few steps:

- Visit a Payment Platform: Open your bank’s app, a digital payment app (like Google Pay, Paytm, or PhonePe), or the service provider’s official website.

- Select the Utility Category: Choose from electricity, water, gas, or broadband, depending on which bill you want to pay.

- Enter Account Details: Add your consumer number, account ID, or mobile number linked to the bill.

- View Bill Details: The platform will automatically fetch your outstanding bill amount.

- Make Payment: Pay using your preferred method UPI, debit card, credit card, or wallet balance.

- Get Confirmation: Once paid, you’ll receive a transaction ID or digital receipt that can be used as proof of payment.

Most banks and apps also allow you to set reminders or enable automatic payments for recurring bills, ensuring you never miss a due date.

Utility Bill Proof of Address – How It Works

A utility bill is often accepted as proof of address for government verification and KYC (Know Your Customer) processes. Since the bill includes your name and residential address, it is considered a reliable document to confirm where you live.

Accepted Utility Bills for Address Proof:

- Electricity Bill

- Water Bill

- Gas Bill

- Landline or Postpaid Mobile Bill

Validity: Usually, bills issued within the last three months are accepted for address verification.

Where You Can Use It:

- Bank account opening

- Passport application

- Driving license

- Aadhaar or PAN updates

If your bill is in digital format (like a PDF from the provider’s app or email), it is equally valid as a physical copy in most cases.

Why Pay Utility Bills Using a Credit Card?

Using a credit card for utility bill payments offers several advantages, especially for those who manage multiple monthly expenses.

Benefits include:

- Cashback and Rewards: Most credit cards offer cashback or reward points on utility payments.

- Expense Tracking: All your bill payments are recorded in one statement, making it easier to manage finances.

- Interest-Free Period: You get up to 45 days of credit before the payment is due to the bank.

- AutoPay Feature: You can automate bill payments to avoid late fees.

- Credit Score Improvement: Regular payments help maintain a healthy credit history.

However, it’s important to clear your credit card balance every month to avoid interest charges or late payment fees.

Also Read: How to Transfer Money From Credit Card to Bank Account

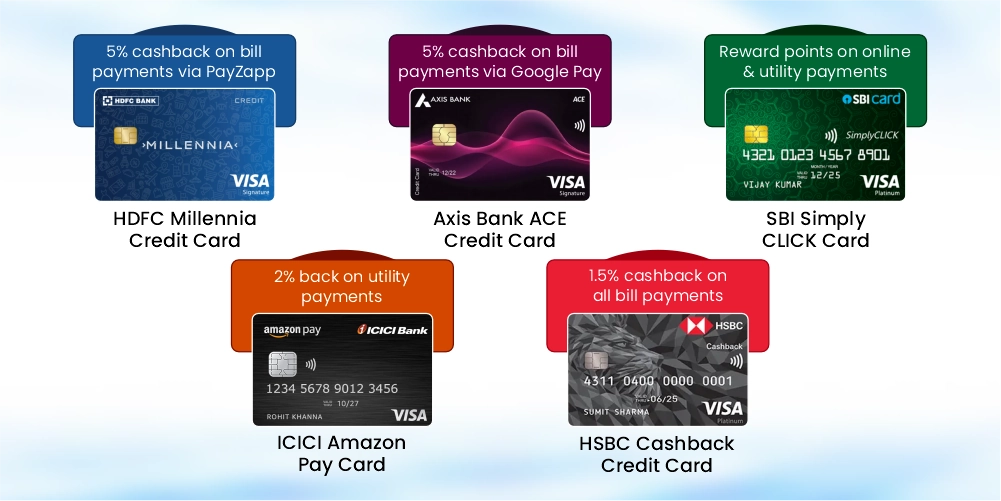

Best Credit Cards for Utility Bill Payments in India 2026

Choosing the right credit card can help you earn rewards and cashback every month on your bill payments. Here are some of the best credit cards for utility bill payments in India:

| Credit Card | Key Benefit | Annual Fee | Best For |

|---|---|---|---|

| HDFC Millennia Credit Card | 5% cashback on bill payments via PayZapp | ₹1,000 | Cashback lovers |

| Axis Bank ACE Credit Card | 5% cashback on bill payments via Google Pay | ₹499 | Utility + UPI spenders |

| SBI SimplyCLICK Card | Reward points on online and utility payments | ₹499 | General users |

| ICICI Amazon Pay Card | 2% back on utility payments | No annual fee | Amazon Pay users |

| HSBC Cashback Credit Card | 1.5% cashback on all bill payments | ₹750 | Frequent payers |

Before selecting a card, compare offers, joining fees, and cashback conditions. Also, check if your preferred biller supports credit card payments on their platform.

Common Mistakes to Avoid During Utility Bill Payment

- Paying After Due Date: Delays can lead to service interruptions or penalty charges.

- Using Unverified Websites: Always pay from official apps or trusted payment platforms to avoid fraud.

- Ignoring Transaction Receipts: Keep receipts for verification and record-keeping.

- Entering Wrong Account Details: Double-check your consumer number or account ID before payment.

- Not Utilising Offers: Many credit cards or payment apps provide cashback on certain days. Check offers before paying.

Avoiding these small mistakes can save you money and prevent unnecessary issues.

How Biznext Helps in Easy Utility Bill Payments

Biznext is an innovative platform designed to make digital payments easier for both individuals and retailers. Through Biznext, shop owners can offer utility bill payment services to their customers and earn commissions for every transaction.

How Biznext Benefits Retailers and Consumers:

- For Retailers: Biznext allows them to collect and pay utility bills for electricity, water, gas, and other services on behalf of customers. Retailers earn a small commission on each payment, creating an additional income stream.

- For Consumers: Customers can visit a nearby Biznext agent or retailer and pay their bills in cash or digitally, without needing to use online apps themselves.

Why Biznext is a reliable option:

- Secure payment gateway integration

- Instant payment confirmation

- Commission tracking and business dashboard for retailers

- Access to multiple services like DTH recharge, mobile top-up, and banking solutions

Biznext simplifies digital transactions and supports the government’s goal of promoting financial inclusion across India.

FAQs on Utility Bills

1. What is a utility bill?

A utility bill is a statement showing charges for using essential services like electricity, water, gas, or internet.

2. Is a mobile postpaid bill considered a utility bill?

Yes, postpaid mobile bills are also treated as utility bills since they represent a recurring service.

3. Can a utility bill be used as address proof?

Yes, most government offices accept electricity, water, or gas bills as valid proof of address.

4. How can I pay my utility bill online?

You can pay using apps like Paytm, Google Pay, PhonePe, or through Biznext retailer agents.

5. Which credit card is best for utility bill payments?

Cards like Axis ACE, HDFC Millennia, and SBI SimplyCLICK offer good cashback and rewards on utility bill transactions.

6. What happens if I miss my bill due date?

Late payments may result in penalties or temporary disconnection of the service.

Conclusion

Understanding your utility bills and paying them on time is an important part of responsible financial management. With online payment options and credit card rewards, managing bills has become more convenient than ever.

Platforms like Biznext make this process even simpler by allowing retailers and individuals to handle multiple bill payments quickly and safely. Whether you are paying electricity, water, or internet bills, using digital methods saves time, helps earn rewards, and ensures that your essential services never stop.

By making smart payment choices, you not only stay organised but also benefit financially from every transaction.

Also Read: How to Earn More From Your Existing Kirana Shop?

Also Read: UPPCL Online Bill Payment 2026: Check, View, Download & Pay Electricity Bill Easily