What is an ATM?

An Automated Teller Machine, commonly known as an ATM, is a nifty money tool you come across in various locations around town. It’s like this machine you see at stores or on street corners, always ready to assist with your financial needs. Let’s keep it simple and call it an ATM.

Think of it as your reliable friend, a mini bank that’s available 24/7. When you want to use it, you grab a special card, slide it in, and type in your secret code, or PIN. The magic begins – it doesn’t just sit there; it hands you cash or shows how much money you’ve got. It’s like having a helpful buddy who makes getting money or checking your funds super easy. No need to go through the hassle of the big bank – the ATM is right there, ready to lend a hand whenever you need it!

What is a Micro ATM Machine?

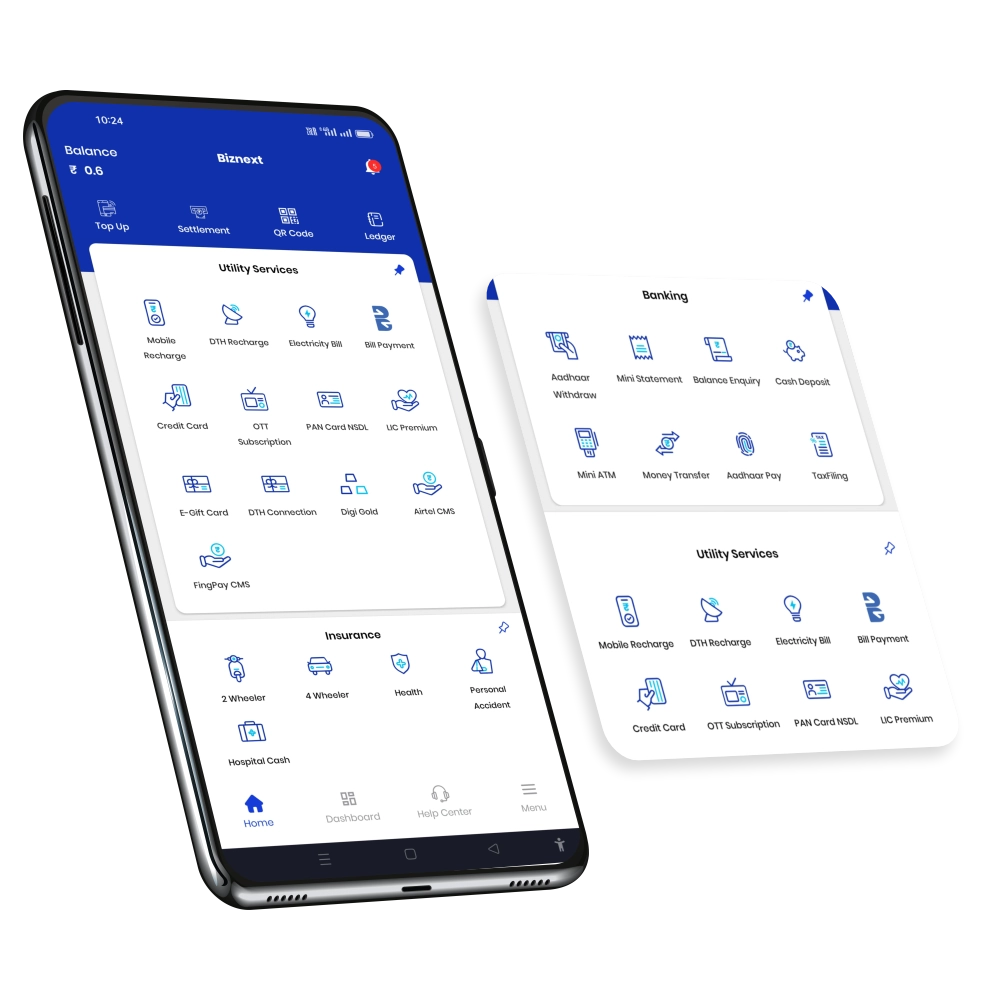

Micro ATMs are small, handy devices designed to bring basic banking services closer to you. Imagine you’re in a small town without a nearby big bank. That’s when the Micro ATM steps in to help with straightforward banking tasks.

Think of the Micro ATM as a small and efficient assistant for simple banking needs. Whether you need cash or want to check your account balance, it’s a straightforward process. Take out your debit card, enter your private PIN – just like at a regular ATM – and you’re done. It’s like having a small and helpful bank with you whenever you need it.

What’s noteworthy is that Micro ATMs aren’t limited to big cities; they go to smaller towns too. So, even if there’s no big bank around, the Micro ATM makes banking easy. It acts like a portable banking solution, making financial tasks simple, whether you’re in a busy town or a quiet place. The Micro ATM becomes a reliable companion, ensuring that basic banking tasks are not just simple but also easy to handle, no matter where you are.

Key Difference Between ATM and Micro ATM

Let’s take a closer look at the key differences between ATMs and Micro ATMs, the two champions of making our banking lives easier.

1) Size and Location:

ATM: Think of it like a big, stationary bank helper. You usually find ATMs in specific places like banks or busy streets. They’re not the kind you can carry around.

Micro ATM: Picture a pocket-sized bank friend. Micro ATMs are small and can go places. You might find them in local shops, mobile vans, or even set up temporarily in different locations. They’re like the on-the-go version of a regular ATM.

2) Accessibility:

ATM: You’ll spot them in urban areas, maybe near big malls or banks. Great for city dwellers, but not always convenient for folks in smaller towns or rural areas.

Micro ATM: Here’s where it gets cool. Micro ATMs are like financial superheroes for smaller places. They bring banking closer to home, reaching areas where big ATMs might not venture. It’s like having a little bank come to you.

3) Functions and Services:

ATM: These machines are like banking multitaskers. They offer a bunch of services – cash withdrawal, checking balances, transferring money, and more. They’re the Swiss Army knives of banking.

Micro ATM: Keep it simple. Micro ATMs focus on the basics – cash withdrawal, checking balances, and sometimes Aadhaar-based transactions. They cater to the needs of folks in smaller areas who might not need all the fancy banking features.

4) User Interface:

ATM: Big screens, many buttons – regular ATMs can be a bit like video game controllers. They’re designed for a variety of transactions.

Micro ATM: Simplified is the name of the game. Micro ATMs have smaller screens and fewer buttons. They’re straightforward to use, making them more user-friendly, especially for those not used to fancy technology.

5) Ownership and Maintenance:

ATM: Mostly owned and managed by big banks. These machines need a good deal of money for installation and maintenance.

Micro ATM: Here’s the twist – they’re often provided by financial service providers or local businesses. This makes them more cost-effective and suitable for smaller communities. It’s like the friendly neighbourhood store owner owning a tiny bank for the town.

6) Connectivity:

ATM: Usually linked to the bank’s network, so they need a stable and robust connection.

Micro ATM: They’re more adaptable. Micro ATMs can work with different connectivity options, making them suitable for areas where a constant and strong connection might be a challenge.

7) Financial Inclusion:

ATM: Primarily serving areas where people are familiar with banking tech, often in urban and semi-urban regions.

Micro ATM: The hero of financial inclusion! Micro ATMs are the bridge, bringing banking to areas where traditional ATMs might not have reached. They’re like the champions of making sure everyone gets to be a part of the banking party.

In a nutshell, ATMs and Micro ATMs are both fantastic in their own ways. ATMs are like the big brothers, versatile and found in busy areas. On the other hand, Micro ATMs are the little buddies, bringing banking to smaller places and making sure no one misses out on the banking fun. It’s like having two superheroes – one for the city and one for the town!

Also, read – Top 10 AEPS service providers list in India

Conclusion

In the world of banking, the Difference Between ATM and Micro ATM is like a story of two heroes with distinct strengths. The ATM, standing tall in the city, is the multitasking giant offering a range of services. On the other hand, the Micro ATM, the small-town hero, focuses on simplicity and accessibility, reaching places where traditional banking might not venture. Together, they form a dynamic duo, ensuring that whether you’re in the city or a smaller town, banking convenience is always within reach. The Difference Between ATM and Micro ATM isn’t just about size; it’s about making banking accessible and celebratory for everyone.