Are you passionate about making a difference in rural communities? Do you dream of becoming a local hero? You would empower your fellow villagers with vital services and opportunities. If so, embarking on the journey to become a Village Level Entrepreneur (VLE) might be the perfect path for you. Today’s world has interconnectedness. Access to banking, insurance, and other vital services is crucial for development. They play a key role in bridging the gap between city luxuries and rural realities.

If you’re ready to step up and spark change in your community, let’s see how you can make your dreams real. You can do this as a village-level entrepreneur.

What is a Village Level Entrepreneur?

Starting your own business in rural areas makes you a rural entrepreneur. It’s a title that carries a lot of weight. They are the backbone of rural economies. They drive local development and create opportunities where they’re needed most. Think about it. In busy cities, there are shops and services on every corner. But, in rural areas, things can be much more spread out. That’s where rural entrepreneurs step in.

These entrepreneurs could be anyone. They could be farmers selling produce at local markets. Or, they might open a small grocery store in a remote village. But among them are the Village Level Entrepreneurs (VLEs). They set up shop in the heart of the village and offer essential services. These services were once out of reach for many rural residents.

But rural entrepreneurship isn’t about making life easier for others. It’s also about creating opportunities for yourself and your community. By starting a business in rural areas, you’re not only providing useful services. You’re also creating jobs and growing the economy. And in a world where rural areas are often overlooked, that’s not a small thing.

How Much Earn Village Level Entrepreneur?

When it comes to the earnings of entrepreneurs in rural areas, it’s all about the services they provide and the demand in their community. Let’s break down the potential income streams for these local business owners:

- AEPS Transactions: Entrepreneurs typically earn a commission ranging from ₹2 to ₹5 per transaction for AEPS services. With an average of 50 to 100 transactions per day, entrepreneurs can earn around ₹3,000 to ₹5,000 per day from AEPS transactions alone.

- Micro ATM Operations: For micro ATM operations, entrepreneurs earn a commission of approximately ₹5 to ₹10 per transaction. With an average of 30 to 50 transactions per day, entrepreneurs can earn around ₹150 to ₹500 per day from micro ATM operations.

- Bill Payment Services: The commission for bill payment services varies depending on the service provider and the amount of the bill. On average, entrepreneurs earn around 1% to 2% of the transaction amount as commission. With bill payments ranging from ₹500 to ₹1,000 per transaction, entrepreneurs can earn around ₹5 to ₹20 per transaction.

- Account Opening Assistance: Entrepreneurs typically earn a commission of ₹50 to ₹100 for each bank account opened. With an average of 5 to 10 accounts opened per week, entrepreneurs can earn around ₹250 to ₹1,000 per week from account opening assistance.

- Insurance Sales: The commission for insurance sales varies depending on the type of insurance policy and the premium amount. On average, entrepreneurs earn commissions ranging from 10% to 20% of the premium amount. With insurance policies ranging from ₹1,000 to ₹5,000 in premium, entrepreneurs can earn around ₹100 to ₹1,000 per policy sold.

- Other Services: Income from other services such as mobile recharge, DTH recharge, and utility bill payments can vary depending on the volume of transactions and the commission rates. On average, entrepreneurs can earn an additional ₹1,000 to ₹2,000 per month from these services.

Overall, entrepreneurs have the potential to earn an average monthly income ranging from ₹20,000 to ₹40,000, depending on the range of services offered and the demand in their area.

Keep in mind that these figures are estimates and actual earnings may vary based on other factors such as location, transaction volume, and commission rates.

Also read – How to Activate (Enable) AEPS Service

Village Level Entrepreneur Registration Process

Becoming a Village Level Entrepreneur (VLE) and offering essential services like AEPS and fintech solutions is a simple and empowering process. Here’s a step-by-step guide to get started:

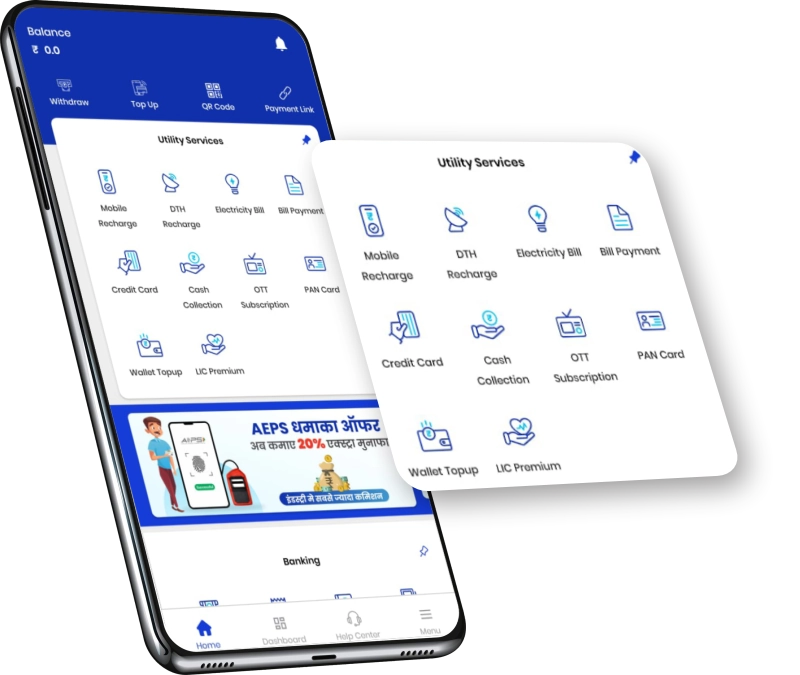

- Download Biznext Mobile Application: Begin by downloading the Biznext mobile application from your smartphone’s app store. This user-friendly platform serves as your gateway to becoming a village-level entrepreneur.

- Login with Your Mobile Number: Upon installing the Biznext app, log in using your mobile number.

- Complete E-KYC Process: The next step involves completing the Electronic Know Your Customer (E-KYC) process. This digital verification ensures compliance with rules. It validates you as a registered agent.

- Activate Services: After you complete your E-KYC, use the Biznext app to activate them. The services include AEPS, Micro ATM, and BBPS. They also include mobile recharge and bank account opening. They enable you to offer a full set of financial and utility services to your customers.

- Provide Services and Earn Instant Commission: You activate your services. You’re now ready to serve your community as a village entrepreneur. You can provide valuable services to your customers. You’ll do this by helping with bank transactions. You’ll also process bill payments and assist with account openings. And, you’ll earn instant commissions for each transaction.

Conclusion

In conclusion, becoming a Village Level Entrepreneur (VLE) offers a career path. It also offers a chance to drive change in rural communities. VLEs provide AEPS and fintech solutions. They bridge the gap between urban and rural life. They empower their fellow villagers and foster economic growth.

The registration process is simple. The potential earnings are high. The journey to becoming an entrepreneur is open to anyone with the drive to make a difference. Are you ready to take the plunge and become a catalyst for positive change in your community? Then, take the chance to start this rewarding journey. Download the Biznext mobile app. Complete the E-KYC process. Then, activate services and start serving your community today. You have the power to change lives. You can shape the future of rural India, one transaction at a time.

Also, Read – AEPS debit facility